Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

Taxes August 22, 2024

The researchers say that charitable giving fell in 2018 because of the law's change to the standard deduction for income taxes.

Taxes August 22, 2024

Starting on Oct. 1, the rate for tax overpayments and underpayments for individuals will be 8% per year, compounded daily.

Accounting August 21, 2024

Raissa Kengne, who worked at BDO USA between 2018 and 2021, shot three people in Midtown, killing two, including her BDO supervisor.

Payroll August 21, 2024

The cost-of-living adjustment for 2025 is projected to be 2.57%, down from 3.2% in 2024, according to The Senior Citizens League.

Taxes August 21, 2024

The Coalition Against Scam and Scheme Threats is comprised of the IRS, state tax agencies, tax software firms, associations, and others.

Firm Management August 21, 2024

The judge said the FTC lacked the authority to enact the ban, which was “unreasonably overbroad without a reasonable explanation.”

Taxes August 21, 2024

The process for obtaining these credits is unlike that of any previous program, and online resources have added to make it easier to navigate.

Taxes August 20, 2024

The Democratic presidential nominee's plan is in line with the corporate tax rate the Biden administration proposed in March.

Firm Management August 20, 2024

According to INSIDE Public Accounting, 16 firms made $1 billion or more in revenue during their most recent fiscal year.

Firm Management August 20, 2024

The eight partners and over 100 professionals at top 100 firm Krost will join top 20 firm EisnerAmper next month.

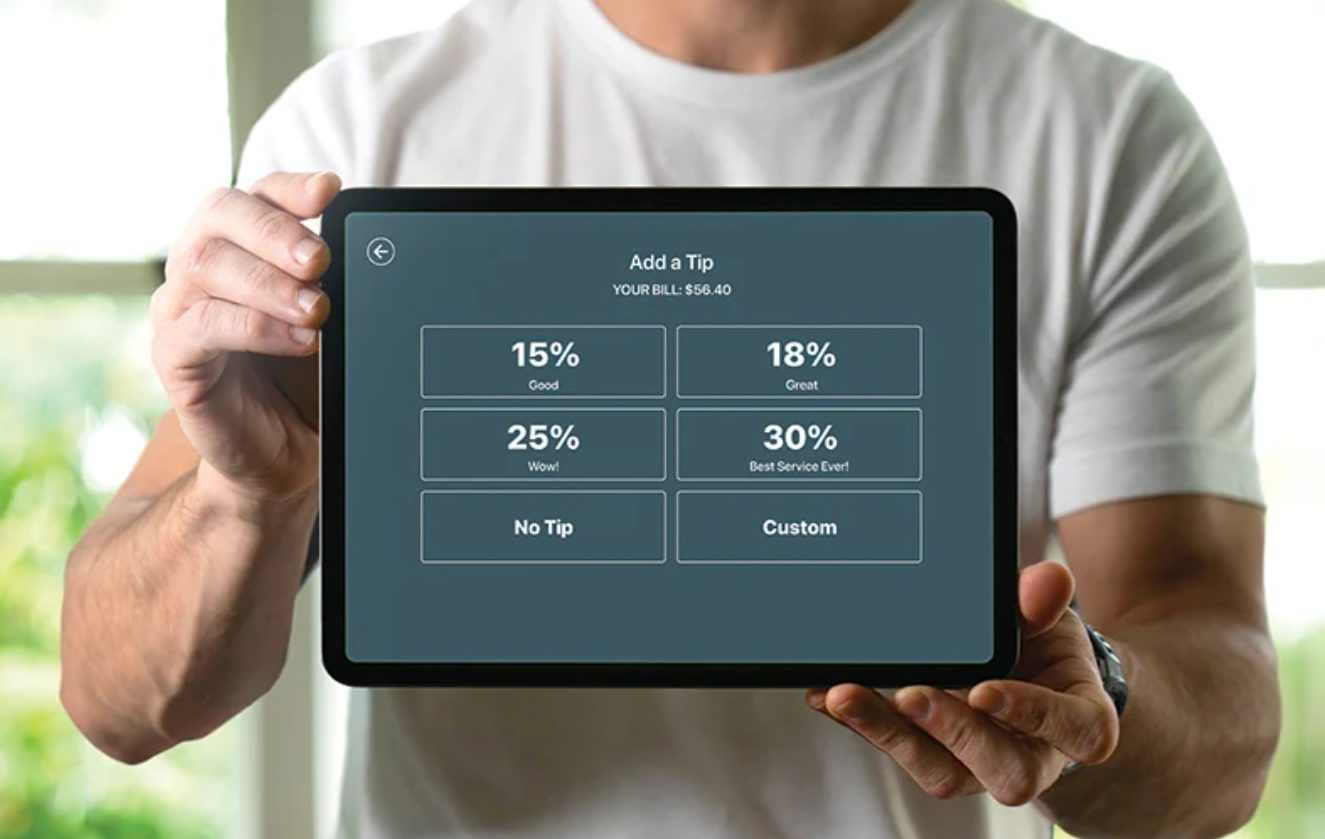

Taxes August 20, 2024

Both presidential candidates are pledging to exempt workers from paying taxes on their tips, but experts say it's bad policy.

Taxes August 19, 2024

The SECURE 2.0 ACT permits employers to provide matching contributions for employees based on their payments on student loans.