A Top Technology Initiative Article Randy Johnston – June 2021 Issue

Finally, three of the most unusual years in the profession are behind us. The Tax Cuts and Jobs Act (TCJA), the COVID-19 pandemic July 15th, 2020 deadline, and the PPP2 May 17th, 2021 deadline have left many firm partners and team members more stressed and tired than usual. Plus, our efforts for our clients were often reactionary to both the legislation and relief bills. As we have done in the past, we completed the work and did the best we could with what we knew.

As we breathe a collective sigh of relief, it will be nice to have our practices and our clients’ companies returning to normal. While many people and businesses will be gone forever, there will be new businesses and new opportunities for our firm. However, we will be cleaning up many situations caused by our clients, interpretations of the relief bills, more new laws, and backlog clean-up from the tax service itself.

Other parts of this month’s issue deal with personal financial planning. This topic has been an interesting area for me for over 20 years, particularly after the regulations permitted practitioners to enter the business of wealth management. While I’ve helped many firms grow practices in this area, several with over $1B in assets under management, quite a few firms have helped clients protect their personal assets in well-run, properly focused fiduciary wealth management.

The technology tools available to assist in this area led me to prepare my first estate plan. When I ran my first personal financial planning models and estate plans in the Kettley Publishing and Back Room Technician, now Advisys solutions with over 40,000 users, I was hooked. Further, using the earliest version of the eMoney Advisor with my wife helped us understand our personal money risk tolerances. The Rutgers Investment Risk Tolerance Quiz, the Profiles module, a part of the Naviplan InvestCloud from Advicent, or one of the risk profiling software options here still makes sense to me when used to help people plan based on their risk tolerance and not as a sales tool. You can find many more options by searching on “money risk tolerance software.”

However, with all the efforts to gather assets under management by all sorts of organizations, professional independence, and a whole-of-client approach makes for a trusted advisor. And the best advisors always put the client first in their advisory practice. As the year progresses, you’ll see other coverage on the 30+ advisory services you can offer, and we’ll point you to more true advisory options instead of the “fake” advisory commonly promoted. We’ll also learn more about “whole-of-client.”

How Do We Choose Tax Advisory Tools?

First, you must decide on your tax advisory offerings. We suggest that there are many useful tax advisory offerings from tax planning to estate planning to tax resolution to cryptocurrency and more. While this column intends not to guide you on building an advisory practice but rather just a few advisory offerings, make sure you take the time to learn how to create an advisory practice with resources like Upward Spiral North America, Oodles, or Advisory 101. We also have Advisory course content at K2 Enterprises on our online website. Remember that advisory services are proactive and not reactive and involve more recurring client advice and less consultation. Tax planning and estate planning are proactive advisory services, and one could make the case it is hard to build a tax resolution advisory service. We’ll be covering many of these tax advisory tools in our Technology Lab Podcast, including several of the products named below. We will also discuss some of the tax planning and cryptocurrency tools in The Technology Lab Podcast.

Notice handling can be time-consuming for your practice, and many of you are handling notices for clients without charging for the service. When Jim Buttonnow and others formed New River Innovation and created the Beyond 415 product, we were pleased with the amount of expertise they brought into a product to handle notices. We were happy for them and sad for you when this product was sold to H&R Block. Some of you offer a tax guarantee service to handle any notices or appearances before the IRS and charge for this service with every return. The retail tax services of Liberty, H&R Block, and Jackson Hewitt readily talk about their guarantees, but you are handling far more complex tax matters at most CPA professional firms than the simple returns processed by most retail tax providers. Providing a fixed fee advisory service for handling aggressive tax clients provides some protection for the firm as well as for the client. However, with so much money to be made and saved by the client, contingency fees are not uncommon in tax resolution. Tax resolution may not qualify as an advisory service with this strategy.

That said, tools for handling tax notices include Canopy Tax Resolution, which has sophisticated notice handling, IRS Transcript retrieval, collections, and other post-filing cases. It would be best if you looked for features that support your tax resolution practice, including step-by-step resolution instructions, access to transcripts, letter templates for responding to the IRS, form auto-population, and IRS call guides. With the average hold time for the past year with the IRS at 18 minutes, you need to be ready when you finally get to an agent PLUS, the agents are just as worn down and stressed out as your team has been with extended tax seasons. Canopy’s competitors of IRSlogics, IRS Solutions, PitBullTax, OIC Tax Planner Tax Resolution Software, and Tax Help Software have similar capabilities with different approaches used in each product. You can see a feature comparison in the sales-biased comparison chart from PitBullTax.

