Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 18, 2026

February 17, 2026

February 17, 2026

Taxes September 23, 2024

Come Oct. 1, the per diem rates will be $319 for business travel to high-cost locations and $225 for travel to low-cost areas.

Taxes September 23, 2024

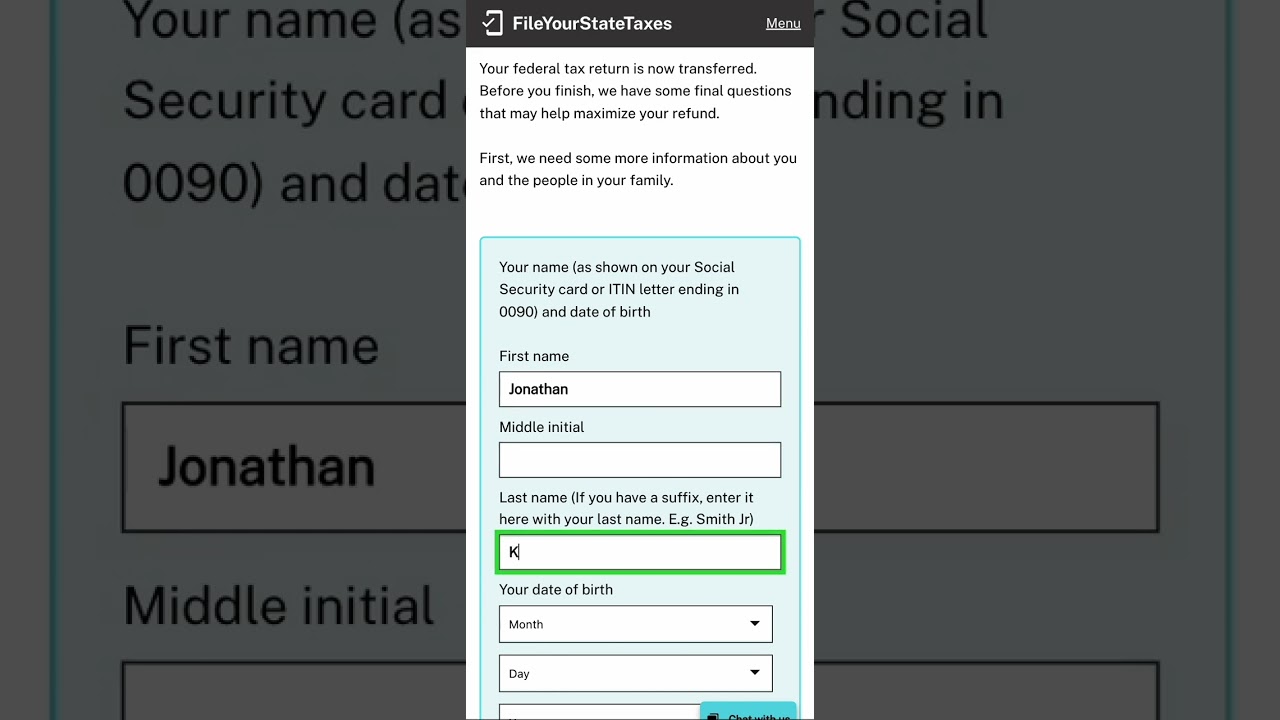

Civic tech nonprofit Code for America is broadening its tax filing simplification process to Maryland and North Carolina in January.

Taxes September 19, 2024

The three people will share a $74 million payout for disclosing a tax evasion scheme that enabled the IRS to collect $263 million.

Taxes September 19, 2024

Assumption that extending Donald Trump's 2017 tax law wouldn't add to deficits could substantially shrink the price tag.

Taxes September 18, 2024

The Tel Aviv District Court has dismissed appeals filed by the company against the tax assessment issued by the Tax Authority on the Central Bottling Company's tax liability for royalties it paid for using the intellectual property rights of Coca-Cola worldwide.

Taxes September 18, 2024

Trump promised to “get SALT back, lower your Taxes, and so much more,” in a post on his social media platform Truth Social on Sept. 17.

Taxes September 17, 2024

Gifts-in-kind organizations are not-for-profits that secure corporate donations of new merchandise and redistribute the items to not-for-profits members, which may include schools and individual teachers.

State and Local Taxes September 17, 2024

With elections approaching, it’s time for governors and mayors to offer some viable new policy options—and ways to pay for them.

Taxes September 17, 2024

A taxpayer can’t deduct start-up expenses if he or she abandons the business before it ever gets off the ground.

Taxes September 16, 2024

The tax briefing aims to distinguish the candidates' tax priorities and propose how their policies could potentially affect all taxpayers.

Taxes September 13, 2024

These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments.

Taxes September 12, 2024

The proposed regulations provide definitions and general rules for determining and identifying AFSI. They also include rules regarding various statutory and regulatory adjustments in determining AFSI.