Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes January 9, 2024

The IRS has seen a new round of email scams where cybercriminals pose as potential clients looking for tax help.

Taxes January 8, 2024

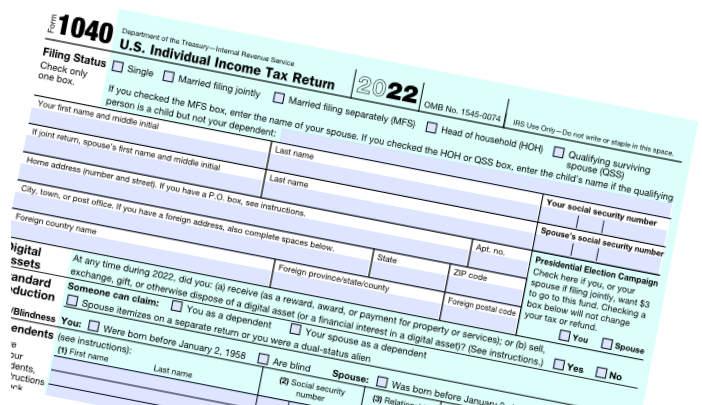

The IRS has announced that it will start accepting and processing tax returns on Monday, Jan. 29, 2024. The agency expects more than 128.7 million individual tax returns to be filed by the April 15, 2024, tax deadline.

Taxes January 8, 2024

The special week is the IRS' latest effort in support of taxpayers and the tax community. Each year, millions of taxpayers seek the help of tax professionals to prepare their federal tax returns and other filings.

Taxes January 5, 2024

Guilty of conspiring with, and paid a public official with the U.S. Department of Interior’s Bureau of Reclamation more than $150,000 in bribes and kickbacks.

Taxes January 3, 2024

The new rules exclude from the tax credit vehicles that use battery components made by Chinese manufacturers.

IRS January 2, 2024

Hundreds of IRS-CI employees still had access to TikTok months after the app was banned from all government devices, TIGTA said.

Taxes January 2, 2024

Not everyone who was entitled to an EIP was able to collect the full amount they were owed. Either they didn’t receive the correct amount or they didn’t get a payment at all.

Tax Planning December 29, 2023

Depending on your situation, you might elect to forgo preferential tax treatment on certain long-term capital gains and qualified dividends in favor of deducting investment interest expenses.

Taxes December 28, 2023

The guidance provides rules for the production of eligible components and sale to unrelated persons, as well as special rules that apply to sales between related persons.

Taxes December 28, 2023

Under the “ordering rules” established under IRS regulations, most of the payout of a nonqualified Roth distribution may be tax-free anyway—maybe even all of it.

Taxes December 27, 2023

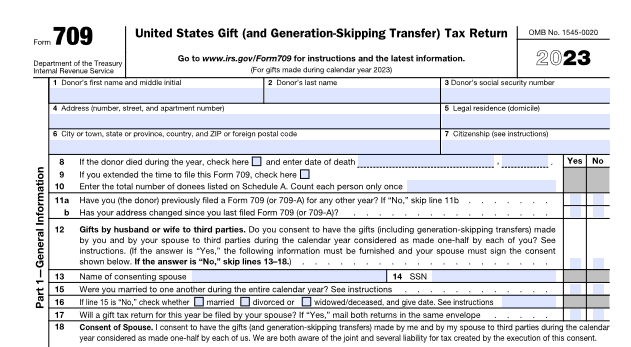

The annual gift tax exclusion allows you to gift up to a specified amount to each recipient each year without any gift tax liability.

IRS December 27, 2023

Businesses interested in taking advantage of the voluntary disclosure program have until March 22, 2024, to apply.