OPINION.

There has been a trend recently for states to mandate that employers offer some type of a retirement plan for their employees. California, Illinois and Oregon have launched their programs, and Colorado, Connecticut, Maryland, New Jersey and Virginia are developing them. In theory this is a positive development as there are currently many employers who do not offer any type of retirement plan to their employees, especially in small businesses, retail, service occupations and restaurants with high employee turnover.

For example, California Employers with 5 or more full or part time employees that do not offer a retirement plan by June 30, 2022, are required to offer a payroll deduction ROTH IRA called “CalSavers” or face fines of up to $750 per eligible employee.

California, historically aggressive in worker rights legislation, has failed in its CalSavers program, which can leave employees less well off then they would be without the state’s intervention.

For example CalSavers has:

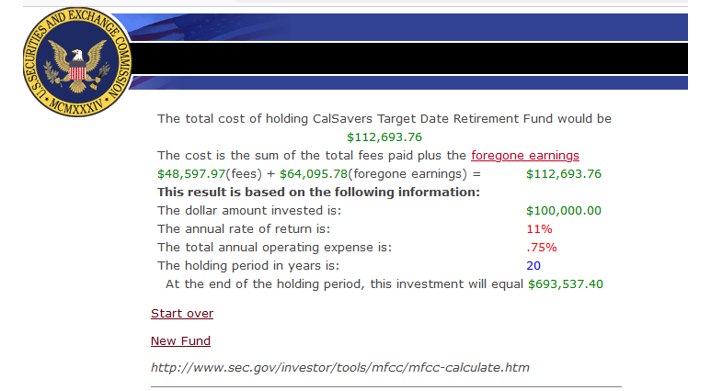

- Higher than average annual administrative fees (.83-.95

CalSavers is hardly the panacea that California pretends that it is. While a state mandate for Employers to offer a retirement plan may be good thing, requiring enrollment in CalSavers is clearly not in the best interests of the California Employee.

This lesson should be an alarm for all Employers and Employees subject to other state mandated retirement programs to carefully assess the details of their state program to decide if it is in their best interests to participate or opt out.

Recent changes in Federal Law in how 401k plans are offered now permit unrelated employers to join a pooled employer 401k plan provided by a U.S. Department of Labor registered 401k plan provider. Employers may wish to consider the pooled employer 401k plan arrangement in lieu of a state mandated payroll deduction IRA to lower administrative fees, give themselves flexibility to match contributions, increase the contribution limits, increase the number and quality available investments and permit Employees to obtain a tax deduction for making pre-tax contributions.

Moreover, a good pooled employer 401k plan might offer:

- Much lower annual administrative fees (.25%)

- No fees or costs at all to Employers

- Tax deductions for contributions if desired

- ROTH after tax accounts as well as traditional pre-tax accounts

- Brokerage accounts offering thousands of investment choices, including stocks, bonds, mutual funds, exchange traded funds, target date retirement funds and index funds

- Employees as owners of their investments able to exercise shareholder rights

- Employer matching contributions may be permitted but not required

- Limited employer fiduciary obligations

- Investments insured and guaranteed by the FDIC (up to $250,000) and the SIPC (up to $500,000)

- The Plan provider may serve as the Plan Administrator and 3(16) Plan Fiduciary and conduct employee enrollment, provide all forms and notices and record and track all contributions

- No greater employer administrative obligations than CalSavers

- Preparation and filing of all IRS returns (Form 5500 and 1099-R)

- Greater creditor protection

===========

Craig Lewis Gillooly is an Attorney admitted to practice law in good standing in California and New York. He is the CEO of 401kAdministrators.com, dba Mrs401k, the first company in the country to register as pooled employer 401k plan provider with the U.S. Department of Labor. For more information, see Mrs401k.com and https://calsavershelp.com/assets/forms/brochure.pdf.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more…Subscribe Already registered? Log In

Need more information? Read the FAQs