Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Advisory September 12, 2025

For firms to succeed, we must adapt our operational strategies to meet these challenges head-on. These are three key factors contributing to the increased demand for tax services.

Taxes September 12, 2025

The One Big Beautiful Bill Act (OBBBA) signed into law earlier this year tweaks the alternative minimum tax (AMT) rules for individuals. Overall, the news for taxpayers is “mixed,” beginning in 2026.

Taxes September 11, 2025

For the first time in history, the new law creates a “floor” for deducting charitable donations deductions. At the same time, it opens up deductions to non-itemizers as well as itemizers.

Taxes September 11, 2025

The report accounts for several new adjustments made under the One Big Beautiful Bill Act (OBBBA) that affect tax planning for taxpayers in 2026 and beyond.

Special Section: Guide to 2025 Tax Changes September 11, 2025

The new “One Big Beautiful Bill Act” (OBBBA) is enhancing several tax breaks relating to education in addition to increasing family tax credits for raising young children.

Taxes September 9, 2025

Thousands of taxpayers have filed inaccurate or frivolous returns that falsely claim the Fuel Tax Credit and the Sick and Family Leave Credit, often resulting in the denial of refunds and steep penalties, the IRS said Sept. 8.

Payroll September 9, 2025

The rule of 55 can benefit workers who have an employer-sponsored retirement account and are looking to retire early or need access to the funds if they’ve lost their job near the end of their career.

Taxes September 9, 2025

Beginning in 2026, the OBBBA rewrites the rules for the educator expense deduction. Notably, the new law removes the $300 cap, but requires taxpayers to claim the write-off as an itemized deduction.

Taxes September 9, 2025

Artificial intelligence is reshaping how compliance is managed, automating tasks once done manually and offering predictive insights. For businesses, the message is clear: adapt now or face greater risk.

Taxes September 9, 2025

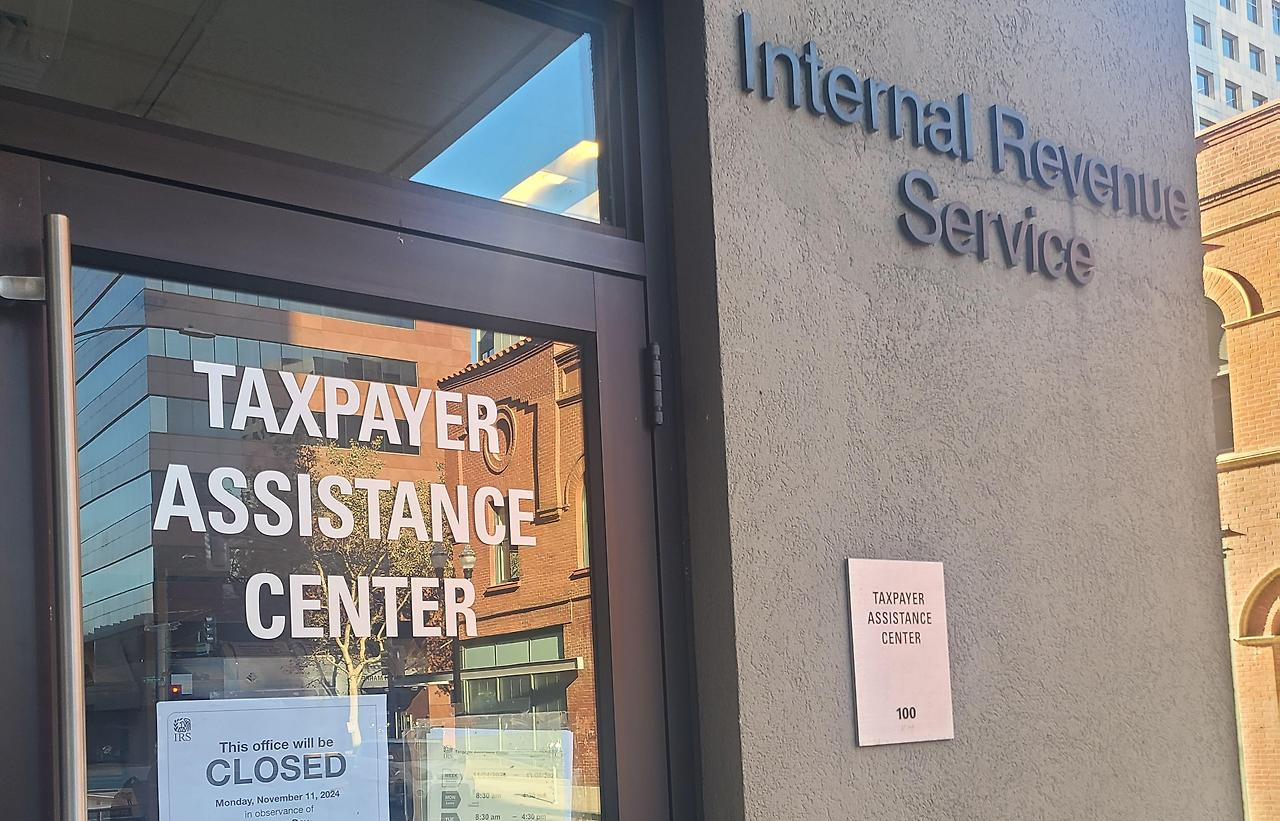

The IRS is reportedly closing nine taxpayer assistance centers in six states later this year in an apparent cost-savings move, as the agency faces a potentially smaller budget for fiscal year 2026.

OBBBA Tax Act August 28, 2025

The One Big Beautiful Bill Act greatly expands business interest deduction limits, which is a boon to capital-intensive businesses with significant interest expense — potentially reducing their federal corporate tax liability and enhancing financial flexibility.

Taxes August 27, 2025

The Treasury Department and the IRS said Aug. 20 that they intend to issue proposed regulations withdrawing the DPL rules and related modifications to the dual consolidated loss rules that were finalized toward the end of the Biden administration.