Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes November 19, 2025

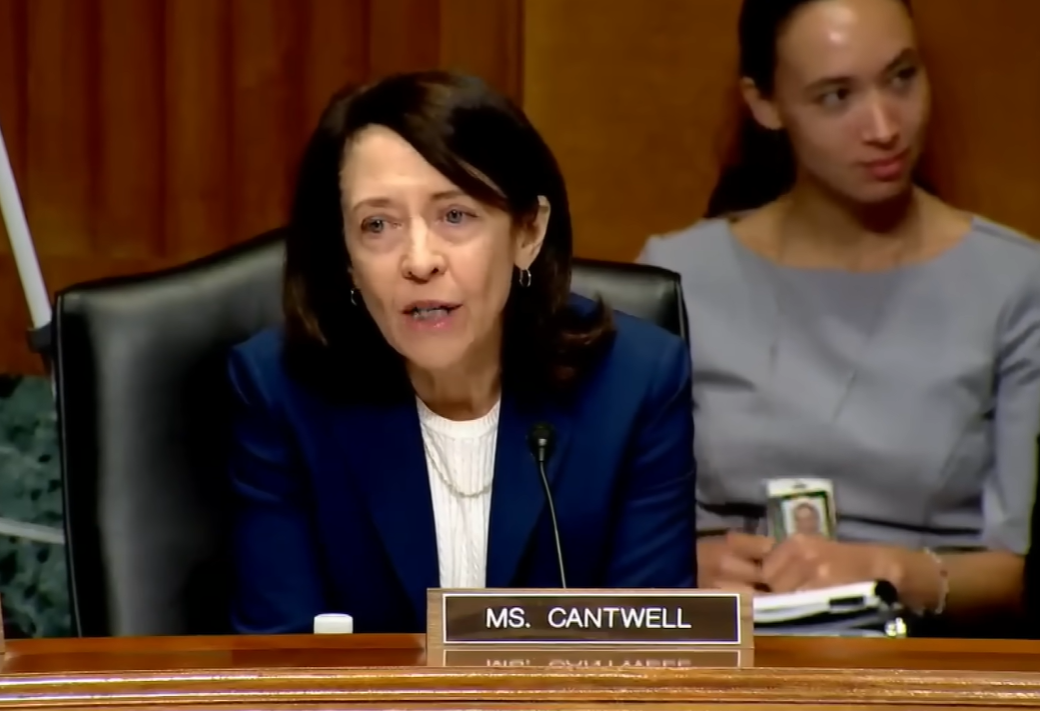

In a letter to the Joint Committee on Taxation, Sen. Maria Cantwell (D-WA) called for an analysis of the current landscape of college athletics centered around the policies that shield much of the industry from taxation.

Taxes November 19, 2025

As evidenced by a taxpayer in a new case, Besaw, TC Sum. Op. 2025-7, 7/21/25, just missing one or two of the key ingredients can spoil the deal.

