Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

February 15, 2017

Xero and Silicon Valley Bank customers will now benefit from a more automated banking experience for their mutual customers. This direct integration, with a seamless do-it-yourself set up process so entrepreneurs, startups and small business owners ...

February 15, 2017

One of the largest areas of confusion for businesses is the completion of Lines 14-16 on Form 1095-C, the form used to provide employees with information about their medical benefits. This section has proven to be so unclear that many businesses pay ...

February 15, 2017

The research examines the five key elements of well-being – purpose, social, financial, community and physical – as well as other important health metrics within the United States. Through a daily survey of 500 adult Americans, the Well-Being Index ...

February 15, 2017

The accounting and tax profession relies on technology as much as almost any other (aside from rocket science, perhaps), which makes finding the right tech imperative to the productivity of a firm, and the small businesses that rely on it.

February 14, 2017

Advertising and marketing executives were asked, "How frequently, if at all, do you use Google or another search engine to learn additional information about a prospective hire?"

February 14, 2017

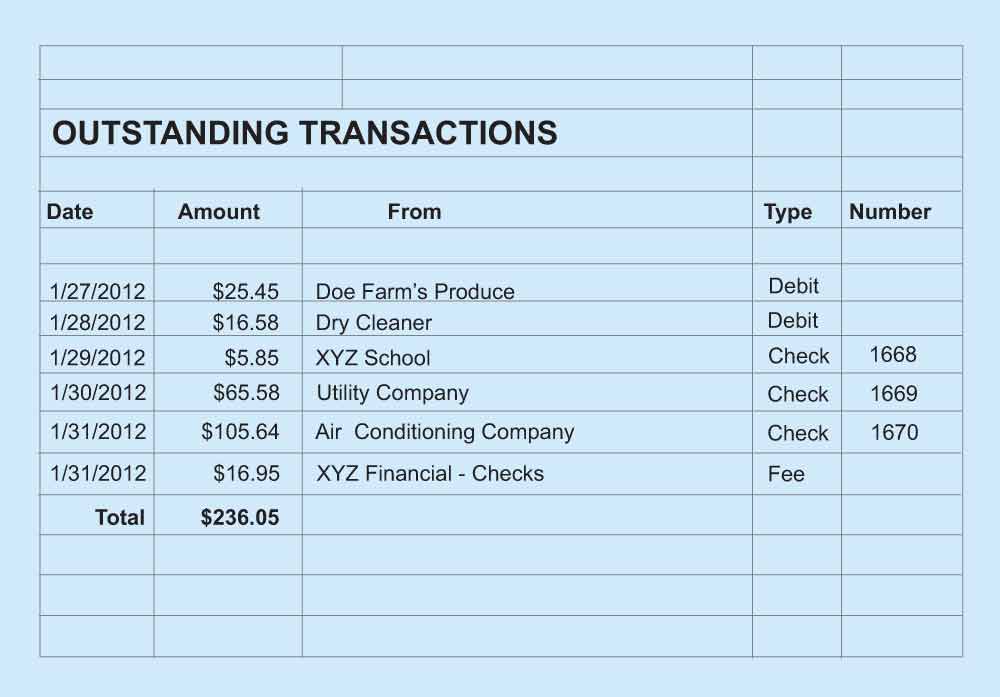

The best way to determine the proper amount of petty cash is to look historically at what your business spends cash on and how often you have "emergency" needs. Most small businesses do well with around two hundred dollars as a good ...

February 14, 2017

The foundation of the financial web, a network of organizations sharing financial data, is bank statement feeds. Small business owners, working in the cloud, now expect their bank transactions to arrive automatically loaded in their accounting ...

February 14, 2017

IT pros understand the dangers facing their companies, but don't have the necessary solutions [AB1] to address these new threats, including IoT malware, like Mirai. Last fall, Mirai was used to arm hundreds of thousands of webcams to attack the ...

February 14, 2017

Thomson Reuters has released a special report, Four Keys to the Future of Audit, which addresses the most pressing challenges facing the audit profession by grouping these issues into four main categories: quality, innovation, talent and relevance.

February 14, 2017

The accounting firm of Markham Norton Mosteller Wright & Company, P.A. has joined PrimeGlobal's North American Region. PrimeGlobal is one of the top five largest associations of independent accounting firms in the world, comprised of approximately ...

February 14, 2017

President Trump’s executive order for immigrants isn’t the only travel ban that may cause controversy. Under a lower-profile highway spending measure passed in 2015, and signed by President Obama, the IRS can prevent tax debtors from using their ...

February 14, 2017

The marketplace is now available to small businesses worldwide via these global websites: Australia, Canada, India, United Kingdom and United States. The marketplace first launched exclusively within QuickBooks Online last December.