Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Technology November 12, 2025

The only way to stay ahead of cyberattacks next tax season is to move from a reactive mindset to a proactive security strategy. Always assume that someone, somewhere, is using AI to test your defenses. Your job is to ensure they fail.

OBBBA Tax Act November 12, 2025

Planning is even more important this year, ahead of the adoption of tax law changes effective this year and next.

Taxes November 12, 2025

The guide breaks down how the OBBBA is reshaping the tax landscape and offers practical strategies for preparing for 2026 and beyond.

Special Section: Guide to 2025 Tax Changes November 12, 2025

The OBBBA tax changes mean a major impact on 2025 tax returns that must be filed by April 15, 2026. Besides creating new tax forms, the OBBBA requires significant modifications to others.

Special Section: Guide to 2025 Tax Changes November 12, 2025

The OBBBA increases the contribution limit for dependent care expenses to $7,500, beginning in 2026. This gives participating employees more leeway as dependent care costs continue to escalate.

Special Section: Guide to 2025 Tax Changes November 12, 2025

If a corporation makes a monetary contribution falling between the 10% ceiling and the 1% floor, the amount “in between” is deductible. Any nondeductible amount above the 10% ceiling may still be carried over for five years.

Special Section: Guide to 2025 Tax Changes November 11, 2025

The deduction for miscellaneous expenses—including unreimbursed employee business expenses and production-of-income expenses—was not revived.

Taxes November 11, 2025

Instead of across-the-board property tax cuts, targeted state and federal incentives for younger first-time home buyers and older would-be sellers could begin to break the logjam in the housing market.

Special Section: Guide to 2025 Tax Changes November 11, 2025

The OBBBA expands the tax benefits for stock issued after July 4, 2025—the date of enactment—for stock that meets revised requirements. The new law contains three key changes of interest to entrepreneurs.

Special Section: Guide to 2025 Tax Changes November 10, 2025

It must seem like the annual threshold of $600 has been in place forever to long-time payroll managers and CPAs. In fact, it hasn’t budged an inch since 1954!

