Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes September 14, 2023

A rash of bogus ERC claims in recent months has prompted the IRS to put the program on hold through at least the end of 2023.

September 14, 2023

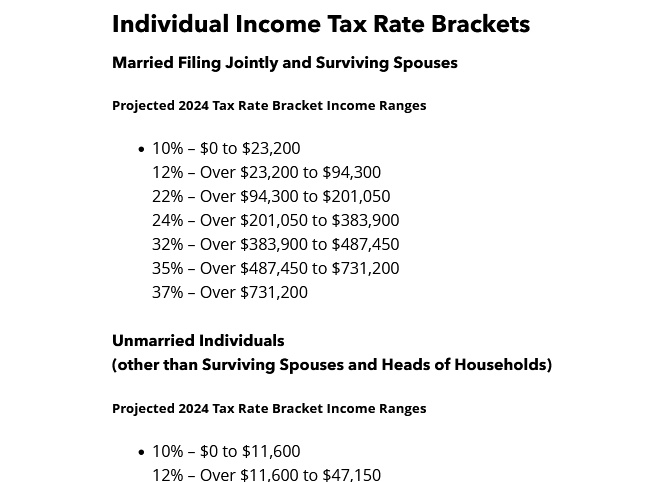

This year’s report projects that several key deductions for taxpayers will see notable year-over-year increases, with the foreign earned income exclusion ...

Taxes September 12, 2023

The question at the heart of the case is whether Mayo Clinic should be considered an educational institution for tax purposes.

September 12, 2023

The IRS often views business travel expense deductions with a healthy dose of skepticism. Consult with your professional tax advisor to ensure you’re on firm ground.

September 12, 2023

The guidance also provides general rules for determining a taxpayer's financial statement income and AFSI.

Taxes September 12, 2023

Notice 2023-63 includes interim rules on the capitalization and amortization of specified research or experimental expenditures.

Taxes September 8, 2023

A judge has ruled that Intuit Inc., the maker of the popular TurboTax tax filing software, “engaged in deceptive advertising in violation of Section 5 of the FTC Act” and deceived consumers when it ran ads for “free” tax products and services for which many consumers were ineligible.

Taxes September 8, 2023

The agency is opening examinations of 75 of the largest partnerships in the U.S. that on average have over $10 billion in assets.

September 8, 2023

The BIG tax often catches business owners by surprise. Fortunately, however, you may be able to avoid adverse tax consequences with some astute planning.

Taxes September 6, 2023

In a report, TIGTA identified employees moving between large accounting firms and the IRS, often referred to as the “revolving door.”

Taxes September 6, 2023

This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300, released in February.

Taxes September 6, 2023

New IRS guidance marked the second time this year the agency raised the specter of subjecting state refunds to federal income tax.