Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 21, 2026

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes August 14, 2025

The IRS is shutting down its self-service kiosk program at Taxpayer Assistance Centers after the Treasury Inspector General for Tax Administration expressed concerns to the agency that several of the computer terminals were unusable.

Taxes August 14, 2025

After nine years, a court of appeals ruling in July officially confirmed Mayo Clinic’s final victory over the IRS in a $11.5 million legal dispute over its tax-exempt status.

Taxes August 13, 2025

Taxpayers who operate large trucks and buses have until Aug. 31 to file Form 2290 for vehicles first used on a public highway in July 2025, the IRS said on Tuesday.

Taxes August 13, 2025

In a letter, Democratic members of Nevada’s federal delegation urged the Treasury Department to address possible shortfalls of the One Big Beautiful Bill Act's "no tax on tips" provision as it’s implemented.

Taxes August 13, 2025

U.S. tariff revenue reached a fresh monthly record in July, though the increase wasn’t enough to prevent a widening in the monthly budget deficit—pointing to the federal government’s continuing fiscal challenges.

IRS August 12, 2025

The total dollar amount of awards paid increased substantially from $88.8 million in fiscal year 2023. The total number of awards in FY 2024, however, decreased from 121 in FY 2023 to 105 in FY 2024.

Taxes August 12, 2025

The IRS has extended the filing deadline to Feb. 2, 2026, for individuals and businesses in two West Virginia counties that were devastated by flash flooding from torrential rains in mid-June that left at least six people dead.

Taxes August 11, 2025

A new BDO USA survey reveals how tax executives have evolved into business strategists on policy changes, tech innovation, and rising business complexity.

Taxes August 11, 2025

SALT, which can be claimed by taxpayers who itemize their deductions, is why the very rich get less of a break in California than most other states, according to experts.

Taxes August 11, 2025

The biggest potential beneficiaries are those who have already built considerable wealth through their property, and they mainly come from states where home prices are high and have increased quickly, according to a Redfin report.

IRS August 8, 2025

Treasury Secretary Scott Bessent will add acting IRS chief to his duties until Long's replacement is installed.

OBBBA Tax Act August 7, 2025

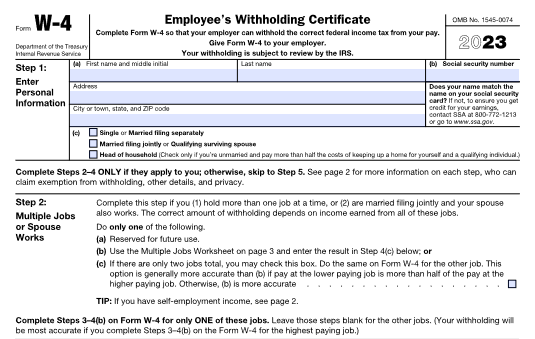

The Internal Revenue Service recently stated that, as part of its phased implementation of the One Big Beautiful Bill Act, there will be no changes to certain information returns or withholding tables for Tax Year 2025 related to the new law.