Accounting February 28, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 13, 2012

As I write this column for the March issue, I am returning from a trip to NY where I spent time with accountants, firms, and vendors discussing how to move the accounting profession into the cloud faster. My guess is that as you read this, it is the farthest thing from your mind. You are...…

February 13, 2012

Sage Peachtree Premium Construction Accounting 2012 800-388-4697 www.Peachtree.com Best Fit: Peachtree is an excellent entry level product that is well-suited for smaller construction companies or contractors that desire affordability and functionality along with solid industry-specific features. Product Strengths Affordable, easy to use industry specific product Solid job cost functionality Large selection of add-on...…

February 13, 2012

CYMA Systems Inc. – CYMA Job Cost Accounting for Windows 800-292-2962 www.cyma.com Best Fit: CYMA is a best suited for mid-sized construction companies that require a solid job cost module, excellent job tracking capability, along with flexible billing capacity. Strengths Modular design offers smaller companies purchasing flexibility Solid job cost module Highly customizable...…

February 13, 2012

eTEK International Inc. – eTEK Accounting 800-888-6894 www.etek.net Best Fit: eTEK is well-suited for smaller construction companies that require flexibility and customization capability and is currently being marketed as a “next step up” from off-the shelf products. Product Strengths: Updated and redesigned for Microsoft Office 2010 Solid Equipment Management module comes standard with...…

February 13, 2012

A-Systems Corporation – A-Systems JobView 800-365-6790 www.a-systems.net Best Fit: JobView offers excellent scalability, offering small to mid-sized construction related businesses a solid financial and job costing product while providing assurance that the software can transition and grow with them. Strengths: Scalable: available in three versions Excellent full-featured payroll designed for the construction industry Latest version...…

February 13, 2012

FOUNDATION Software – FOUNDATION for Windows 800-246-0800 www.foundationsoft.com Best Fit: FOUNDATION for Windows contains a full menu of features designed specifically for construction related businesses. While small construction companies with under $1 million in revenues may not need Foundation, just about any mid-to large construction company or contracting firm will find this product useful. Product...…

February 13, 2012

Management Information Control Systems – Builder Information System (BIS) 800-838-6427 www.bissoftware.com Best Fit: Builder Information Systems is well-suited for small to mid-sized or larger construction related businesses that desire a scalable product that offers room for growth. Strengths Scalable with 4 Editions available Excellent job costing capability Excellent subcontract management Solid document management and...…

February 13, 2012

In any economic downturn, companies at some point will consider improving their cash flow by “extending” the payment cycle for their vendors. Larger companies in particular will use this strategy, since they have fewer worries about being cut off by suppliers and are not dependent on their D&B ratings to obtain credit. Typically, this strategy...…

February 10, 2012

Yesterday, Apple announced they will hold an event in early March 2012 to launch and debut the iPad 3. As with the initial version and the iPad 2, the products likely won’t be available until April or shortly thereafter. I am not an Apple person, but I had an original version of the iPad, and...…

February 8, 2012

Lytro, Inc., maker of the first consumer light field camera, replaced its in-house ERP system with NetSuite, the provider of cloud-based financial and ERP solutions.

February 8, 2012

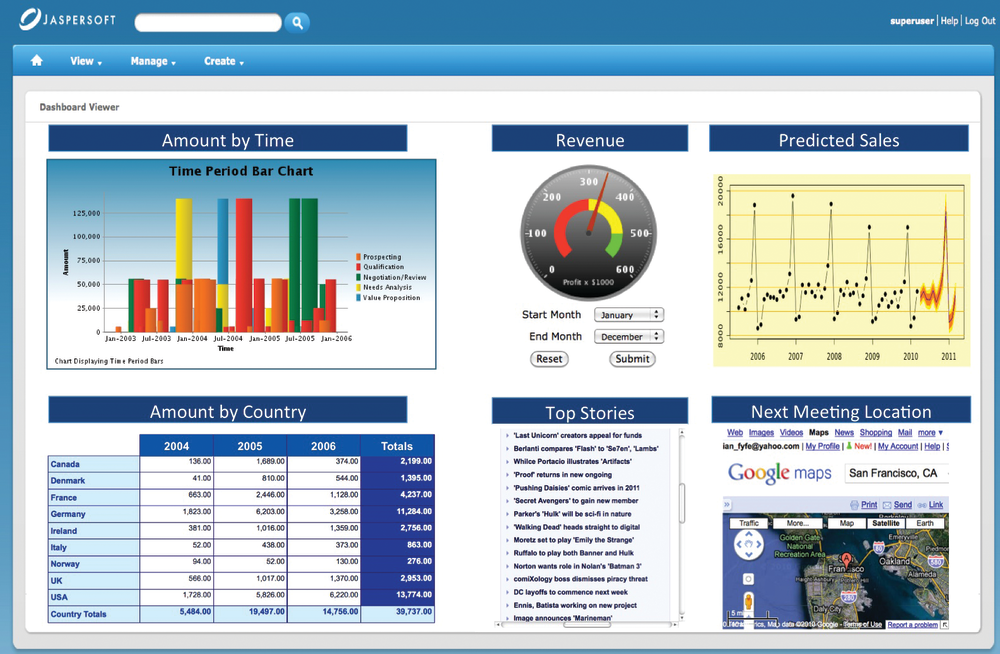

Accountants and bookkeepers are eager to put dashboards in front of their clients. There’s no faster way to drive a deeper relationship than to begin surfacing insights and automating opportunities for more regular and substantive interaction.

February 8, 2012

Traveling can be challenging, and even just planning your travels can be time-consuming and frustrating.