Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes February 21, 2023

The final regulations reflect changes made by the Taxpayer First Act that strengthen e-filing requirements.

Taxes February 21, 2023

Margarita Aispuro-Camacho faces a maximum of 20 years in prison and a $1 million fine.

Taxes February 21, 2023

Taxpayers receiving these notices can respond securely to the IRS online, even if they don't have an IRS online account.

Accounting February 21, 2023

Accounting thought leaders convened in New York City Feb. 20-22, 2023, for CPA Practice Advisor's 13th annual Accounting Thought Leader Symposium.

Taxes February 21, 2023

The CAMT imposes a 15% minimum tax on the adjusted financial statement income of large companies starting in 2023.

Taxes February 17, 2023

To fight identity fraud and cybercrime, tax preparers and filers must collaborate and adopt effective methods to secure their data and financial resources.

Taxes February 16, 2023

The AICPA supports the deferral of IRC Section 174 amortization requirement of the research and experimental expenditures and requests that Congress retroactively extend the effective date to ...

Sales Tax February 16, 2023

Initially focusing on bookkeeping and payroll services, VARC Solutions has expanded to offer fully outsourced business management, payment processing, invoice management, consulting, implementation, and training.

Payroll February 15, 2023

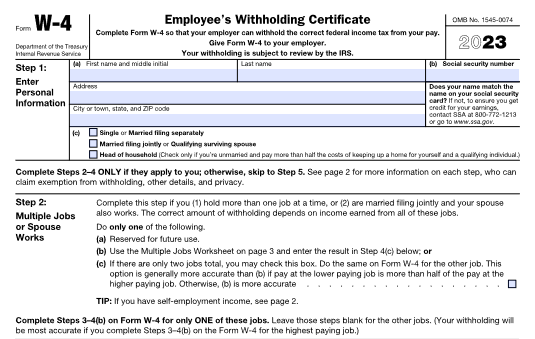

If you know Form W-4 like the back of your hand, knowing these 2023 changes should be enough to close out this article and go about your day.

Accounting February 15, 2023

The U.S. Census Bureau reported that overall retail sales in January were up 3% from December and up 6.4% year over year. In December, sales were down 1.1% month over month but up 5.9% year over year.

Taxes February 15, 2023

This guidance applies to owners of certain solar and wind facilities placed in service in connection with low-income communities that are eligible for the section 48 energy investment credit.

Taxes February 15, 2023

The CAP program began in 2005 as a way to resolve tax issues through open, cooperative and transparent interactions between the IRS and taxpayers before the filing of a return.