Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes October 6, 2023

The consumer discount is one of the significant changes to electric vehicle tax credits implemented under the Inflation Reduction Act.

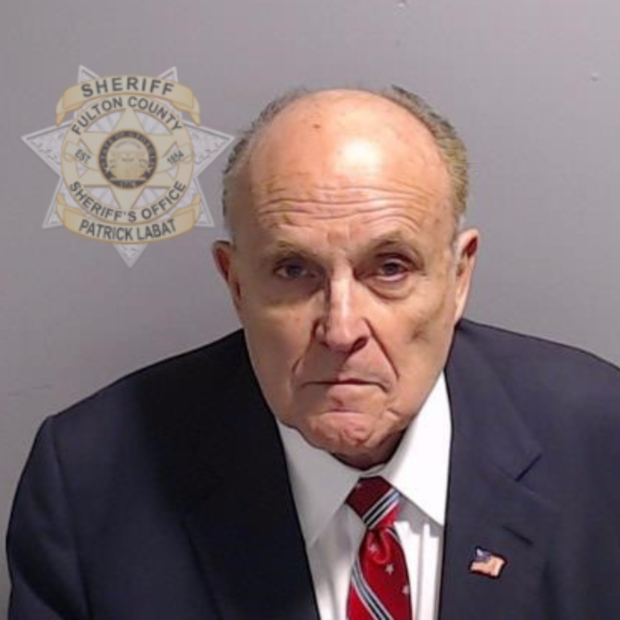

Taxes October 5, 2023

According to a report, former New York City mayor Rudolph Giuliani owes $549,435.26 in unpaid taxes and, as a result, the agency has placed a tax lien on a condo he owns in south Florida.

Taxes October 5, 2023

Taxpayers, particularly wealthy filers, were warned Thursday about scams involving exaggerated art donation deductions.

Taxes October 5, 2023

The IRS is slashing the costs for paid tax return preparers to renew their preparer tax identification numbers in 2024 by nearly 36%.

Taxes October 3, 2023

There are a myriad of challenges and changes in the tax codes affecting their business clients each tax season.

Taxes October 2, 2023

New additions to Tax Pro Account, available through IRS.gov, will help practitioners manage their active client authorizations on file with the Centralized Authorization File (CAF) database.

Taxes September 30, 2023

The Senate overwhelmingly passed bipartisan legislation Saturday to avoid a disruptive U.S. government shutdown, sending the bill to President Joe Biden for his expected signature just hours before a midnight deadline.

Taxes September 28, 2023

Jack Fisher and James Sinnott designed, marketed and sold to high-income clients abusive syndicated conservation easement tax shelters based on fraudulently inflated charitable contribution tax deductions, promising them deductions 4.5 times the amount the taxpayer clients paid.

Taxes September 26, 2023

Chatbots will be used to help answer basic taxpayer questions about three notices in the CP series, the IRS said on Tuesday.

Taxes September 26, 2023

Taxpayers can use the special per diem rates to substantiate the amount of expenses for lodging, meals, and incidental expenses.

Taxes September 25, 2023

All individuals and business owners in these two states now have until Feb. 15, 2024, to file their returns and make tax payments.

Taxes September 25, 2023

Companies could face thousands of dollars in fines for using clients’ confidential data for purposes other than tax preparation.