Taxes November 19, 2025

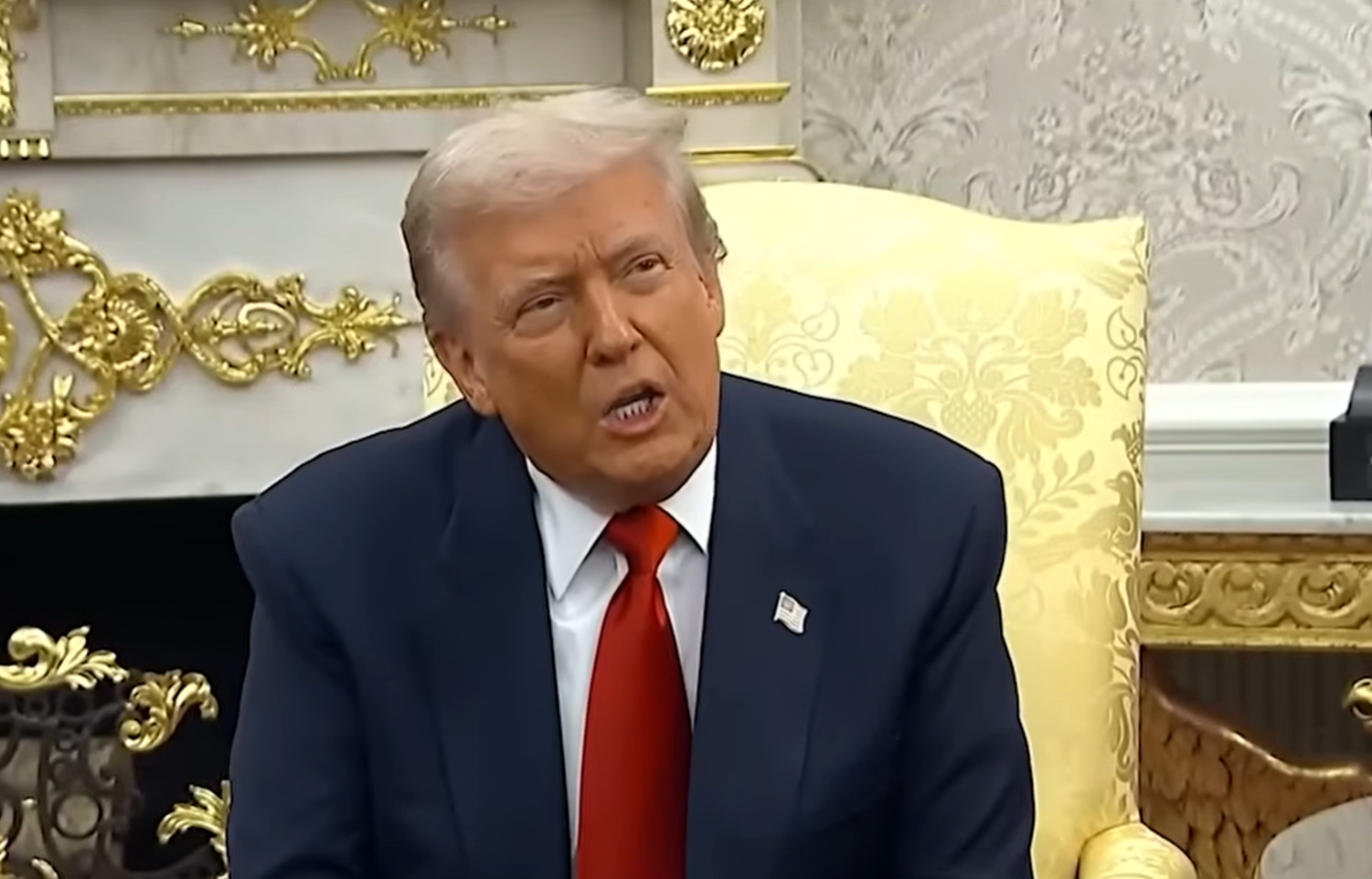

President Donald Trump on Tuesday gave his sharpest rebuke of congressional Democrats’ efforts to extend expiring Affordable Care Act enhanced tax credits, saying he would not support legislation to do so.

Taxes November 19, 2025

Donald Trump’s presidential library foundation plans to raise almost a billion dollars in tax-exempt contributions over the next two years to build and operate his high-rise legacy project in downtown Miami, according to new tax filings.

Taxes November 18, 2025

Chicago aldermen voted down Mayor Brandon Johnson’s 2026 budget in a Monday committee vote, a historic display of rebellion against the freshman mayor who has been struggling to shore up support for his controversial head tax.

Special Section: Guide to 2025 Tax Changes November 18, 2025

The OBBBA generally enhances the tax benefits available for investments in the Qualified Opportunity Zone (QOZ) program and makes these favorable tax law changes permanent.

Taxes November 18, 2025

Diana Miller-Lloyd, 44, who currently lives in Jacksonville, FL, pleaded guilty in Hartford federal court to aiding in the preparation of false tax returns.

Taxes November 18, 2025

For individuals, the rate for tax underpayments and overpayments will be 7% per year, compounded daily, the IRS said on Nov. 13.

Taxes November 18, 2025

Supporters say it will boost economic development, but opponents say it will hurt ordinary Georgians by hiking sales taxes and other fees.

Taxes November 17, 2025

The 27-year-old internet personality, whose real name is Cody Detwiler, is accused of “unlawfully and willingly” attempting to evade state sales tax he owed on his Ferrari, which could have amounted to tens of thousands of dollars.

Special Section: Guide to 2025 Tax Changes November 14, 2025

An ABLE account works like the better-known Section 529 account for higher education expenses. After you establish the account and contribute to it, any earnings inside the account are exempt from current tax.

Taxes November 13, 2025

The amount individuals can contribute to their 401(k) plans and individual retirement accounts will be higher in 2026, the IRS announced on Nov. 13.