Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

November 7, 2017

The one-year $5,000 scholarship, part of the AICPA’s Legacy Scholars Program, is awarded to students who come from liberal arts or non-traditional business backgrounds and are now pursuing graduate accounting degrees and working towards their CPA ...

November 7, 2017

The National Awards recognize outstanding women who exemplify AFWA’s core values in career and life, and set a positive example for other women in the accounting and finance industries.

November 7, 2017

The third major software release of the year, Adaptive Suite 2017.3, brings new features and functions that continue to deliver on the company’s commitment to offer a planning, reporting, and analytics platform that enables businesses to adopt an ...

November 6, 2017

CPA Practice Advisor, the source for news, software reviews, and best practices advice for members of the accounting profession, has launched a new weekly newsletter specifically directed at tax preparers.

November 6, 2017

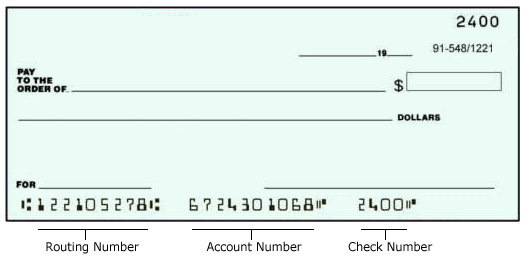

Lack of adoption for electronic payments in B2B transactions is still a widespread problem. With 50 percent of businesses still using paper checks as their primary mode of payment, the inefficient paper processes maintained by accounting professionals ...

November 4, 2017

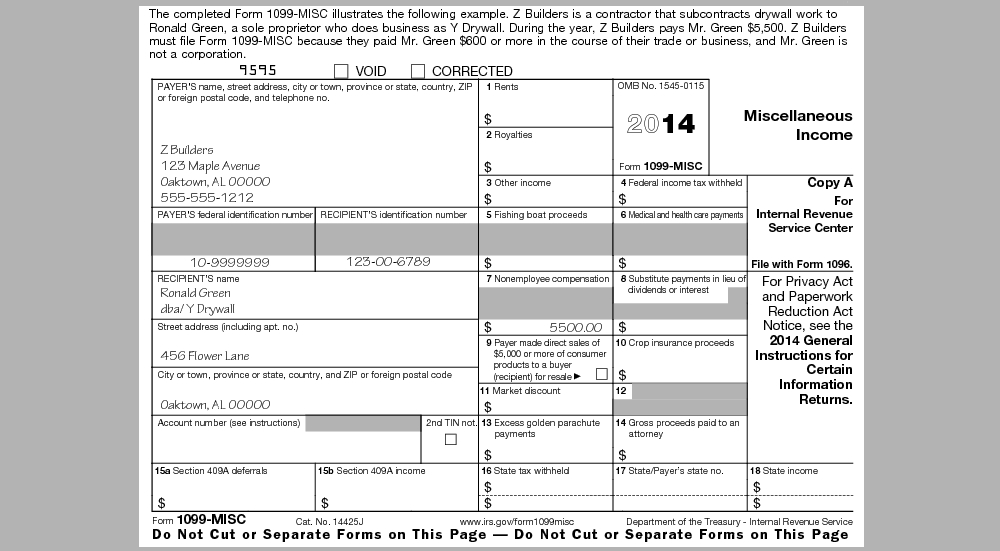

Printable and fileable Form 1099-MISC for tax year 2017. This form is filed by April 15, 2018.

November 3, 2017

Most of those affected taxpayers can easily reduce or, in some cases, eliminate the penalty by increasing their withholding or adjusting estimated tax payments for the rest of the year. With a little planning, taxpayers can avoid the penalty altogether.

November 2, 2017

The current graduated seven-bracket structure would be reduced to four rates of 12%, 25%, 35% and 39.6%. The previous plan was based on only three brackets with a top rate of 35% and didn’t specify income amounts. Thus, this new plans preserves the ...

November 2, 2017

Sometimes called secure scheduling, fair scheduling, or restrictive scheduling, new employment laws are creating major compliance requirements for businesses. Currently 5 cities and 1 state have passed some form of a scheduling law.

November 2, 2017

Twenty-seven states — plus Washington, D.C. — index their minimum wages to rise automatically with the cost of living. More states will index minimum wage increases annually, starting in the following years, like: Minnesota (2018), Michigan (2019) and ...

November 2, 2017

The plan would also repeal the alternative minimum tax (AMT) and the estate tax, while preserving the current status quo tax deferred treatment of 401(k) and similar accounts.

November 2, 2017

The acquisition combines two customer-centric, accounting vertical-focused market leaders, bringing together a comprehensive set of offerings that address every step of the cloud journey for CPA firms, accounting professionals and their SMB clients.