Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes September 9, 2025

Beginning in 2026, the OBBBA rewrites the rules for the educator expense deduction. Notably, the new law removes the $300 cap, but requires taxpayers to claim the write-off as an itemized deduction.

Taxes September 9, 2025

Artificial intelligence is reshaping how compliance is managed, automating tasks once done manually and offering predictive insights. For businesses, the message is clear: adapt now or face greater risk.

Taxes September 9, 2025

The IRS is reportedly closing nine taxpayer assistance centers in six states later this year in an apparent cost-savings move, as the agency faces a potentially smaller budget for fiscal year 2026.

Taxes September 8, 2025

As hurricane season peaks and wildfire risks remain high, the IRS is urging individuals and businesses to create or update their emergency preparedness plans as part of National Preparedness Month.

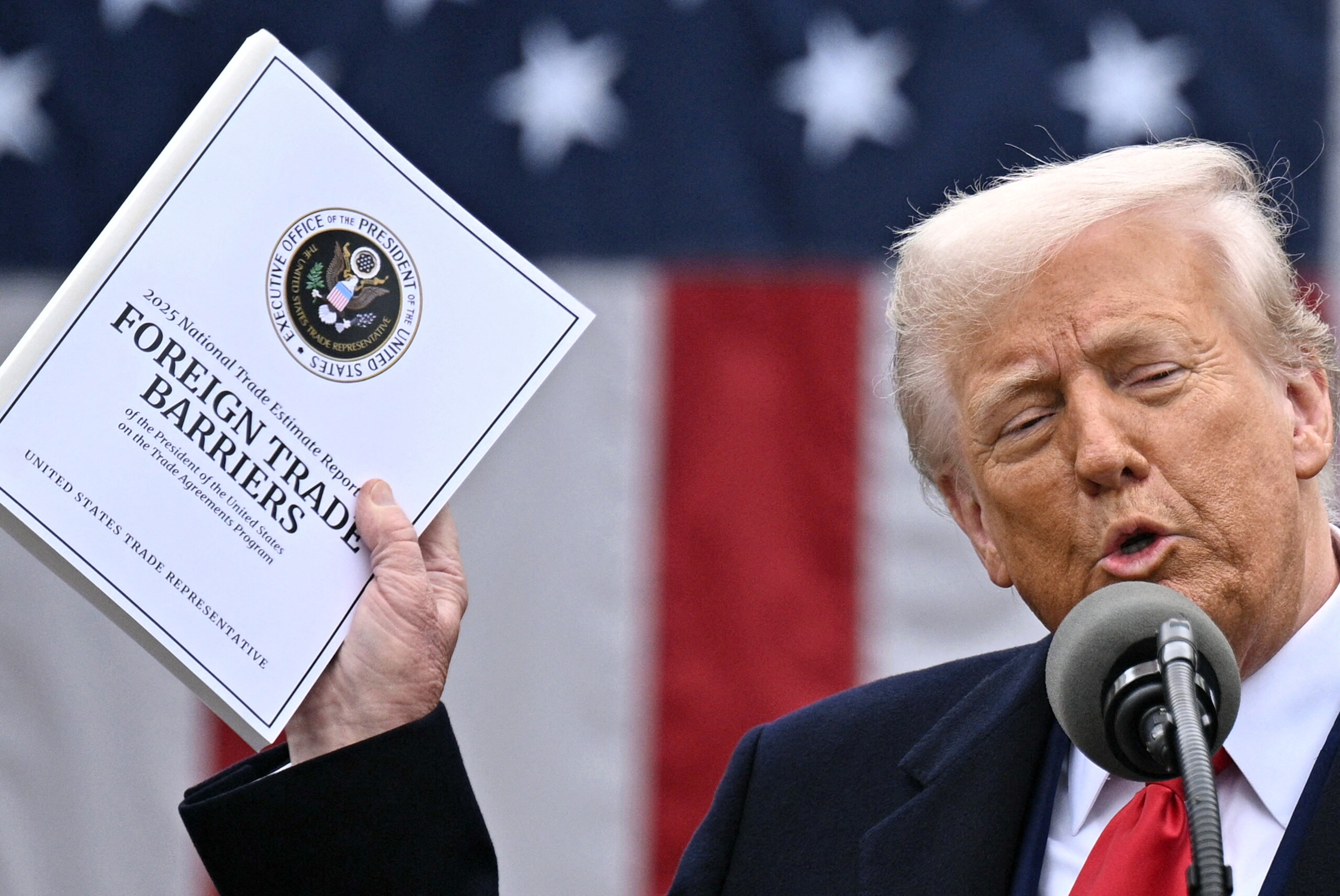

Taxes September 5, 2025

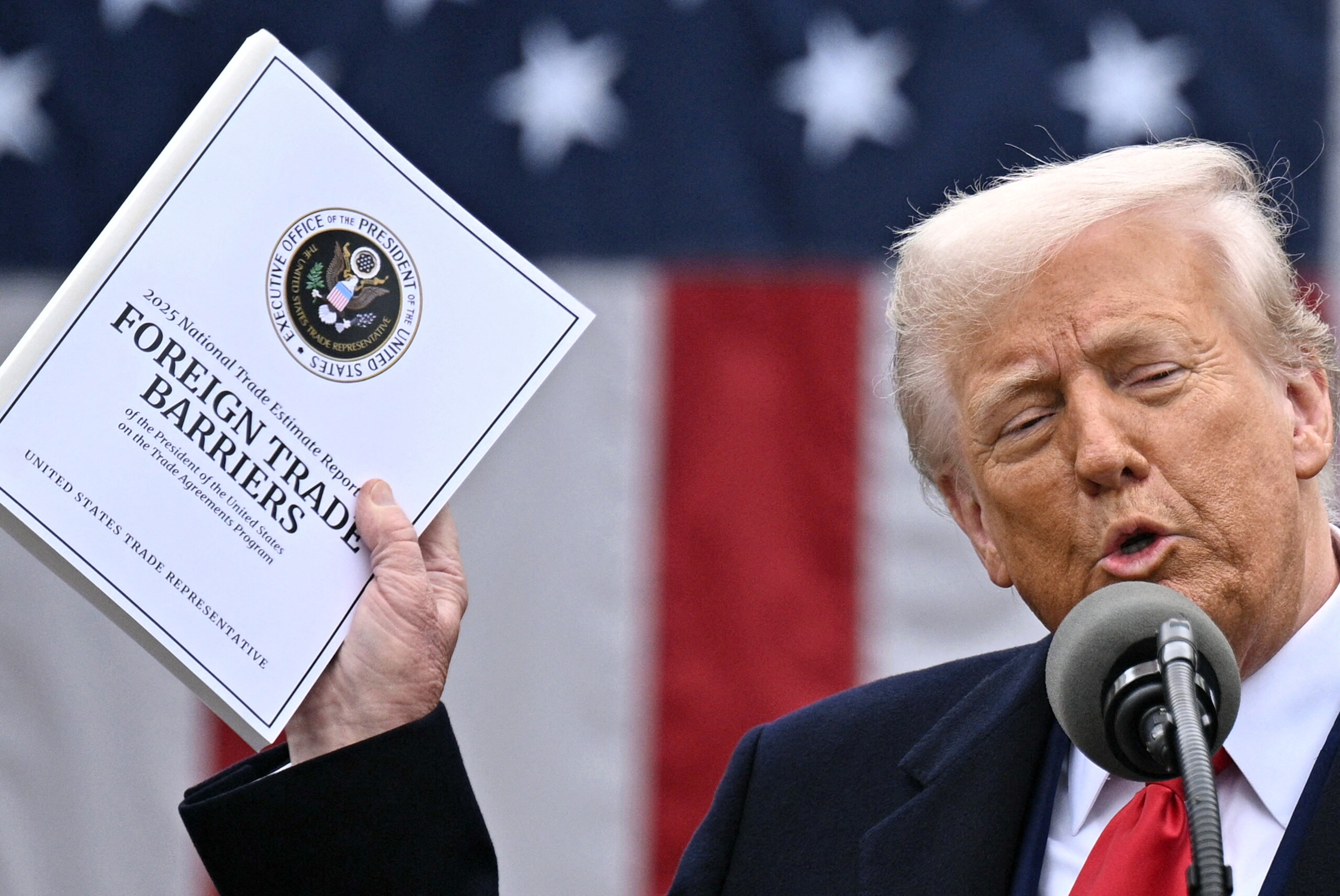

Donald Trump promised to slash red tape for business. His tariff regime has gotten American companies increasingly tangled up in it.

Taxes September 4, 2025

The IRS has already shared the residential addresses of more than 40,000 foreigners with immigration authorities, who are seeking to have the confidential information of at least 1 million more people incorporated directly into their database.

Accounting October 14, 2025 Sponsored

Retirement planning is not one-size-fits-all—it evolves through distinct stages of life and business ownership. This course explores key milestones and strategies to help individuals and small business owners prepare for a secure and efficient retirement.

Taxes August 27, 2025

The Treasury Department and the IRS said Aug. 20 that they intend to issue proposed regulations withdrawing the DPL rules and related modifications to the dual consolidated loss rules that were finalized toward the end of the Biden administration.

IRS August 26, 2025

The IRS released a draft W-2 form for 2026 on Aug. 15 that takes into account tax provisions in the One Big Beautiful Bill Act for deductions related to tip income and overtime pay.

Taxes August 26, 2025

The IRS on Aug. 21 issued a fact sheet containing frequently asked questions about Biden-era clean energy tax credits and deductions soon to expire under the One Big Beautiful Bill Act.

Taxes August 26, 2025

The president threatened to impose fresh tariffs and export restrictions on advanced technology and semiconductors in retaliation against other nations’ digital services taxes that target U.S. technology companies.

Accounting August 26, 2025

Most senior accountants (75%) described this busy season as "somewhat" or "extremely" stressful, compared to 22% of associates, according to the results of a new survey from staffing agency Distinct.