Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

Firm Management July 18, 2022

Citrin Cooperman has announced the establishment of their first Midwest office through the acquisition of Shepard Schwartz & Harris (“SSH”), a Chicago based firm.

Accounting July 18, 2022

Paystand has launched a new dynamic discounting application designed for seller accounts receivable (AR) teams and powered by Ethereum smart contracts.

July 18, 2022

The Internal Revenue Service and the Federal Trade Commission will sponsor a free webinar designed to help everyone recognize and combat tax scams and tax-related identity theft.

July 18, 2022

A ballot initiative that would have raised taxes on California millionaires and billionaires to fund public health programs and pandemic prevention is dead — at least for this year.

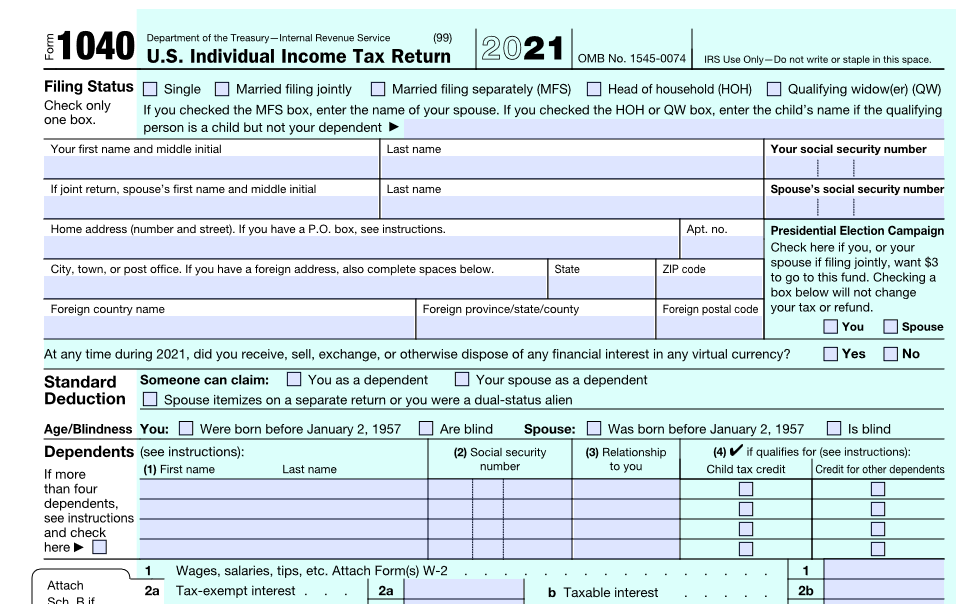

Taxes July 15, 2022

The legislation would direct the IRS to create software that would allow any taxpayer to prepare and file their individual income tax return beginning in tax year 2023.

July 15, 2022

He claimed $165 million in refunds on behalf of the purported trusts. The IRS paid $5 million of the requested refunds. Mattox used those funds to purchase a new house ...

July 15, 2022

These include people filing corrections to the Form 1040-NR, U.S. Nonresident Alien Income Tax Return and Forms 1040-SS, U.S. Self-Employment ...

July 15, 2022

Identity thieves were especially active this past year as they continued to use the pandemic, nationwide teleworking practices and other events as predatory ...

Accounting July 15, 2022

The company has announced the appointment of two new members to its leadership team,Jonathan Lupa and Thomas LeSaffre.

Accounting July 15, 2022

Accountant Dashboard has a single-pane view of all client dashboards and offers easy toggling between clients for all relevant banking information and bulk statement downloads.

Accounting July 14, 2022

Given the outlook for budgets and staffing levels, most internal audit departments remain optimistic about their department’s continuing value and growth.

Firm Management July 14, 2022

50 players, 17 spectators and 13 corporate sponsors participated in the BSSF Cornhole Tournament on September 24, 2021, at the BSSF Camp Hill office.