Accounting firms are professional services organizations (PSOs), and no matter how small or large, they sell the time and skills of their personnel. Despite industry developments and new business models, this is still where the rubber meets the road. So, owners and leaders must be able to calculate and track billable resources for each employee, and the firm itself, doing so with the utilization rate.

Understanding efficiency and productivity when creating revenue is critical to profitability.

Basically, a utilization rate comes from the number of hours an employee works divided by their total availability over a set time. It can be tracked over a week, month, quarter, year – whatever period you wish – and you can do the same to assess the utilization of your organization. The billable utilization rate, known as billability, relates to actual time billed versus total available hours.

It’s all about maximizing resources to raise profitability. If you don’t know what’s available to sell, you could take on business you’re not able to service or miss out on opportunities you could have taken on. If you don’t know how many hours are spent on particular work, it’s easy for staff to over-service, particularly if they’ve got time on their hands. Burnt out employees, irate customers, high overheads; understanding the utilization rate is key to preventing a host of financial and operational woes.

If you don’t use it, you’ll likely lose control of your workforce – and company.

How do you rate?

Whereas all organizations have different strategies, there’s no single formula for determining resource utilization. At Big Four firms, employees will likely generate revenue through longer, ongoing work that’s often on-site. Utilization rates would typically be higher because they have plenty of clients, tasks are more focused, and raising revenue is a foremost goal.

Simply put, there’s plenty of opportunity to bill and motivation to make sure billability is high.

If you look at a smaller practice, where growth is more important, building could be the overarching goal. Their utilization rates could be high, too, but not because they’re trying to set a new revenue mark. They likely charge less, for starters, and margins are smaller. They may be working more because they’re hoping to hire or make investments and need greater cash flow.

There’s no set one-size-fits-all formula and rates vary based on type of work, fee structure, roles, goals and more. Benchmarking competitor rates for comparison can help, but you still really need to understand what differentiates your operation and where you want to go.

A calculated approach

Setting utilization targets shouldn’t be a route for achieving a sales goal. CPA leaders need to know their available resources and how to most cost-effectively service clients. Utilization rates for employees should be realistic, otherwise, you’ll have a stressed staff. According to research, this can cause turnover, raise employee absences and decrease productivity; a scenario that costs U.S. business $300 billion annually.

Calculating utilization rates requires an understanding of the roles in your firm. For instance, titles have different hourly costs; a partner would bill out much higher than an associate doing basic audit work. Furthermore, you’d expect a partner to spend time managing personnel, working on business strategy and developing new business. While valuable functions, these hours are not billable to a client. The associate, however, will spend the majority of their time on billable projects.

Being able to separate billable from non-billable hours is essential. Paid time off, training, conferences and internal meetings, all are important. When employees know you’re investing in their development, when they’re not overworked, they stick around. Recruiting new talent isn’t easy and has a cost.

Keep in mind, though, employees not only must generate revenue for their own salaries, a portion should be attributed to those tasks that don’t generate revenue. Overhead costs also need to be spread across all billable employees to truly ensure your firm is operating profitably.

Some people fine-tune their utilization formula to take into account such things. A basic approach might be to measure billability based on hours billed, multiplied by available work time and acceptable non-billable hours, like holidays, recurring meetings, etc.

Regardless of how you do it, be sure to anticipate non-billable time from the start, otherwise your utilization calculations will be off the mark.

What’s ahead?

Capacity management aims to ensure maximum future profitable production given available resources and what the upcoming workload holds. While utilization rates examine the past, capacity management is forward-looking.

To properly manage capacity, client engagements need to be budgeted in both sales dollars and hours. Anticipated work in the pipeline should be included when there’s reasonable certainty of closing the deal. Cost rates for resources and roles should be factored in. Production, after all, isn’t just about meeting demand – it’s also about turning a profit.

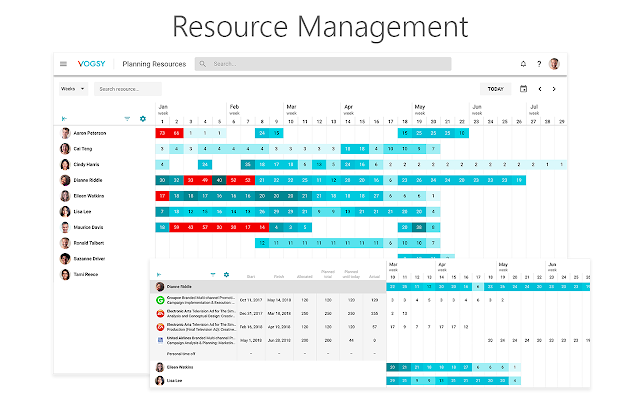

Resource forecasting is a segment of capacity management. It requires insight into orders booked, work in progress, pipeline, hours for activities and talent/skill availability. Often, one metric, like utilization rates, can snowball. With the right data, you can create a resource plan that maps staff to projects, forecasting areas where you have excess or too little capacity.

Through this, a firm can make better decisions about taking on new work, and if so, whether they’ll need additional talent.

Use it, don’t lose it

Without utilization accuracy, PSOs like accounting firms can’t know for certain whether they’re producing at optimum capacity. They’ll never understand how they’re performing on projects, per client or specific service lines. Leaders will also not know who is pulling their weight, who delivers the right outcomes fastest or what team is delivering the most value.

With this in mind, use utilization rates to create billable targets for employees. Share them with staff to put everyone on the same page and ensure goals are realistic. Remember, idle employees not only are not making revenue, they can worry about job security when there’s not enough work in the pipeline. You don’t want them looking elsewhere.

There are tools purpose-built to simplify this process, namely professional services automation platforms. They can enable accounting leaders to easily unearth and harness important data, set and monitor utilization rates, gain real-time visibility, analyze the past and forecast the future.

The data is in there, and when you can find it – and know how to apply it – you’ll never end up losing control.

=========

Mark van Leeuwen is CEO of VOGSY. He previously spent 10 years in a variety of complex projects working for a multinational bank on topics such as marketing, international finance, BPR, customer care and automation, followed by over 15 years leading PSO’s and growing services technology vendors’ market presence internationally.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs