Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

August 11, 2020

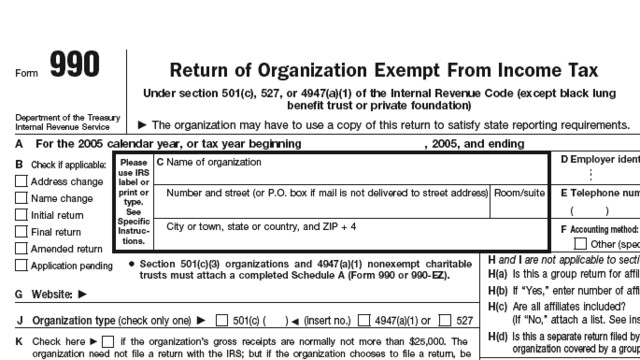

Form 990 provides the public with financial information about a nonprofit organization, while Form 990-T is a form that a tax-exempt organization files with the IRS to report its unrelated business income and to figure the tax owed on that income.

August 11, 2020

The paper was initially exposed for public comment in August 2019 and was developed by a Working Group of the AICPA Assurance Services Executive Committee (ASEC).

August 11, 2020

The program helps students pay for college, easing their journey to becoming CPAs. Funded by the AICPA, the AICPA Foundation, and partners, the Legacy Scholars program consists of six distinct scholarships awarding between $3,000 and $10,000 per student.

![ficpa[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/08/ficpa_1_.5f31ca1ad5b06.png)

August 10, 2020

The annual program is designed to strengthen and amplify the leadership skills of its Young CPA members, build a peer group network of talented and motivated CPAs, and develop the future influencers of the profession.

August 10, 2020

How leadership teams handle challenges during times of uncertainty can make or break a CPA practice....

August 10, 2020

It’s simple: At-home WiFi networks are a hacker’s favorite target. Put a stop to these network attacks before they even have a chance to begin with 1 simple change to the tax and accounting software your firm depends on, today.

August 10, 2020

While many teams may be dispersed right now, a sense of workplace competition is alive and well, new research from global staffing firm Robert Half shows.

August 10, 2020

Take an in-depth look at the Business Process Outsourcing (BPO) industry.

August 10, 2020

Retailers with no physical presence in Tennessee are currently required to collect and remit Tennessee sales tax if their annual sales into the state exceed $500,000. Starting October 1, 2020, out-of-state businesses and marketplace facilitators must ...

August 9, 2020

To understand how tools and technology are being leveraged throughout the pandemic and the resulting impact, respondents were asked to discuss how technology is helping and what types of solutions have been the most effective.

August 9, 2020

From the August 2020 Issue. In the June 2020 issue, my column Do You Have a Clear Tax Vision? addressed tax software innovations in around a dozen categories. Many of you have just finished the unusual tax season of 2020 with the COVID-19 pandemic extended personal tax deadline of July 15 just behind us. You...…

![unemployment11_11505634[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/08/unemployment11_11505634_1_.5f2f47a42676f.png)

August 9, 2020

President Donald Trump announced four executive actions on Saturday, including continued expanded unemployment benefits and a temporary payroll tax deferral for some workers, as the coronavirus pandemic continues to hobble the U.S. economy.