Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

June 13, 2016

Beware of the "wash sale" rule. This rule says you can't deduct the loss from the sale of securities if you buy "substantially identical" securities within 30 days before or after the loss sale. The disallowed loss is added to your basis in the new stock.

June 10, 2016

Most of you who know me understand that I’ve had the privilege of having a long career in technology. The opportunities to help vendors build hardware products, as well as networking, productivity, accounting and document management software have been som

June 10, 2016

Risk & regulatory work across the U.S. consulting market grew strongly by 7.8 percent to over $14 billion, but cybersecurity work is what’s really hot for many firms, including the Big Four - as headline-grabbing news stories have struck fear into the ...

June 10, 2016

In order to remain above the competition and provide the most up-to-date accounting skills, it’s wise to stay informed on what’s affecting the world of accounting and what kind of an impact it has on the overall health of the accounting industry.

June 10, 2016

Whether you’re self-employed, an independent contractor or a freelancer – Xero TaxTouch is made for you. Discover how a simple swipe delivers a fast, easy and completely mobile solution that organizes and manages your ...

June 9, 2016

Whaling is a form of phishing attack where senior executives and others with access to valuable and sensitive data are sent very personal and well researched emails. The attacker may send the target an email that appears to be from someone they ...

June 9, 2016

Global growth expert Radius has acquired San Francisco-based Montage Services, a rapidly growing tax and compliance advisory firm. Montage, whose clients include the London Stock Exchange, UniCredit, and Biz Apps, will immediately bolster Radius’ ...

June 9, 2016

Do you donate to charitable organizations? If so, you are supporting a thriving industry in the United States. According to the National Center for Charitable Statistics, individuals in 2015 donated more than $258 billion to nonprofit organizations.

June 9, 2016

Bookkeepers anticipate growth in the next one to two years and are turning to the cloud in droves, according to the State of Bookkeeping Practices 2016 Survey, sponsored by Bill.com and released today. The survey also reveals that despite offering a ...

June 9, 2016

Markets with the tightest inventory have some of the fastest rising home values. Over the past two years, Portland has seen an almost 40 percent decrease in the number of homes for sale, with home values up 15 percent over the past 12 months.

June 8, 2016

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

June 8, 2016

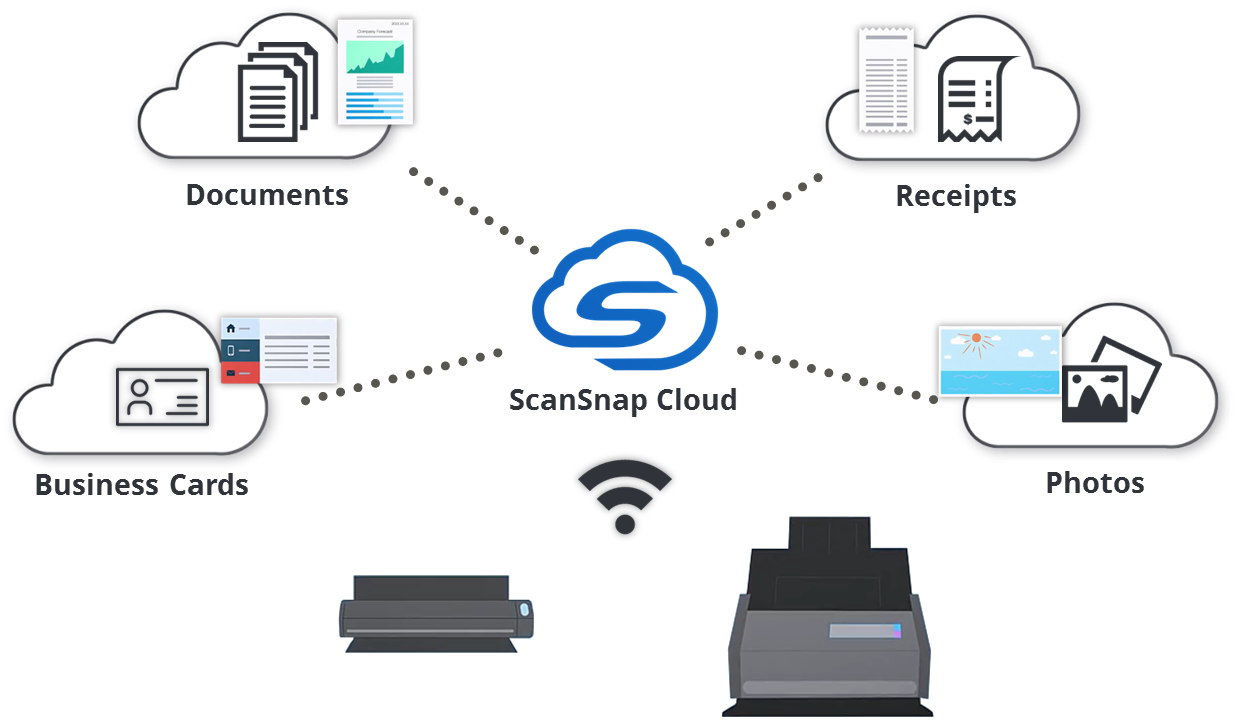

With a quick push of the Scan button, ScanSnap Cloud automatically classifies scanned data into four categories: documents, receipts, business cards and photos. Customers can simply set profiles for each category by selecting the cloud service of ...