Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes November 24, 2025

The AICPA is asking Treasury and the IRS to allow an exception for these permanently disallowed amounts so companies aren’t penalized unnecessarily.

Taxes November 23, 2025

With this complex issue, the state needs to proceed with caution and learn from what happens in states without an income tax, a professor of economics says.

Taxes November 21, 2025

The Treasury Department and the IRS issued guidance on Nov. 21 for employees who are eligible to claim the deduction for tips and for overtime compensation under the One Big Beautiful Bill Act for the 2025 tax year.

Taxes November 21, 2025

The Treasury Department and the IRS released interim guidance Nov. 20 on a new tax benefit for certain lenders, such as FDIC-insured banks, that provide loans secured by rural or agricultural real estate.

Taxes November 21, 2025

The Federal Trade Commission recently filed a joint lawsuit with the state of Nevada against American Tax Service as well as its owners and seven affiliated parties for making false claims that they could help taxpayers with their debts.

Taxes November 20, 2025

Missouri Gov. Mike Kehoe has offered no specifics about his plan but said it revolves around offsetting the $10 billion generated by the state’s 4.7% income tax rate, which represents about 63% of the state’s general revenue.

Taxes November 19, 2025

An investment portfolio where any one stock has appreciated dramatically over the original purchase is the perfect candidate for a contribution to a charitable organization or a DAF.

Taxes November 19, 2025

As evidenced by a taxpayer in a new case, Besaw, TC Sum. Op. 2025-7, 7/21/25, just missing one or two of the key ingredients can spoil the deal.

Taxes November 19, 2025

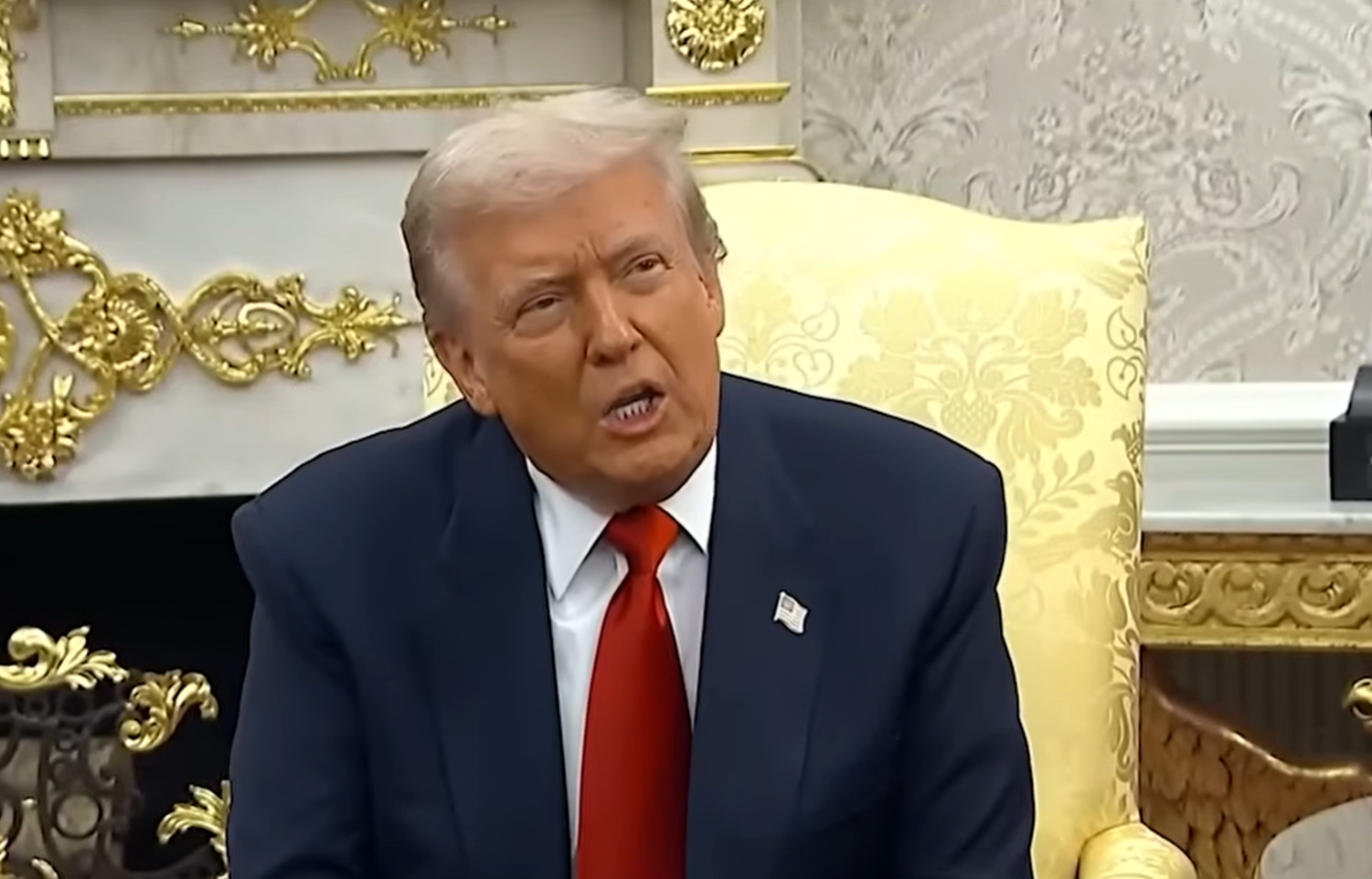

President Donald Trump on Tuesday gave his sharpest rebuke of congressional Democrats’ efforts to extend expiring Affordable Care Act enhanced tax credits, saying he would not support legislation to do so.

Taxes November 19, 2025

Donald Trump’s presidential library foundation plans to raise almost a billion dollars in tax-exempt contributions over the next two years to build and operate his high-rise legacy project in downtown Miami, according to new tax filings.

Special Section: Guide to 2025 Tax Changes November 18, 2025

The OBBBA generally enhances the tax benefits available for investments in the Qualified Opportunity Zone (QOZ) program and makes these favorable tax law changes permanent.

Technology November 18, 2025

Documents uploaded by clients in Liscio can now flow directly into GruntWorx’s automation suite where they are intelligently sorted, verified, and prepared for tax processing.