Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes January 31, 2024

The bill would devote about $33 billion to reviving a trio of business tax breaks and roughly the same amount to expand the child tax credit.

Taxes January 29, 2024

Taxpayers in 12 states — Arizona, California, Florida, Massachusetts, New Hampshire, Nevada, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming — will have access to a new program from the IRS called Direct File.

Taxes January 26, 2024

Between 2015 and 2020, Coates claimed $228,788 in tax refunds on her individual federal income tax returns by falsely reporting that taxes had been withheld from her income and had been paid to the IRS.

Taxes January 26, 2024

The sessions held in February aim to ensure that tax professionals have the latest ERC information and understand ERC eligibility criteria.

Small Business January 24, 2024

Tax professionals have the opportunity to help reduce their business clients’ taxes by recognizing the opportunity for a retirement plan.

Taxes January 24, 2024

The IRS has extended its April 15 filing deadline for impacted taxpayers until June 17 to submit returns and make tax payments.

Taxes January 24, 2024

EAs with a Social Security number ending in 7, 8, or 9 must renew their status by Jan. 31 before their current enrollment expires March 31.

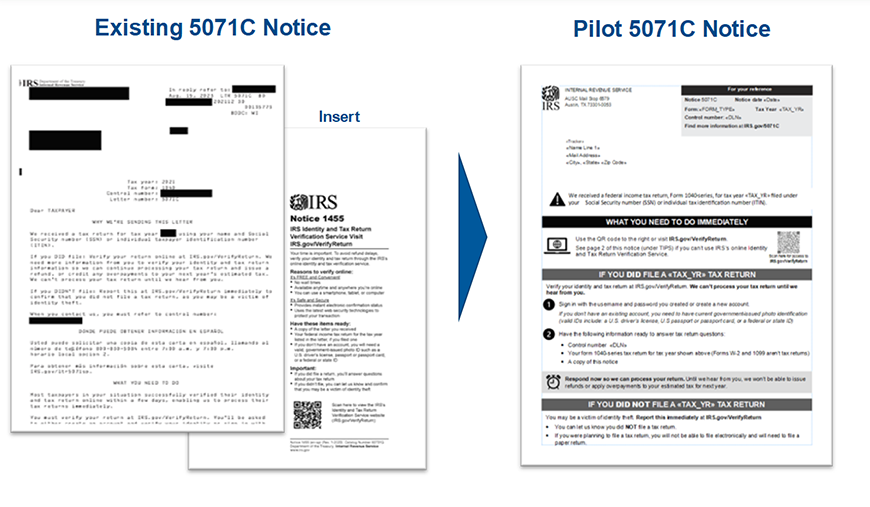

Taxes January 23, 2024

The Simple Notice Initiative will review and redesign hundreds of notices with an immediate focus on the most common notices that individual taxpayers receive.

Taxes January 19, 2024

Ways and Means voted to approve a tax package that would revive a trio of business tax incentives and expand the child tax credit.

Taxes January 19, 2024

Charles Littlejohn, 38, pleaded guilty Oct. 12 to stealing Donald Trump’s tax data from the IRS and leaking it to The New York Times.

Taxes January 19, 2024

The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022 and before Jan. 1, 2033.

Taxes January 18, 2024

The two halves of this deal provide the biggest bang for the buck—in terms of reducing poverty and growing the U.S. economy.