Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes December 15, 2025

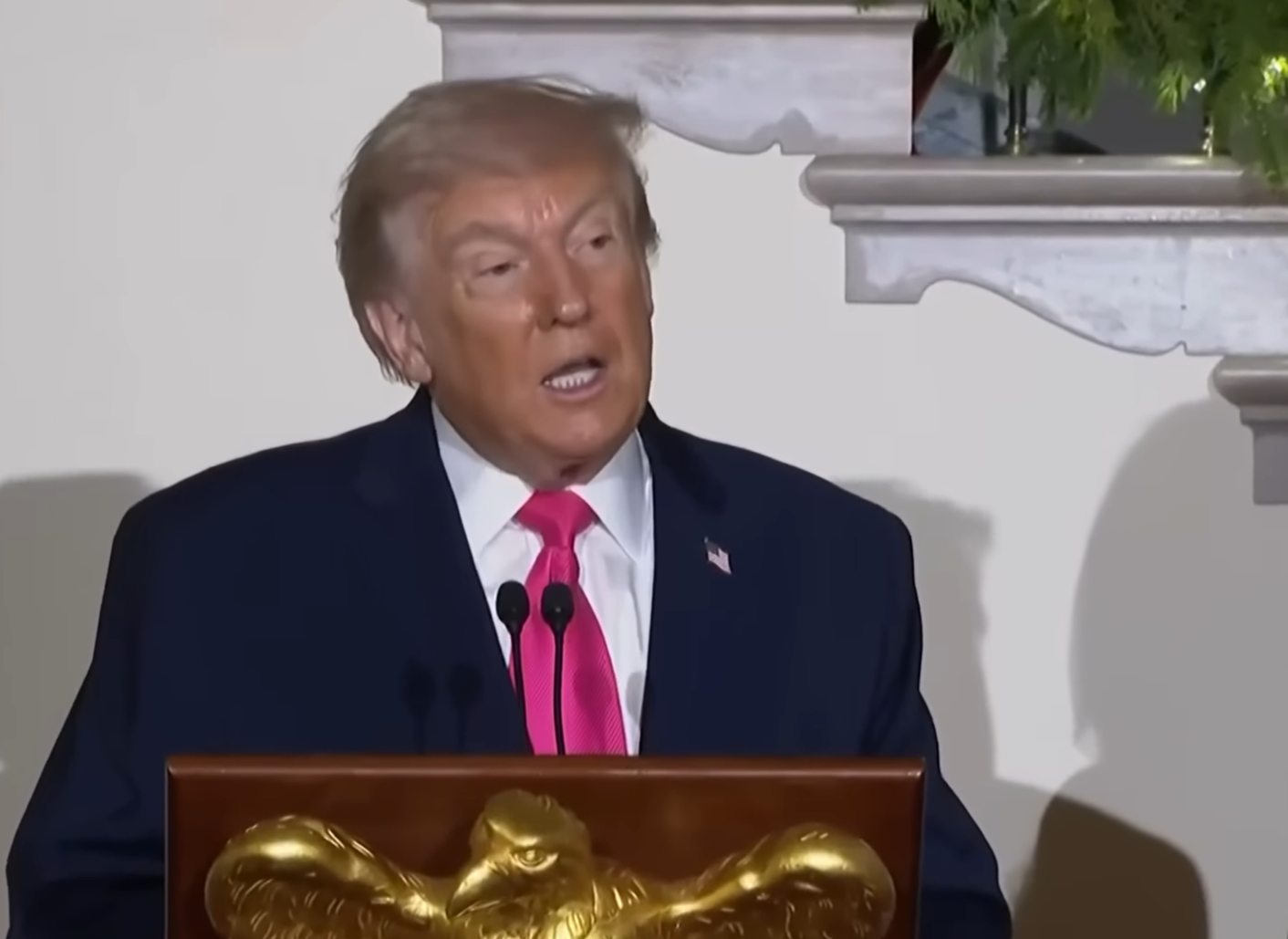

Forecasts of a bump in the average tax refund coming in the new year mask the uneven distribution of new tax breaks in President Donald Trump’s signature legislation, said Adam Michel, director of tax policy studies at the Cato Institute.

