Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 10, 2026

February 10, 2026

February 10, 2026

February 10, 2026

Taxes November 25, 2025

The Treasury Department and the IRS are seeking feedback on the implementation of a new federal tax credit scholarship program under the One Big Beautiful Bill Act designed to support school choice initiatives and students with education-related expenses.

Taxes November 25, 2025

TaxWise Online now integrates Wolters Kluwer Expert AI, a proprietary layer of generative and agentic capabilities that elevates how tax preparers work, make decisions, and deliver value.

Taxes November 24, 2025

While speaking with comedian Jon Stewart earlier this week, Mikie Sherrill called the prospect of the state withholding federal tax dollars a “good idea,” adding, “I think about that all the time.”

Taxes November 24, 2025

The AICPA is asking Treasury and the IRS to allow an exception for these permanently disallowed amounts so companies aren’t penalized unnecessarily.

Taxes November 21, 2025

The Treasury Department and the IRS issued guidance on Nov. 21 for employees who are eligible to claim the deduction for tips and for overtime compensation under the One Big Beautiful Bill Act for the 2025 tax year.

Taxes November 21, 2025

The Treasury Department and the IRS released interim guidance Nov. 20 on a new tax benefit for certain lenders, such as FDIC-insured banks, that provide loans secured by rural or agricultural real estate.

Taxes November 20, 2025

Missouri Gov. Mike Kehoe has offered no specifics about his plan but said it revolves around offsetting the $10 billion generated by the state’s 4.7% income tax rate, which represents about 63% of the state’s general revenue.

Taxes November 19, 2025

An investment portfolio where any one stock has appreciated dramatically over the original purchase is the perfect candidate for a contribution to a charitable organization or a DAF.

Taxes November 19, 2025

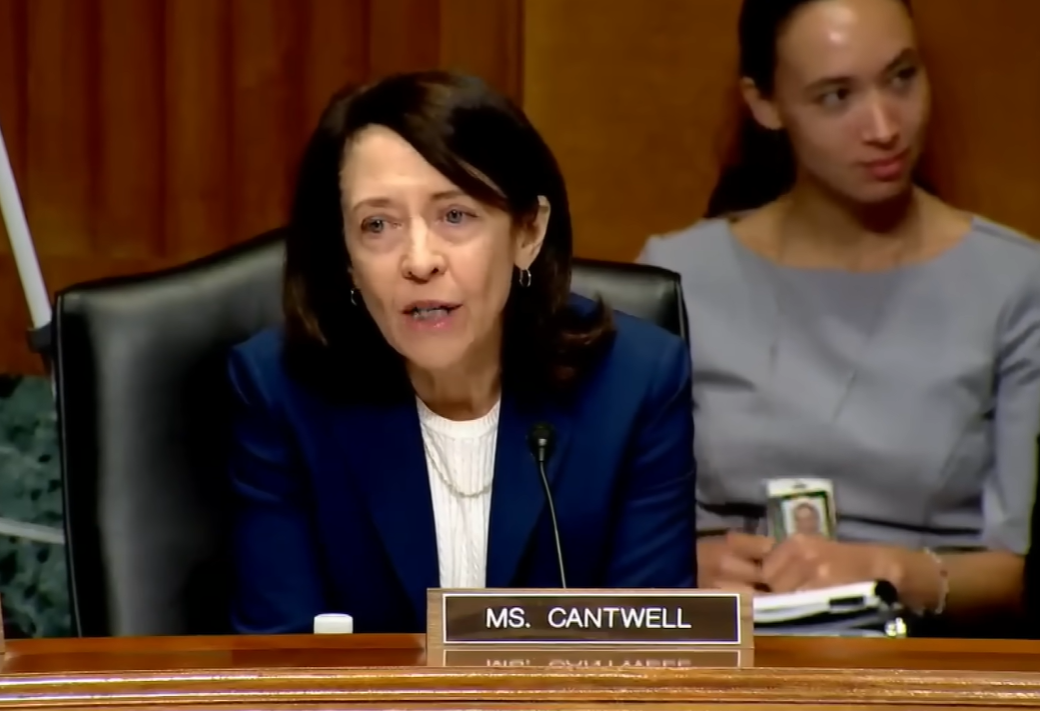

In a letter to the Joint Committee on Taxation, Sen. Maria Cantwell (D-WA) called for an analysis of the current landscape of college athletics centered around the policies that shield much of the industry from taxation.

