Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes September 6, 2023

Is the sale of an NFT subject to tax? Should it be? While lawmakers and tax officials worldwide have at least 91.8 million reasons to ensure tax laws account for sales of NFTs and other new tech, crafting tax policies for NFTs is difficult.

Accounting September 6, 2023

The Innovation Awards are presented to honor new or recently enhanced technologies that benefit tax and accounting professionals and their clients through improved workflow and efficiencies, increased accessibility, enhanced collaboration, greater accuracy, or other means.

Taxes September 4, 2023

The accumulated earnings tax must be paid in addition to the regular corporate income tax. Despite recent threats by Congress to raise the ante, this penalty tax remains at the 20% rate.

September 1, 2023

The guidance is being issued as part of the IRS's efforts to provide additional certainty to states and their residents regarding the federal income tax consequences of state payments made to taxpayers.

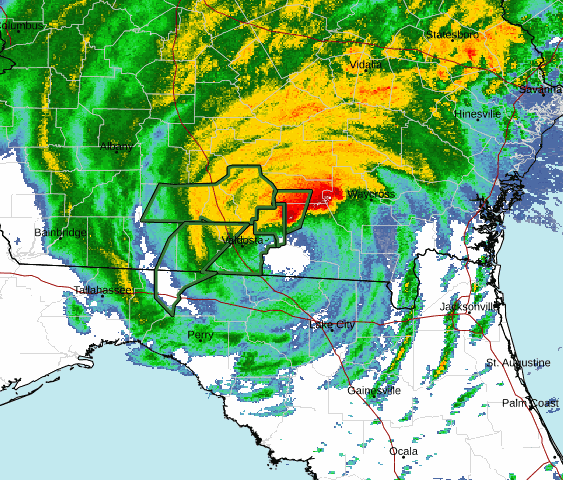

Taxes September 1, 2023

These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

Taxes August 29, 2023

Under the 2015 Fixing America’s Surface Transportation (FAST) Act, the IRS can deny, revoke or limit a passport if you have a seriously delinquent tax debt.

Taxes August 29, 2023

The proposed regulations include prevailing wage and registered apprenticeship requirements for clean energy projects.

August 29, 2023

The 40 Under 40 Awards spotlight the top practicing public accountants, educators and thought leaders who are leading their profession by visibly and incrementally changing...

Taxes August 28, 2023

In comment letters sent to the IRS, the AICPA requested improvements be made to two tax returns pertaining to foreign trusts.

Taxes August 25, 2023

The last time the agency increased interest rates on tax overpayments and underpayments was for Q1 of this year.

Taxes August 25, 2023

The proposed regulations are viewed by backers as critical to policing a largely unregulated sector plagued by tax avoidance.

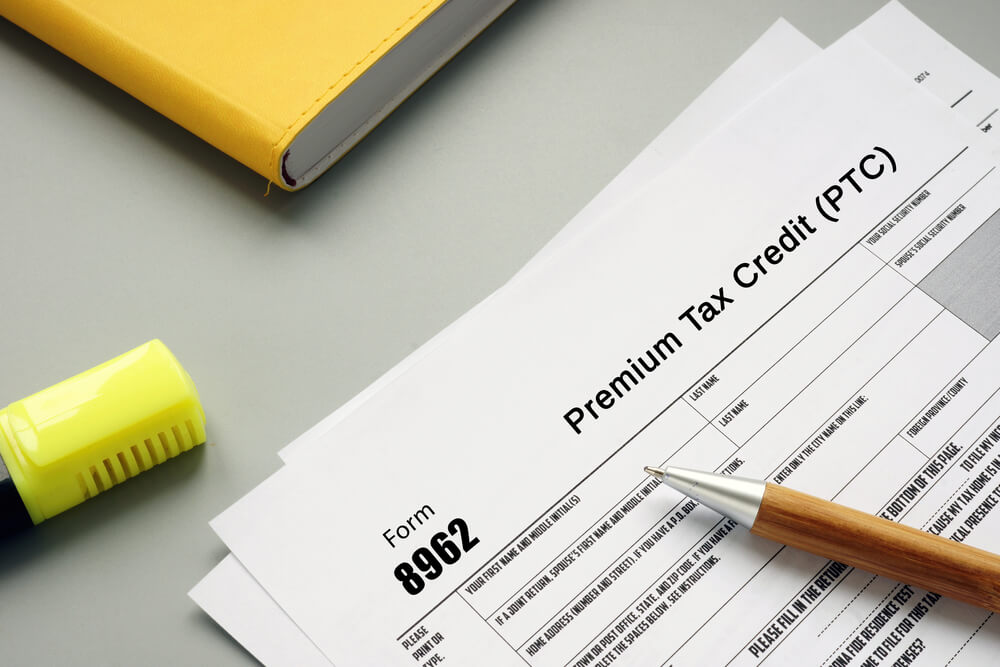

Taxes August 25, 2023

The IRS on Aug. 23 announced 2024 indexing adjustments for important percentages under the Affordable Care Act.