Accounting February 28, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

December 1, 2011

Broker and Barter Exchange Software Prints 1099-B Recipient Copy (Copy B) on regular paper instead of laser forms. Prints 1099B Federal Copy (Copy A For Internal Revenue Service Center) on pre-printed red laser forms. Imports 1099-B forms Intuit QuickBooks, Sage Peachtree, Sage DacEasy , Microsoft Dynamics and Microsoft Excel Format Supports 1099 B, 1099...…

December 1, 2011

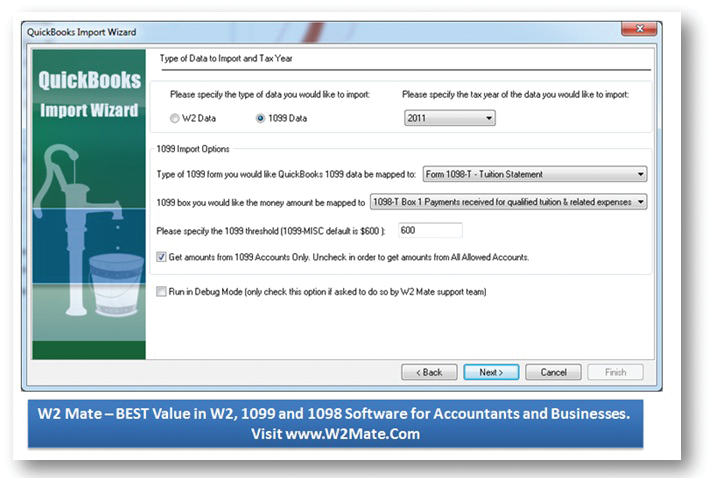

1098 Tuition Statement Software IRS Form 1098 T : Tuition Statement Prints on 1098 Tuition laser forms and on blank paper. Imports 1098-T forms Intuit QuickBooks, Sage Peachtree, Sage DacEasy , Microsoft Dynamics and Microsoft Excel Format Supports 1098-T, 1098, 1099-MISC, 1099-INT, 1099-DIV, 1099-R, 1099-S, 1099 (A, B, C, PATR) & 1099 OID Forms....…

December 1, 2011

IRS 1099-A Software IRS Form 1099-A: Acquisition or Abandonment of Secured Property Imports 1099-A forms Intuit QuickBooks, Sage Peachtree, Sage DacEasy , Microsoft Dynamics and Microsoft Excel Format Prints 1099-A Copy B (For Borrower) on regular white paper, eliminating the need to buy these forms. Prints 1099A Federal Copy (For Internal Revenue Service Center)...…

December 1, 2011

1099 Cancellation of Debt Software IRS Form 1099-C: Cancellation of Debt Prints 1099 Cancellation of Debt Copy B on regular paper instead of expensive forms. Prints 1099C Federal Copy (Copy A For Internal Revenue Service Center) on pre-printed red laser forms. Imports 1099-C data from CSV, Excel, Intuit QuickBooks, Peachtree, Microsoft Dynamics (Great Plains)...…

December 1, 2011

1099 Real Estate IRS Form 1099 S: Proceeds From Real Estate Transactions Prints on 1099 Real Estate forms and on blank paper. Supports 1099-S, MISC, INT, R, DIV, 1098-T, 1098, 1099 A, 1099 B, 1099 C, 1099 PATR and 1099 OID Forms. Imports 1099-S data from CSV, Excel, Intuit QuickBooks, Peachtree, Microsoft Dynamics (Great...…

December 1, 2011

IRS 1099 Electronic Filing Create 1099 electronic filing submissions that comply with IRS Publication 1220 (Specifications for Filing Forms 1097-BTC, 1098, 1099, 3921, 3922, 5498, 8935, and W-2G Electronically). Prepare tax information returns for submission to Internal Revenue Service (IRS) using IRS FIRE electronic filing system (fire.irs.gov). 1099 electronic filing is paperless, secure, efficient, fast...…

November 30, 2011

AccuCode, Inc. (www.AccuCode.com) has announced the start of its new referral-based program for the software developer’s AO: Rapid Inventory system, which is the only cloud-based inventory management program for QuickBooks that includes options for fully-integrated RFID and barcode scanning. Designed as an add-on to enhance inventory capabilities for businesses using QuickBooks Pro, Premier or Enterprise,...…

November 30, 2011

Your business web presence speaks volumes about your capabilities and focus. Your purpose and abilities should be clear on the public side of your website. And once a client logs into your site, the additional features of the private side should impress even more.

November 30, 2011

888-455-0183; www.atxinc.com 888-455-0182; www.taxwise.com 2012 Overall Rating 3.75 Best Firm Fit Firms using TaxWise or ATX that are looking for both a document management and automated tax document tool. It’s a good fit for high-volume retail firms that need a solution housed entirely on premises, especially those that will use the integrated electronic signature...…

November 30, 2011

Holiday parties mean much more than free food and fun. They also can bring entrepreneurs a host of new opportunities to network and build relationships. Most people think of networking only through the traditional venues, whether chamber of commerce events, business contact referral groups, or online sites such as LinkedIn. But holiday parties, including professional...…

November 30, 2011

Tax & Accounting vendors talk about best of breed, best of process, web services and the need for products to be easy to use and to play well with others.