Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 21, 2026

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes June 20, 2025

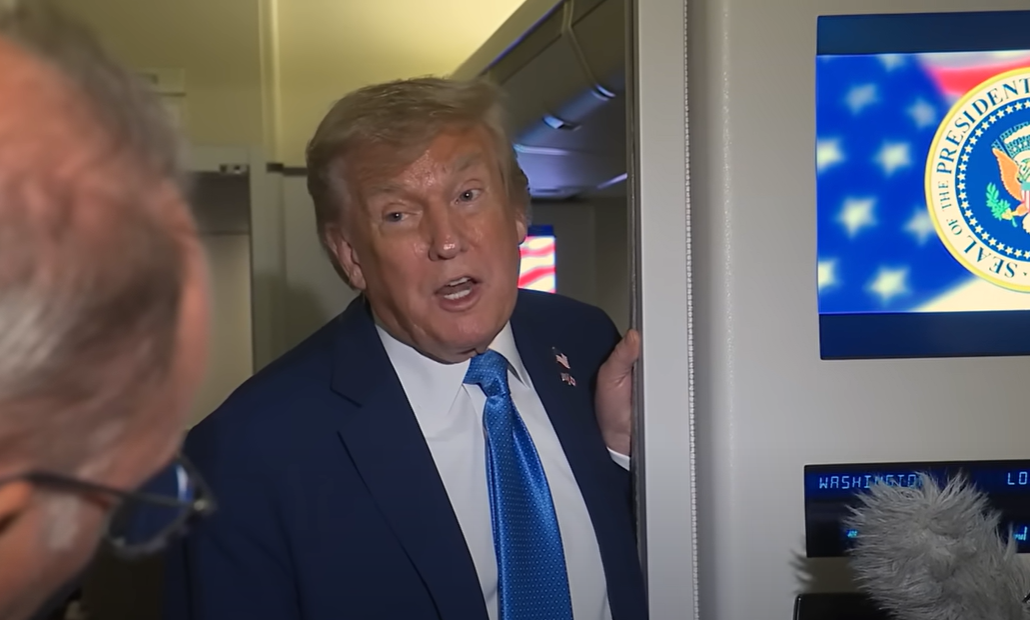

The 3.5% tax on remittances, which are not currently taxed, is among several provisions tucked inside President Donald Trump’s “One Big, Beautiful Bill” tax-and-spending plan.

Taxes June 19, 2025

Mexican-made packs of popular U.S. cigarette brands are flooding the market as a result of a loophole in U.S. trade law.

Taxes June 18, 2025

Following the release of the reconciliation bill by the Senate, the AICPA has identified several provisions it supports.

Taxes June 17, 2025

Despite changes from the Tax Cuts and Jobs Act (TCJA), military personnel may still claim a deduction for job-related moving expenses. But simply working for the armed forces doesn’t command a deduction.

Taxes June 17, 2025

The proposal, which follows the House’s narrow passage of its own version in May, includes sweeping changes to the tax code.

Taxes June 17, 2025

Senate Republicans’ tax bill would eliminate federal taxes and regulations on short-barreled rifles, short-barreled shotguns, and silencers as well as preempt state or local licensing requirements in a win for gun-rights advocates.

Taxes June 17, 2025

Senate GOP released a bill that would end tax credits for wind and solar earlier than for other sources, and make only modest changes to most other incentives, dashing hopes of those seeking relief from major cuts passed by the House.

Taxes June 17, 2025

The Senate's version of President Donald Trump’s signature economic package expands some tax breaks while raising the debt ceiling by $5 trillion, instead of $4 trillion in the House-passed measure.

State and Local Taxes June 16, 2025

The Senate Finance Committee Monday rolled back the SALT deduction cap to $10,000 in its first draft of President Trump's sprawling budget bill, a dramatic reversal from the $40,000 that was negotiated in the House last month.

Taxes June 16, 2025

State CPA societies across the country are expressing their strong opposition to a provision in the One Big Beautiful Bill Act which would eliminate the ability of specified service trades or businesses (SSTBs) to deduct state and local taxes (SALT) at the entity level.

Small Business June 13, 2025

President Donald Trump’s trade war is affecting Americans from buying groceries to paying electric bills, with the cost of bananas, ground beef, and electricity surging to all-time highs.

