Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

October 11, 2011

Every year around this time I receive a variety of demo gadgets and information on technologies that span the spectrum of being useful for business, as well as those geared toward personal entertainment, hobbies and sometimes just peculiar things. I include them in our annual Holiday Gift Guide, which runs in our December issue and...…

October 11, 2011

Tax & Accounting vendors share how their product strategies are addressing the cloud movement.

October 11, 2011

October 10, 2011

Many of the vendors who provide services or products to accountants offer network, reseller, community or partner programs. These programs are designed to make it easier for accountants to recommend and support the vendor’s products and services.

October 10, 2011

How optimism and remote technologies paved the way to one firm's success. The accounting profession has often been stereotyped as curmudgeonly, grumpy, stodgy, and fiscally dour, and, well … there were probably good reasons for those descriptions at one time.

October 10, 2011

The Sleeter Group awards the Awesome Add-Ons each year to products that aid small businesses and their accounting firms by providing enhanced capabilities that integrate with small business accounting systems.

October 10, 2011

As with most organizations, nonprofits vary in size and scope, and their software needs vary, as well. As an accounting professional, you know that the software needs of the local animal shelter will vary widely than the needs of the United Way. While this may be a drastic comparison, it really highlights the wide range…

October 10, 2011

800-443-9441 www.blackbaud.com 2011 Overall Rating 5 Best Fit The Financial Edge is well-suited for mid-sized to large nonprofit organizations and government entities that require both top-notch reporting capability along with excellent donor and grant management. Strengths Excellent customization capability Easy integration with dozens of add-on modules Unlimited customized dashboards Solid grant tracking Easy integration...…

October 10, 2011

877-495-9904 www.peachtree.com 2011 Overall Rating 4.5 Best Fit Sage Peachtree would work well with smaller nonprofit organizations that place affordability equal to functionality, and it is optimally designed for the one- to 10-person organization. Strengths Easy to install & easy to navigate Good nonprofit reporting capability and advanced Business Intelligence for custom reporting and...…

October 10, 2011

800-811-0961 www.sagefundaccounting.com 2011 Overall Rating 5 Best Fit Sage Fund Accounting (formerly Sage MIP Fund Accounting) is optimally designed for mid-sized nonprofit organizations and government entities that require flexibility as well as detailed budgeting and grants management capabilities. Strengths Extensive list of modules Contains fundraising & grant management add-on options Excellent budgeting capability Available...…

October 10, 2011

877-872-2228 www.accufund.com 2011 Overall Rating 4.75 Best Fit AccuFund is an ideal fit for mid-sized nonprofits and government entities that desire a modular design and consistency throughout the program. Strengths Two versions available Excellent budgeting & grant management capability Easy system navigation User-defined dashboards Solid, customizable reporting options Available as a desktop or SaaS...…

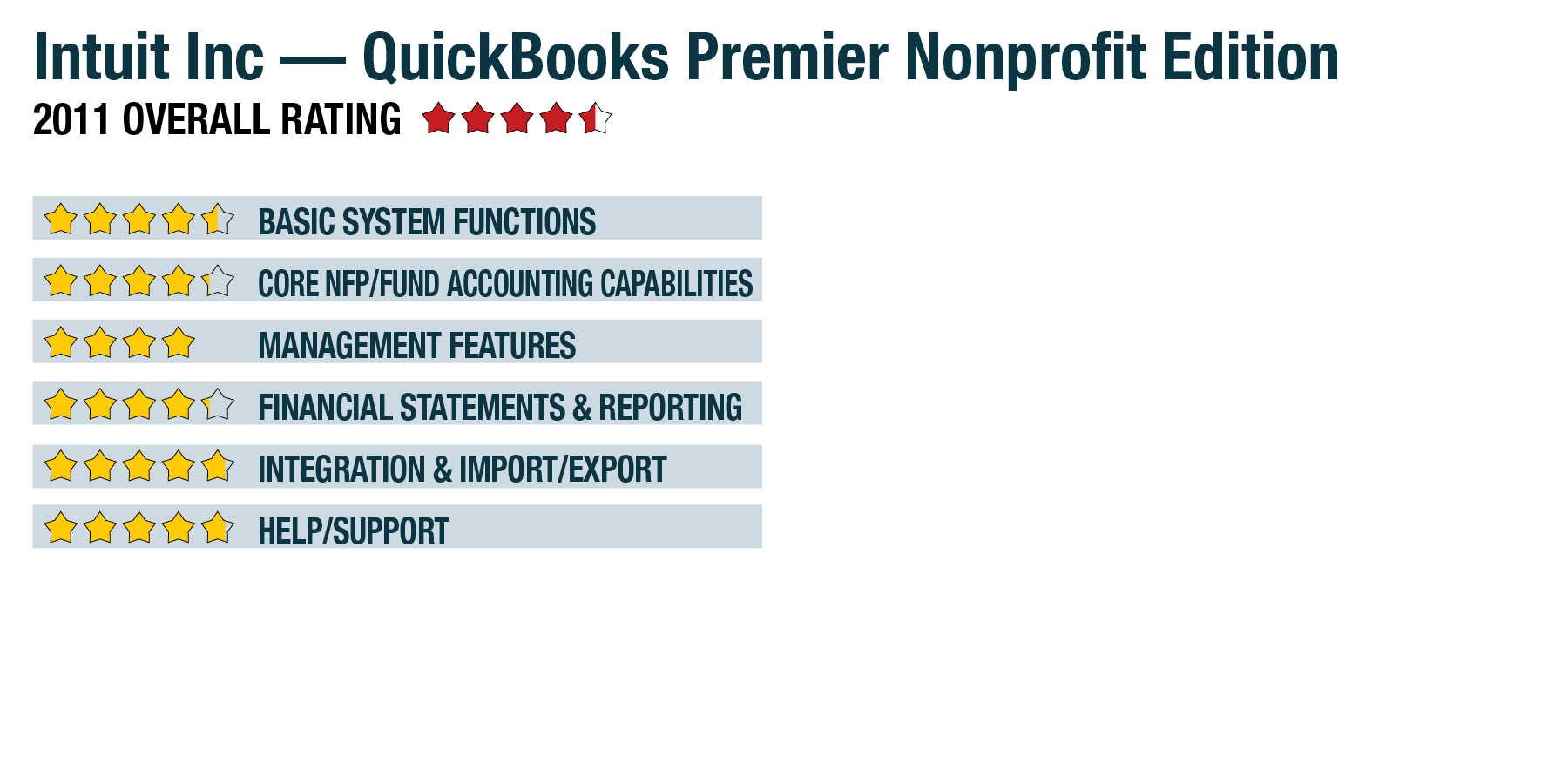

October 10, 2011

866-379-6636 www.quickbooks.com 2011 Overall Rating 4.5 Best Fit QuickBooks Premier Nonprofit 2011 is best suited for smaller nonprofits that are looking to get organized quickly and inexpensively. Strengths Easy installation & system navigation Numerous tutorials & training videos available Good reporting Affordability Solid budget tracking At-a-glance snapshot of customer activity Potential Limitations Easy to...…