Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 21, 2026

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Accounting July 30, 2025

Jason Crace, CPA, was sentenced to three years in prison on July 21 for preparing false tax returns for clients who participated in an illegal tax shelter.

Taxes July 30, 2025

According to court documents: between 2010 and 2022, Gilda Rosenberg, of Golden Beach, conspired with two family members to conceal from the IRS more than $90 million in assets and income.

Small Business July 30, 2025

A further benefit of owning QSBS is that a taxpayer who sellers QSBS can make a Section 1045 election to roll proceeds tax-free into other QSBS investments.

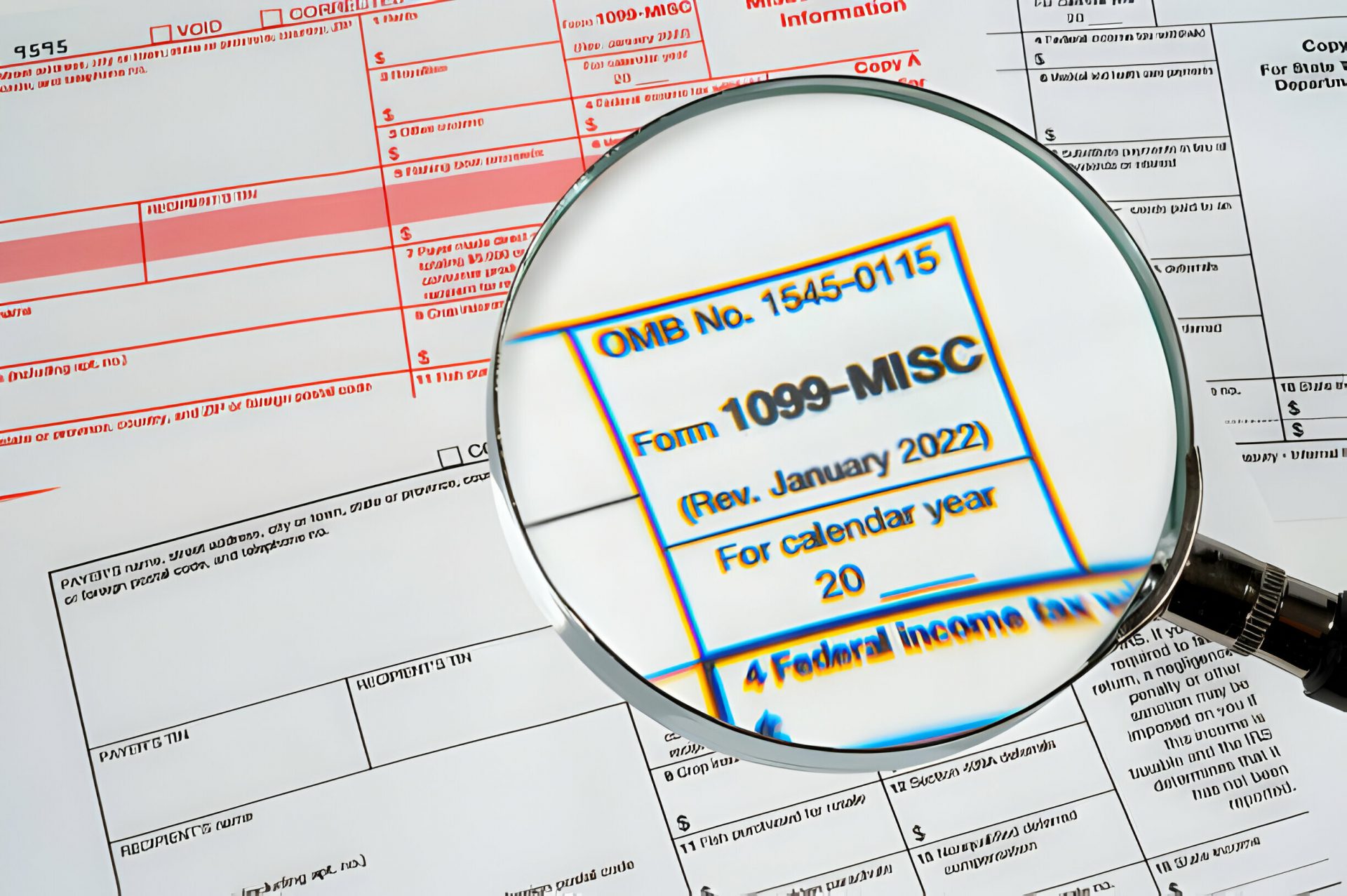

Taxes July 30, 2025

The One Big Beautiful Bill Act raises the 1099-MISC and 1099-NEC reporting thresholds to $2,000.

Taxes July 29, 2025

Mayor Brandon Johnson on Tuesday pointed to a handful of tax-the-rich options he might consider to balance Chicago’s next budget, among them a corporate head tax.

