Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

June 12, 2014

In its latest report, the National Retail Federation has calculated that May retail sales remained mostly unchanged when seasonally adjusted month-to-month, yet they showed an increase of 3.0 percent unadjusted year-over-year. The data excludes automobiles, gas stations and restaurants.

June 12, 2014

Income from an S corporation, which flows through to its shareholders and is taxed at the individual level, is normally not subject to self-employment tax. Most S corporations, however, have shareholders performing substantial services for the corporation as officers and otherwise.

June 11, 2014

Two prominent accounting firms announced on Wednesday that they are planning to merge. Kennedy and Coe, LLC will merge with Matson and Isom effective January 1, 2015, pending final approvals of negotiations.

June 11, 2014

Cloud accounting provider Xero is rolling out a new practice management solution that offers job costing, time tracking and invoice management functions. Xero Practice Manager is designed for accountants and bookkeepers who provide services to a variety of business and individual clients.

June 11, 2014

Sherlock Holmes is fond of saying, “You see but you do not observe.” Poirot states: “It is the why of human behavior that interests me.”

June 11, 2014

A look at the unique cyber vulnerabilities that SMBs face, and how they can mitigate data breaches with an inside-out approach to information security

June 11, 2014

Private sector employment in the U.S. increased in all nine Census Bureau Divisions during May, according to the monthly ADP Regional Employment Report, which is produced by ADP, a provider of Human Capital Management (HCM) solutions, in collaboration with Moody’s Analytics, Inc. The ADP Regional Employment Report measures monthly changes in regional non-farm private employment…

June 11, 2014

Taken separately, workers’ compensation laws, the Americans with Disabilities Act (ADA), and the Family and Medical Leave Act (FMLA) represent complicated laws that are often difficult for employers and employees alike to figure out. When workers must be absent from the workplace under two or three of these laws, the situation becomes even more complex,…

June 11, 2014

CFS Tax Software’s CA Sales Tax Preparer and NY Sales Tax Preparer applications are full-featured standalone tools for preparing New York and California sales tax returns for multiple clients. The applications support all state, city, county, and other special districts which levy sales taxes in the two states. The products also support most major forms...…

June 11, 2014

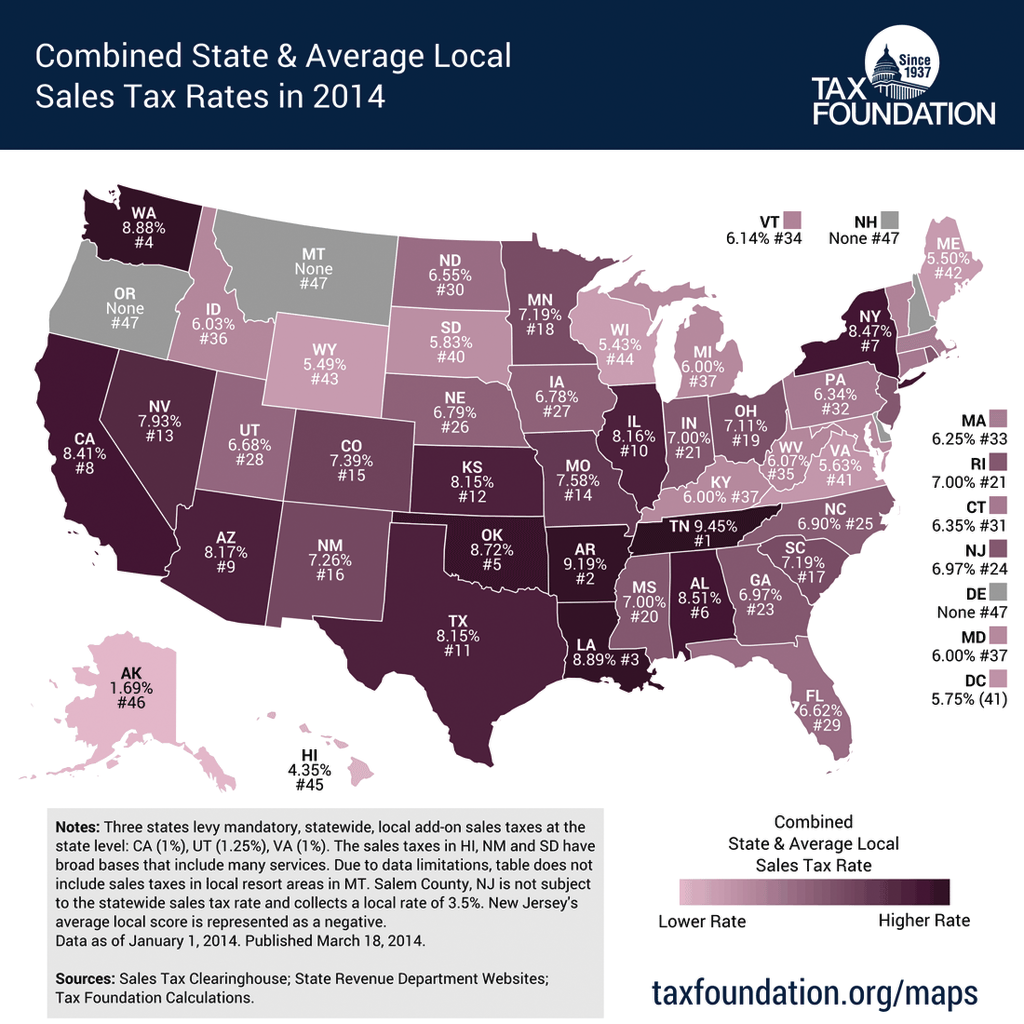

Sales and use tax is a key source of government funding in most states. Unlike property tax and state income tax, however, the legislators and regulators have adopted a patchwork of different rules which affect the taxability of the items. In addition to dealing with statewide tax rates in 45 states, 38 states levy sales…

June 11, 2014

In addition to its publishing products, Bloomberg BNA offers two software tools which are designed to help companies and practitioners stay up to date on tax rates and prepare accurate forms.

June 11, 2014

CCH’s sales tax compliance applications are priced based on a range of factors, including the number of entities, the number of returns, and the features purchased. Specific pricing is available upon request.