Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes December 19, 2024

The optional standard mileage rate for automobiles driven for business will increase by 3 cents in 2025, while the mileage rates for vehicles used for other purposes will remain unchanged from 2024.

Taxes December 18, 2024

While many workers hoped for tax-free tips, experts warn the proposal could disproportionately benefit higher earners and exacerbate inequalities in the service industry.

Taxes December 17, 2024

Savvy savers should plan ahead to help save more and avoid penalties and tricky tax situations. Here are five changes coming to IRAs and 401(k)s in 2025.

Taxes December 16, 2024

Whether the provisions in the Tax Cuts and Jobs Act are extended, modified, or left to expire, the decisions made in the coming years will shape the tax landscape for a generation.

Taxes December 16, 2024

While measures up for renewal that largely benefit individuals and households are an easy sell to voters, economists caution on the scale of economic dividend they generate. The bigger spur for investment, they say, would be cuts for corporations.

Small Business December 13, 2024

The 1099 filing offering from BILL is an all-in-one solution that enables businesses to manage their AP needs and 1099-NEC and 1099-MISC forms together from a single platform.

Taxes December 12, 2024

The update given by the IRS on Dec. 12 comes as the threat of additional budget cuts from Republicans and a potential new leader of the agency loom once Donald Trump takes office next month and both chambers of Congress are controlled by the GOP.

Taxes December 12, 2024

The latest expansion of the IRS business tax account makes this online self-service tool available to C corporations, the tax agency said on Dec. 12. In addition, designated officials can now access business tax account on behalf of their S corporation or C corporation.

Small Business December 12, 2024

According to SCORE, 82% of small businesses fail due to issues managing cash flow. If money has not been set aside for taxes, an unexpected rise in expenses can cause their business to fail. As a result, personal savings can be wiped out, and those with small business loans can go into debt.

Payroll December 11, 2024

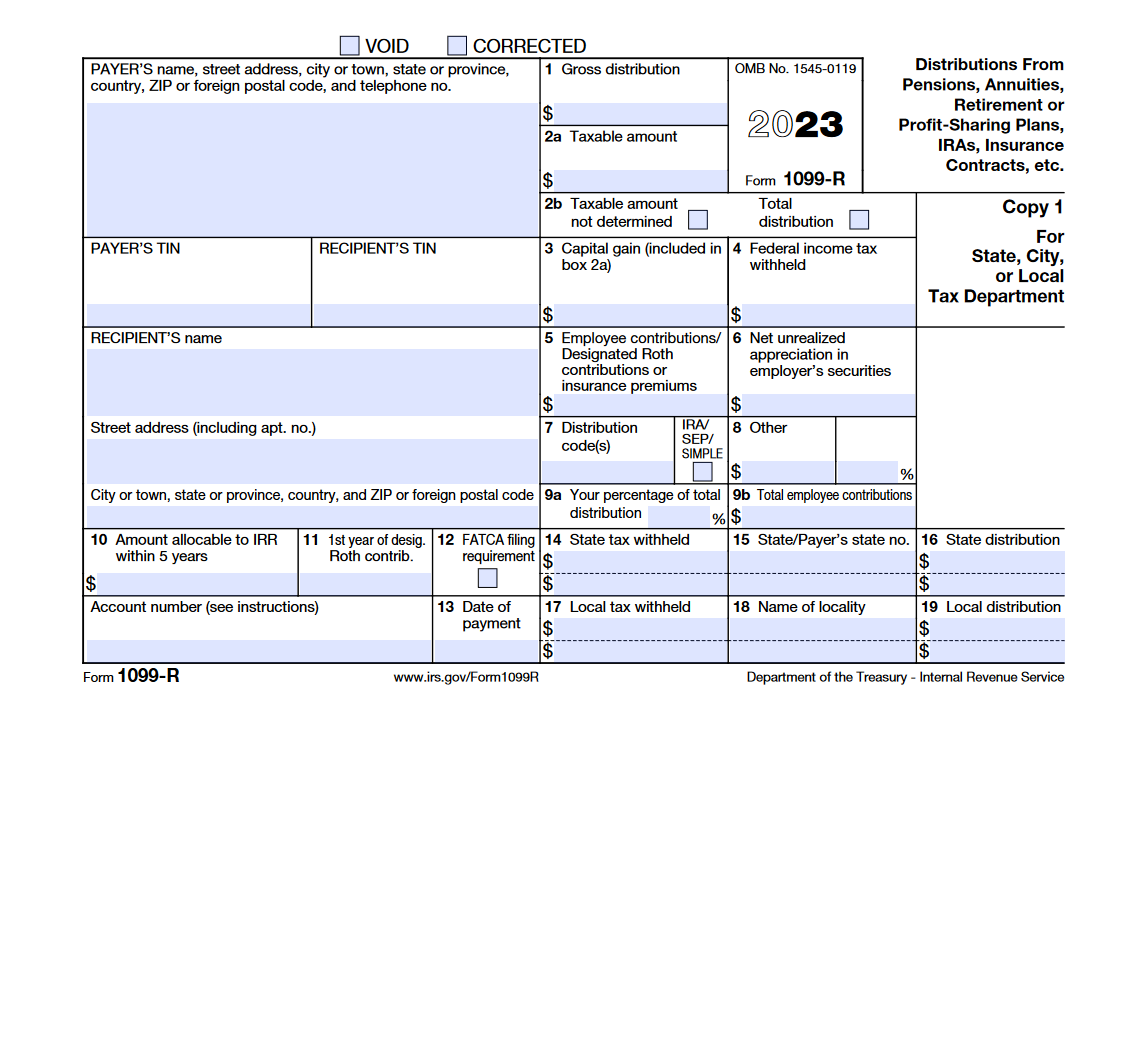

Required minimum distributions (RMDs) are amounts that many retirement plan and IRA account owners must withdraw annually. These withdrawals are considered taxable income and may incur penalties if not taken on time.

December 18-19, 2024

The end of the year is almost here, and that means you need to check if you have all of your CPE completed. A lot of us have just gotten out of extension season, then the election, but if you need more CPE, Ensuring Success is an easy way to earn up to 14 hours…

Taxes December 10, 2024

The agency awarded grants to 41 Tax Counseling for the Elderly and 315 Volunteer Income Tax Assistance applicants.