Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

IRS August 26, 2025

The IRS released a draft W-2 form for 2026 on Aug. 15 that takes into account tax provisions in the One Big Beautiful Bill Act for deductions related to tip income and overtime pay.

Taxes August 26, 2025

The IRS on Aug. 21 issued a fact sheet containing frequently asked questions about Biden-era clean energy tax credits and deductions soon to expire under the One Big Beautiful Bill Act.

Taxes August 26, 2025

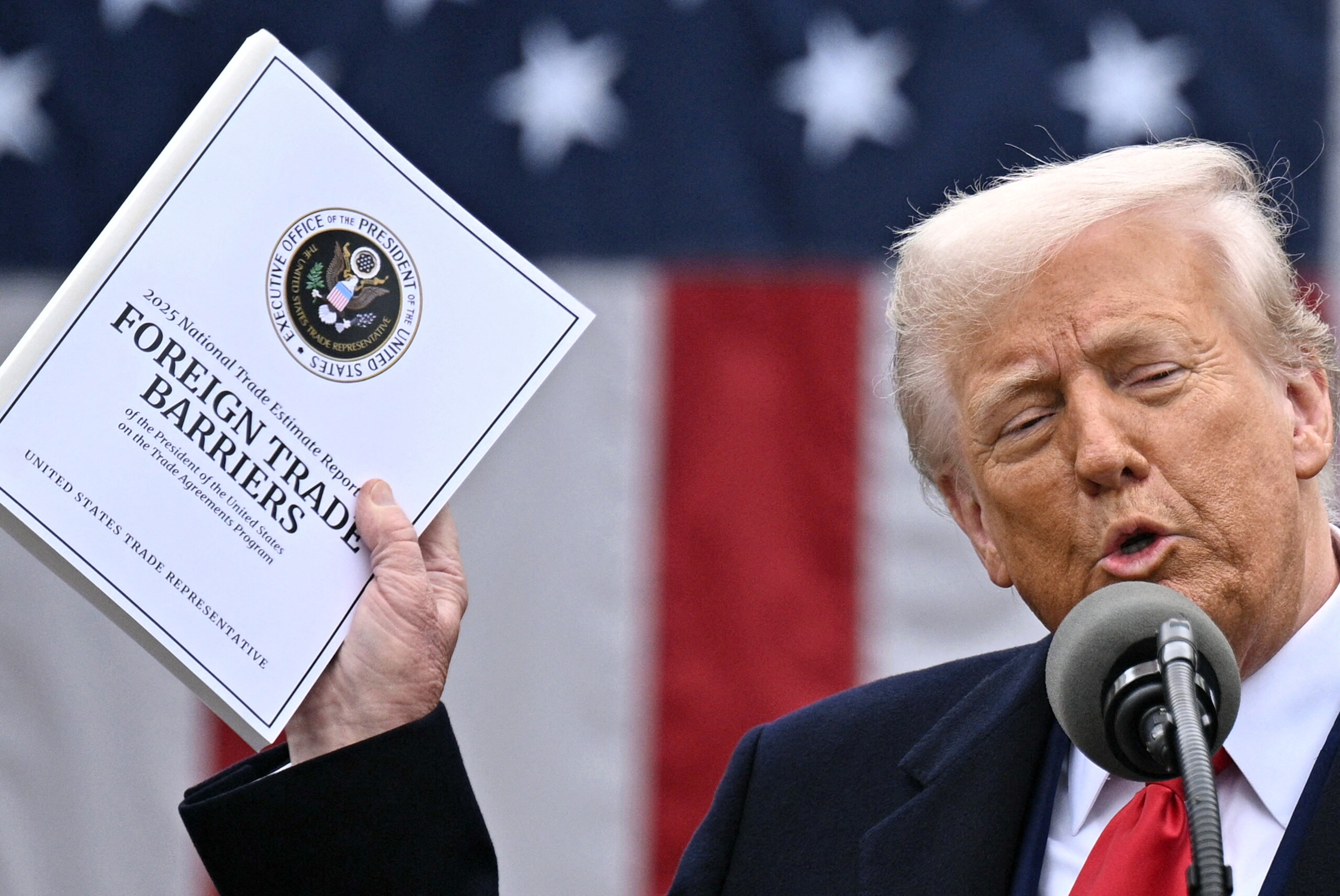

The president threatened to impose fresh tariffs and export restrictions on advanced technology and semiconductors in retaliation against other nations’ digital services taxes that target U.S. technology companies.

Accounting August 26, 2025

Most senior accountants (75%) described this busy season as "somewhat" or "extremely" stressful, compared to 22% of associates, according to the results of a new survey from staffing agency Distinct.

Taxes August 25, 2025

For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily, the IRS said on Aug. 25.

IRS August 25, 2025

Taxpayers have through Sept. 5 to fill out a survey that will be presented to Congress, as the Biden-era program that allows taxpayers to file their taxes for free is at risk of being shut down.

Taxes August 25, 2025

A fight over taxes consumers pay for cannabis products has prompted a standoff between unusual adversaries: child-care advocates and the legal weed industry.

Taxes August 25, 2025

Kylie Leia Perez, who lives in Tampa, FL, and uses the stage name “Natalie Monroe,” owes the IRS at least $1.6 million in back taxes, the U.S. Attorney's Office said on Aug. 14.

Taxes August 21, 2025

Between 2015 and 2022, Dawson did not pay to the IRS the taxes withheld from his employees’ paychecks. He also used RPC Group’s business accounts to pay for personal expenses.

Taxes August 20, 2025

Analysts expect manufacturers to further scale back production of EVs to match limited interest among buyers, especially as Trump works to remove federal emissions requirements.

Software September 25, 2025 Sponsored

As a tax and accounting firm, your clients’ data is among your most precious commodities. That means its security must be a priority. Are you confident that the solutions your firm uses are keeping your clients’ data safe?

Taxes August 14, 2025

The IRS is shutting down its self-service kiosk program at Taxpayer Assistance Centers after the Treasury Inspector General for Tax Administration expressed concerns to the agency that several of the computer terminals were unusable.