Taxes June 13, 2025

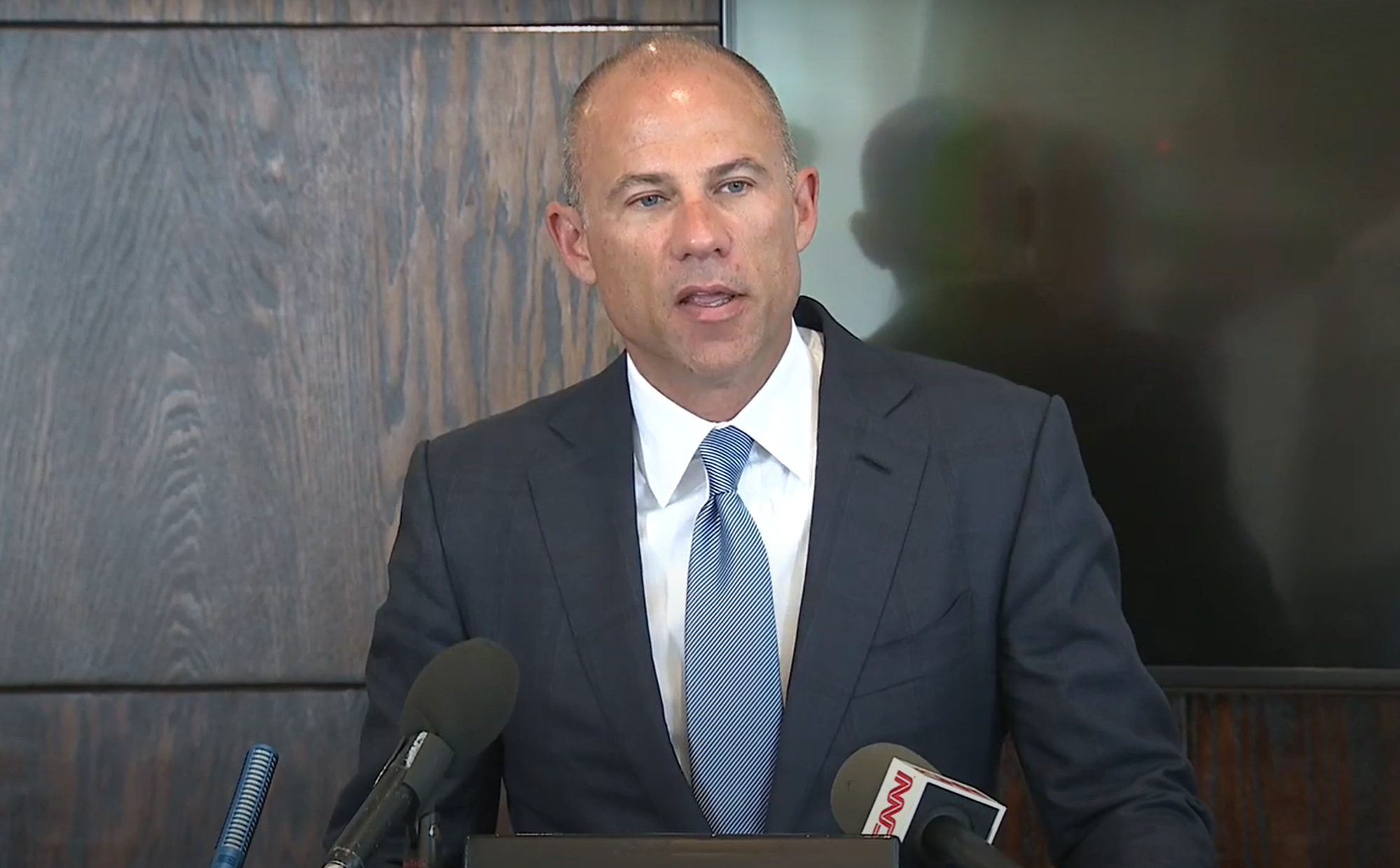

The lawyer who represented adult film star Stormy Daniels in her court battles against President Donald Trump, was resentenced June 12 to 11 years in prison for dodging taxes and stealing millions of dollars from clients.