Taxes November 10, 2025

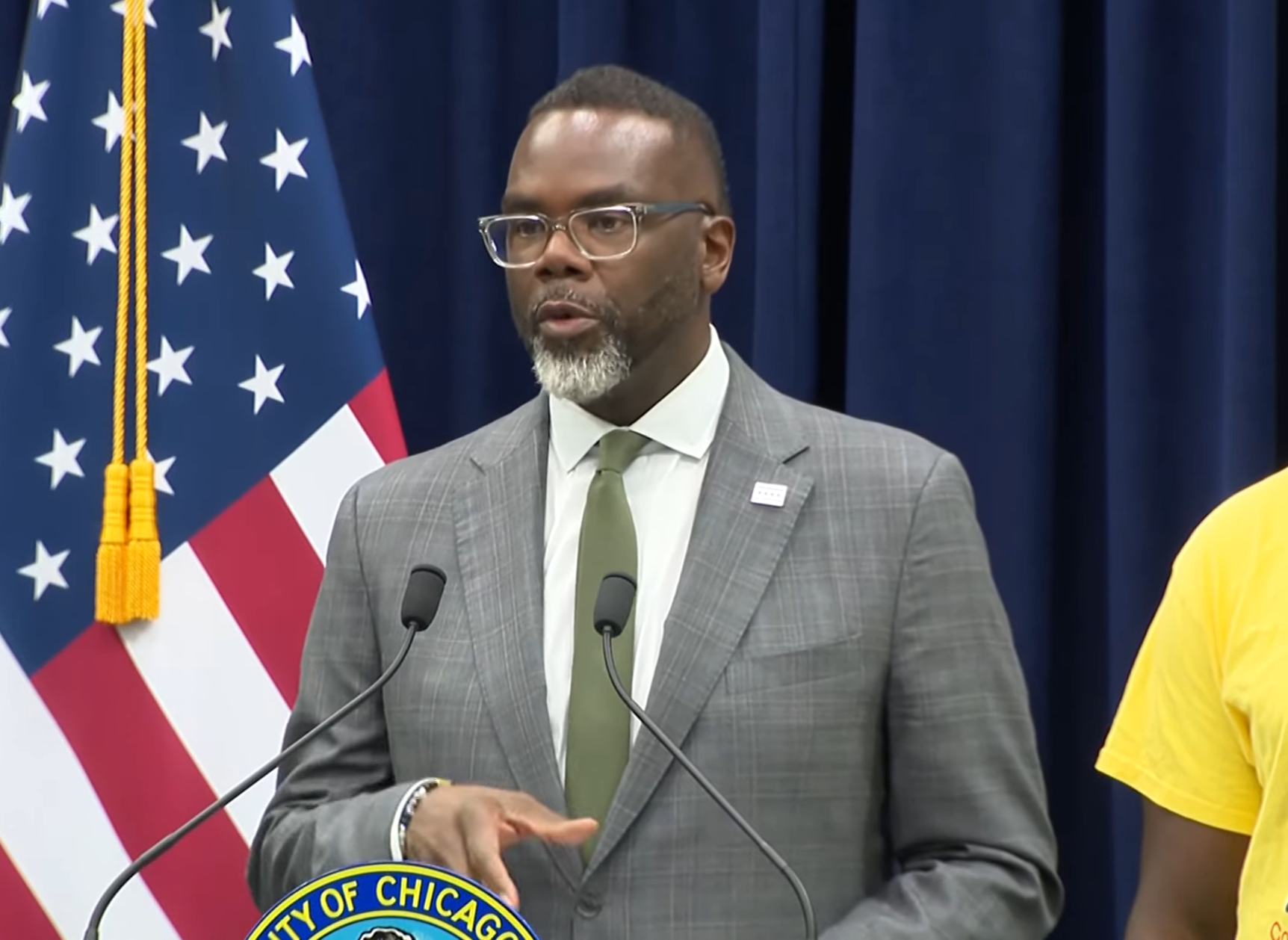

Having already failed to deliver other key tenets of his ambitious tax-the-rich wish list, the head tax is a watershed moment for Johnson and his allies.

Income Tax November 10, 2025

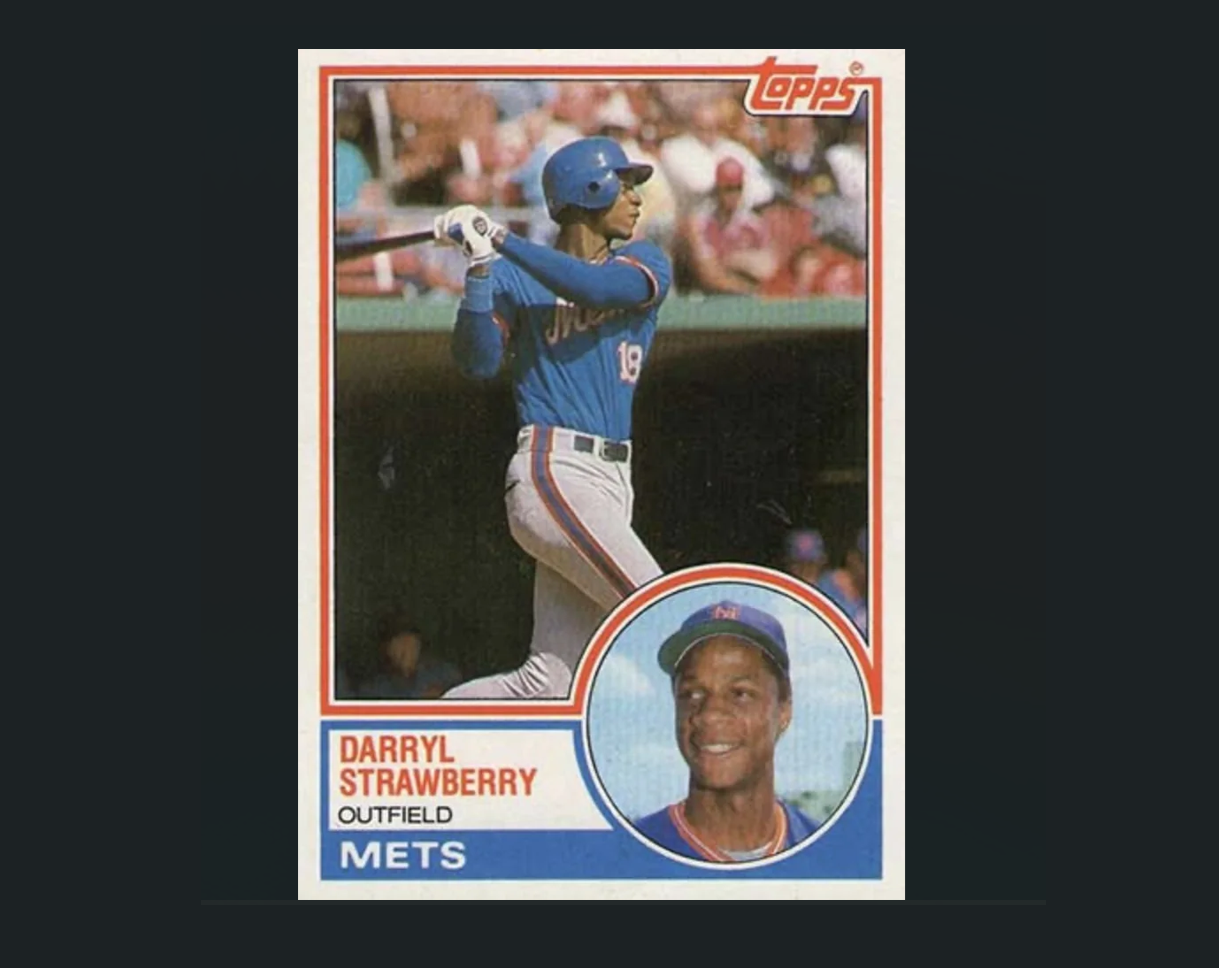

President Donald Trump is granting a pardon to former baseball star Darryl Strawberry, who pleaded guilty three decades ago to tax evasion, according to a White House official.