Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes October 21, 2024

The IRS provided new guidance to taxpayers using the safe harbors for the SAF credit that were outlined by the agency last April.

Taxes October 21, 2024

All current preparer tax identification numbers expire on Dec. 31, and the fee to renew or obtain a PTIN for 2025 is $19.75.

Taxes October 17, 2024

Deep ideological differences could make striking an agreement on expiring tax breaks difficult if there is divided government.

Income Tax October 17, 2024

The ad tells Americans they should have a "tax break up" with their professional preparer by using one of TurboTax's live experts.

Small Business October 16, 2024

Halloween can be a scary time for retailers. In addition to inventory issues and trends, figuring out whether and how to charge sales tax on candy can be frightening.

Taxes October 15, 2024

Scammers commonly set up fake charities to take advantage of peoples’ generosity during natural disasters and other tragic events.

Taxes October 15, 2024

The moral of the story is that you should not run risks with so much at stake. The cost of an accurate qualified appraisal from a reputable source is money well spent.

Taxes October 14, 2024

The American Institute of CPAs recently submitted a comment letter to the Department of the Treasury and the Internal Revenue Service in response to their release of a guidance package addressing certain basis-shifting transactions involving partnerships and related parties.

Technology October 14, 2024

CFOs' and corporate tax executives' stances on GenAI have shifted over the past year—from mostly negative to mostly positive.

Taxes October 11, 2024

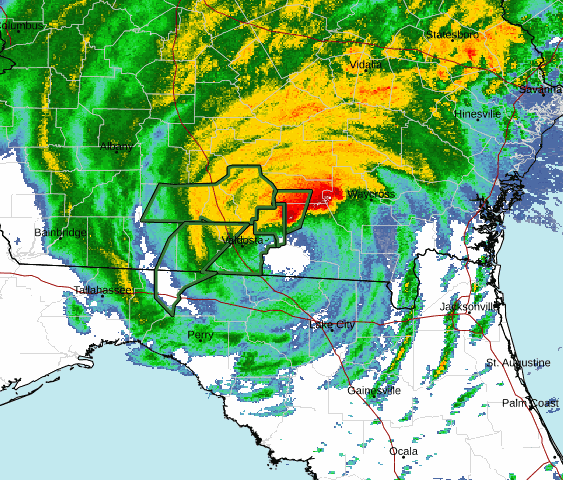

Because of hurricanes Debby, Helene, and Milton, affected taxpayers have until May 2025 to file returns and make tax payments.

Taxes October 11, 2024

The projected gross tax gap for 2022 is down $12 billion from a revised 2021 tax gap of $708 billion, the agency said Oct. 10.

Taxes October 10, 2024

Designed for professionals who handle federal tax matters, the IFT provides high-level updates, insights, analyses, and practical advice from America’s top tax authorities on the latest federal tax trends and developments.