Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes July 30, 2024

The updated FAQs, issued July 26, pertain to the New, Previously Owned, and Qualified Commercial Clean Vehicle Credits.

Taxes July 26, 2024

These red flags come from common issues that IRS compliance teams have seen while analyzing and processing ERC claims.

Taxes July 26, 2024

The immediate unknown is whether Vice President Kamala Harris would recalibrate Democrats' economic agenda.

Taxes July 26, 2024

Direct File will now be a permanent option for taxpayers in states that choose to participate, and New Jersey said it's in.

Taxes July 25, 2024

The agency provided an update July 25 on its Strategic Operating Plan, which sets out several priorities for the IRS to accomplish.

IRS July 25, 2024

Danny Werfel said he's "fairly optimistic" the Supreme Court ruling won't deter future efforts to provide better taxpayer services.

Small Business July 25, 2024

The 2024 Mid-Year Sales Tax Rates and Rules report, commissioned by Vertex Inc., outlines the evolving landscape of local tax implementation, proliferation of fees, and increasing complexity of tax compliance for businesses across the U.S.

Taxes July 24, 2024

Notice 2024-60, issued by the IRS on July 24, details how taxpayers can claim the credit for the sequestration of carbon oxide.

Taxes July 24, 2024

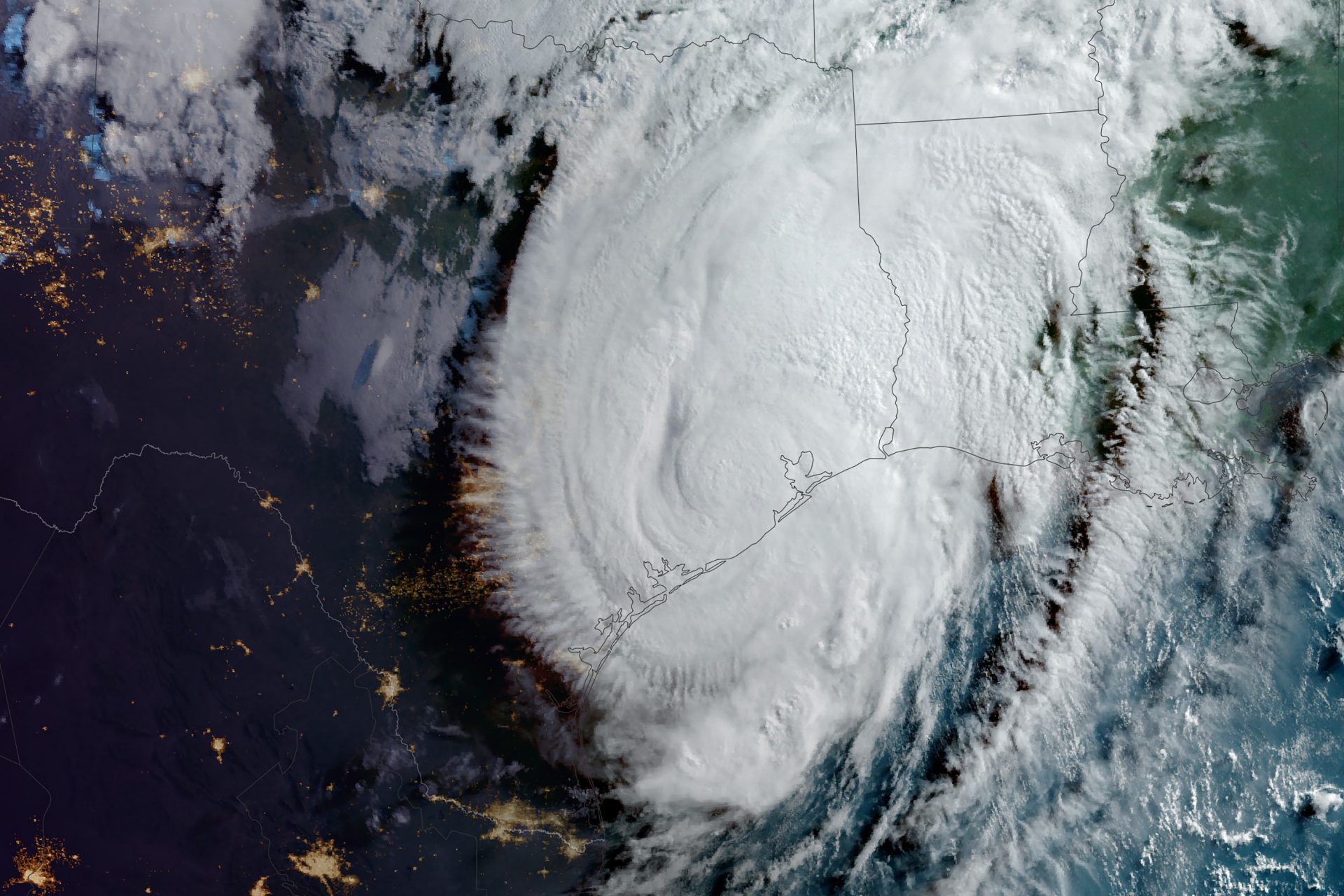

Individual and business taxpayers in 67 counties now have until Feb. 3, 2025, to file their returns and make tax payments.

Taxes July 22, 2024

The decision in Connelly v. United States last month impacts certain types of smaller businesses, in particular closely held companies.

Small Business July 22, 2024

Here’s a quick explanation for how things went wrong so quickly for so many Windows users around the world, including airlines, hospitals, banks and government agencies.

Payroll July 18, 2024

The final regulations reflect changes made by the SECURE Act and the SECURE 2.0 Act impacting retirement plan participants, IRA owners and their beneficiaries.