Taxes November 19, 2025

As evidenced by a taxpayer in a new case, Besaw, TC Sum. Op. 2025-7, 7/21/25, just missing one or two of the key ingredients can spoil the deal.

Taxes November 19, 2025

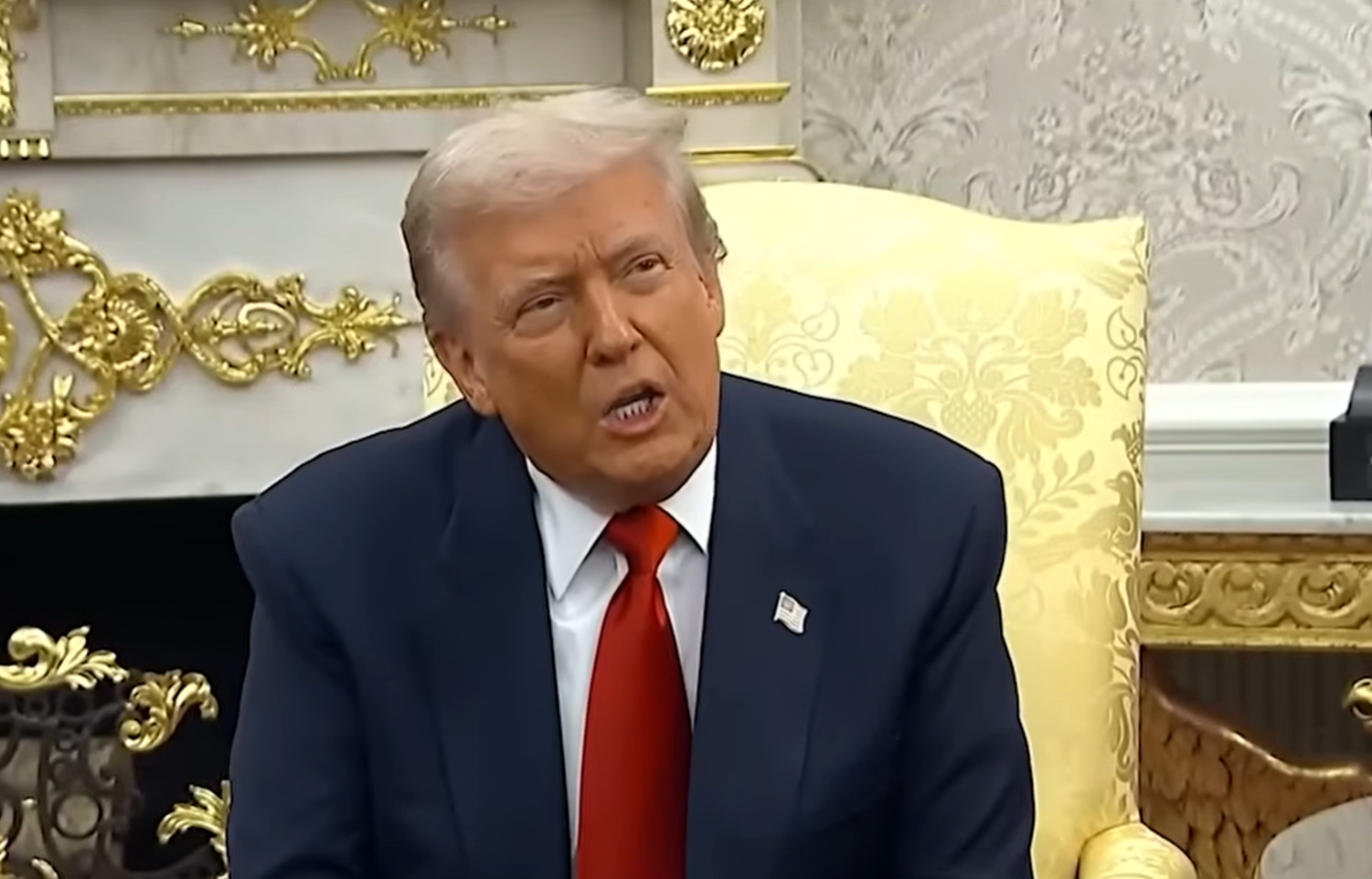

President Donald Trump on Tuesday gave his sharpest rebuke of congressional Democrats’ efforts to extend expiring Affordable Care Act enhanced tax credits, saying he would not support legislation to do so.

Taxes November 19, 2025

Donald Trump’s presidential library foundation plans to raise almost a billion dollars in tax-exempt contributions over the next two years to build and operate his high-rise legacy project in downtown Miami, according to new tax filings.