Taxes December 11, 2025

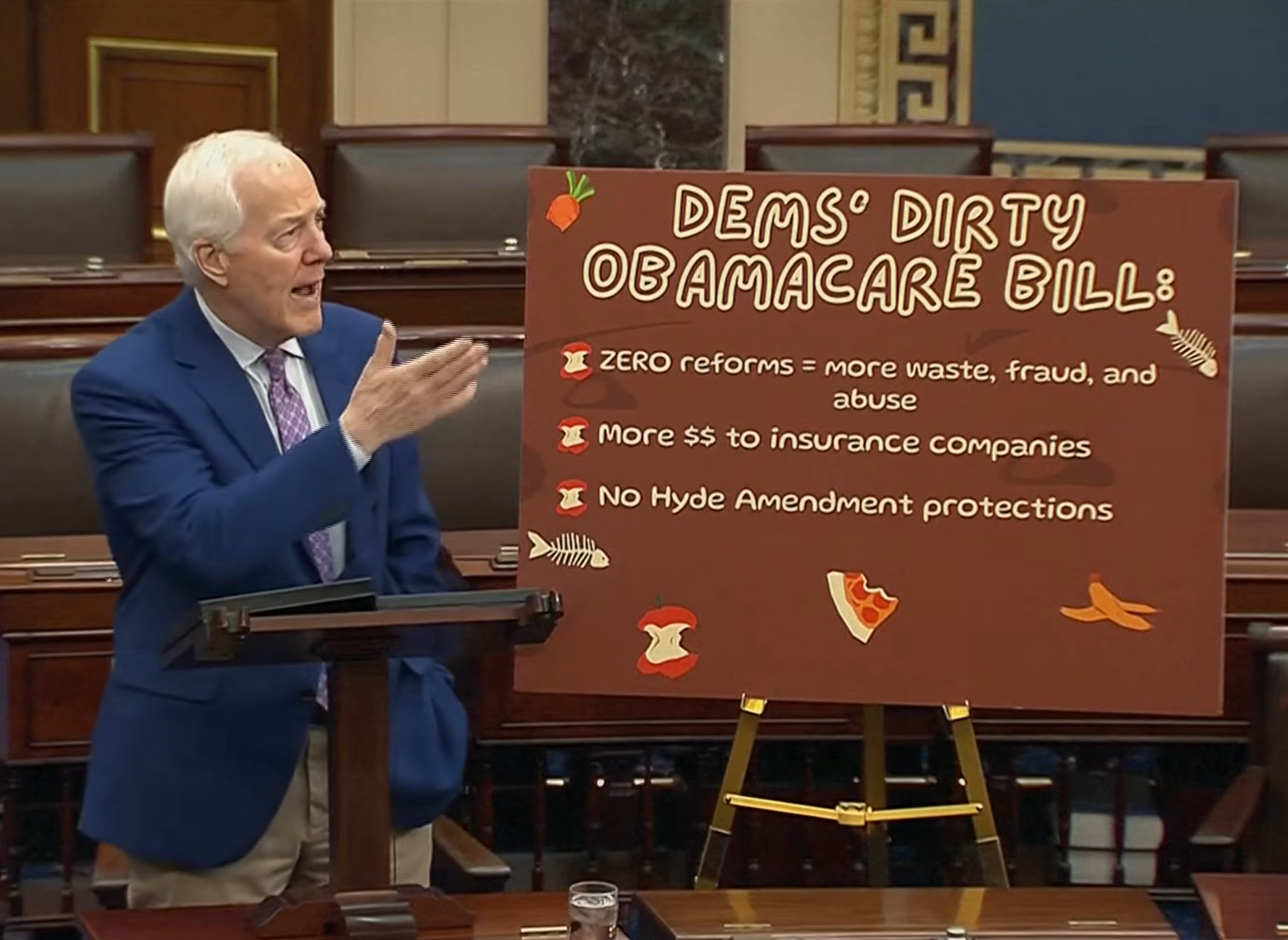

The Senate on Thursday rejected plans from Republicans and Democrats to ease soaring health care costs, making it more likely many people face health insurance premiums that could double shortly.

Taxes December 11, 2025

Scott Bessent targeted New York Gov. Kathy Hochul, Colorado Gov. Jared Polis, and Illinois Gov. JB Pritzker over their state's taxes amid the ongoing holiday season.

Taxes December 11, 2025

The Treasury Department and the IRS provided guidance in Notice 2026-05 on Dec. 9 on new tax benefits for health savings account participants under this summer's One Big Beautiful Bill Act.

Taxes December 11, 2025

Boston Mayor Michelle Wu has said the new tax rates will result in a 13%, or $780 increase, in property taxes for the average single-family homeowner next year.

Taxes December 9, 2025

A Michigan judge ruled against marijuana businesses in the state Dec. 8, rejecting their arguments that a new 24% wholesale tax on their products, imposed by the Legislature as part of a road-funding deal, should be immediately blocked.

Taxes December 8, 2025

Even if you never claim a tax deduction, the federal government may still know which charities you support.

Legislation December 8, 2025

For CPAs, accountants, and tax professionals, the OBBB delivers sweeping reforms, some long-awaited from the Tax Cuts and Jobs Act (TCJA) of 2017 and some unexpected.

Taxes December 1, 2025

The latest numbers from the Tax Foundation show that Wyoming is the most taxpayer-friendly state, Montana is 6th, and Idaho is 9th. But Washington coming in near last at 45th is a cause for concern.

Taxes November 25, 2025

The Treasury Department and the IRS are seeking feedback on the implementation of a new federal tax credit scholarship program under the One Big Beautiful Bill Act designed to support school choice initiatives and students with education-related expenses.

Taxes November 25, 2025

TaxWise Online now integrates Wolters Kluwer Expert AI, a proprietary layer of generative and agentic capabilities that elevates how tax preparers work, make decisions, and deliver value.

Taxes November 24, 2025

While speaking with comedian Jon Stewart earlier this week, Mikie Sherrill called the prospect of the state withholding federal tax dollars a “good idea,” adding, “I think about that all the time.”