Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes April 19, 2023

Interacting with the agency should be less painful over the next decade as the IRS’s $80 billion spending plan is implemented.

Taxes April 19, 2023

The Bidens were responsible for $169,820 in combined federal, Delaware, and Virginia income taxes last year.

Small Business April 18, 2023

Before launching a campaign, make sure you understand all of the tax implications of crowdfunding.

Taxes April 18, 2023

While IRS customer service is getting better, the agency is prone to stumble, particularly when technology is involved.

Taxes April 17, 2023

GM, Tesla, and Ford all have at least one EV that qualifies, while Ford and Stellantis have one eligible plug-in hybrid model.

Taxes April 13, 2023

The favorable tax treatment isn’t automatic. To avoid current tax, you and the qualified intermediary must sign a "Qualified Exchange Accommodation Agreement."

Taxes April 12, 2023

Taxpayers usually have three years to file and claim their tax refunds. If they don't file within three years, the money becomes the property of the U.S. Treasury.

Taxes April 12, 2023

if you can’t present clear and convincing evidence that the loan is tied to a business transaction, the transaction may be deemed to be a gift.

Taxes April 12, 2023

Depending on the circumstances, it may be better to bypass the exclusion on a current sale and save it for the time when it will do you more tax good.

Taxes April 12, 2023

Now that the IRS has just released its Strategic Operations Plan which lays out the allocation of the funds, you may want to pay close attention to this plan.

Taxes April 12, 2023

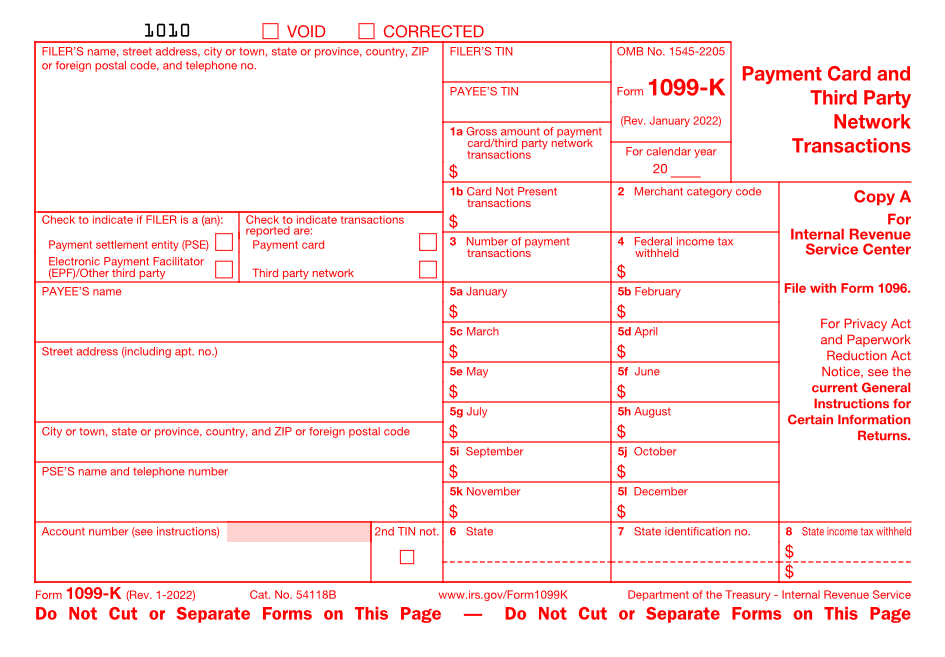

The IRS lists 21 different 1099 forms. Here is an overview of each form, as of March 2023, and why you could receive one.

Taxes April 11, 2023

When you officially add your spouse to the company payroll, they are taxed on the compensation, but are also eligible for benefits just like any other employee.