Taxes July 29, 2025

The Survivor Assistance for Fear-free and Easy Tax Filing Act of 2025 (SAFE Act) allows survivors of domestic abuse or spousal abandonment to file their taxes as if they were not married.

Taxes July 29, 2025

As part of a special five-part series, the IRS and its Security Summit partners highlight the importance of tax pros creating and maintaining a WISP.

Taxes July 28, 2025

President Donald Trump on July 25 said that he’s considering issuing rebate checks to Americans that would be paid out of the revenue generated by increased tariffs on other countries

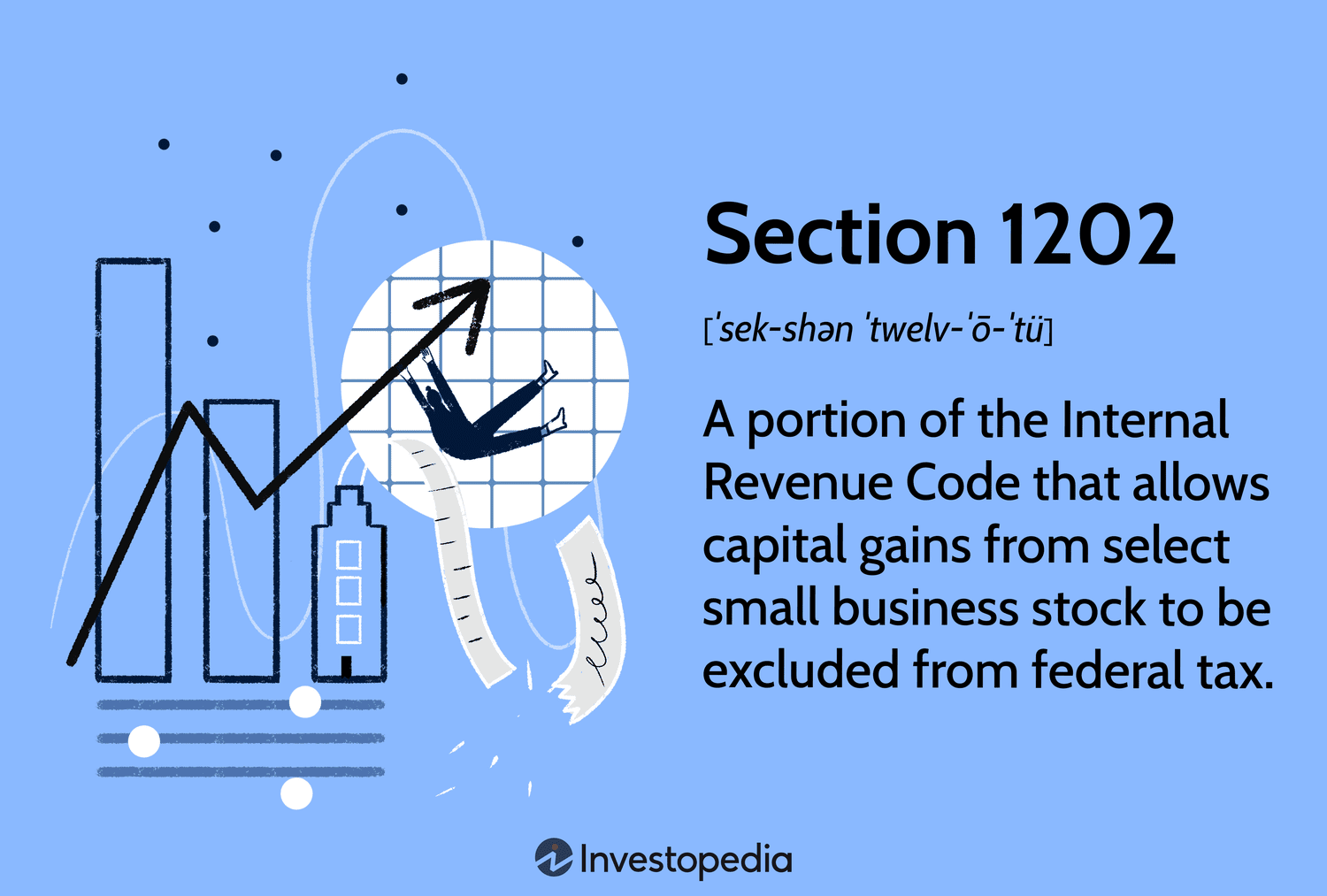

Taxes July 25, 2025

Section 1202 provides for a substantial exclusion of gain from federal income taxes when stockholders sell qualified small business stock (QSBS).

Taxes July 25, 2025

Business Tax Account designated officials must revalidate their accounts by July 29 in order to maintain access, the IRS said on Wednesday.

Small Business July 25, 2025

Business owners have shared concerns about cuts to Medicaid and other health care programs, while the U.S. Chamber has praised the new law as pro-growth.

State and Local Taxes July 25, 2025

Now that the 2025 federal tax bill has been signed into law, it’s appropriate to revisit one of its most news-making elements: the federal deduction for state and local taxes.