Tax Planning as Advisory Service

Let’s turn our attention to tax planning. For years, we have used tools from the major publishers or developed our own strategies and simple guidelines and spreadsheets to make recommendations. If we had more sophisticated clients, we would use BNA Income Tax Planner from BNA Software. We could use Planner CS from Thomson Reuters or ProSystem fx Planning from CCH, a Wolters Kluwer business, for less complex situations. The models we could build were not very interactive, and the scenarios were limited. A few new tools, such as Tax Planner Pro, created by Christopher Ragain, came along to help small business owners that were using QuickBooks Online or Xero. Christopher has positioned this tool as an advisory offering with Accountant Portal and Registered Tax PlannerTM (RTP) designation.

The most impressive new product we have seen in any category in some time, Corvee provides simple, sophisticated tax planning. If you only learn one thing from this column, you should look at Corvee. Firms that add Tax Planning Advisory services experience an 88.82

(Click for larger image.)

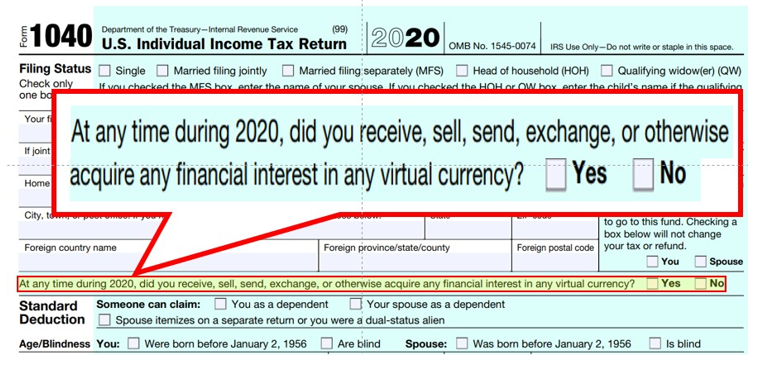

Practitioners are reporting many of their high-value clients are investing in cryptocurrencies. Perhaps you’ve put off dealing with the crypto for your client’s return because your client can’t find documentation associated with the trades, and you decided to file an extension. You know that the information exists, and the IRS is aggressively targeting cryptocurrencies. In short, you and your client need help now to avoid unpleasant surprises later. Consider using the Crypto Compliance Checklist, available free from Ledgible and developed with professionals from my K2 team.

It would be best if you had tax tools that can gather transaction data from most major cryptocurrencies and exchanges, that has the data needed to calculate the basis and fair value of transactions in many cryptocurrencies, and generates reports for supported currencies that can be used for gain/loss reporting and an inventory of open positions. Based on my research, I’ve concluded you can’t handle cryptocurrency on a tax return without wasting a lot of time unless you have a tool. While there may be more options, Ledgible by Verady and LukkaTax are two trustworthy solutions. Ledgible has automated interfaces that support the major blockchains, exchanges, wallets & accounting platforms, and more added interfaces every month. If you only learn a second thing from this column, a product like Ledgible is mandatory to handle cryptocurrency tax clients. We expect cryptocurrency to be an ongoing advisory need of clients. Recent reports suggest as many 10% of all Americans invested some of their relief funds in cryptocurrency during the past two years.

So, What Can We Do Today?

While we could have produced another whole article on Estate Planning tools and the complexities of Trust accounting, I wanted to get you thinking about the “whole-of-client” approach to advisory services. All advisory services should start with what the client wants, and you need to address the personal needs at the same time as the business needs. It doesn’t matter whether someone is self-employed or works for a Fortune 500 company; all individuals have personal needs and are trading their lives for income.

In a recent book by Peter Vessenes, he noted that “Capitalism is an exchange of goods or services wherein all parties in the trade believe that the value received is equal to or greater than the value offered.” He goes on to say, “At the time of being hired, you are bartering your work efforts in exchange for a compensation package and other ‘intangibles.’ People usually regard what the company offers to them in exchange for service in the tangibles, that is, wages, bonuses, health care, stock options, and other perks. Some include career growth opportunities, continuing education, and retirement programs. Though all of these are important parts of the trade, studies of employees have shown that these tangibles never appear at the top of surveys that question job satisfaction (value received in trade by the employee). Appearing ahead of the tangibles are comments such as ‘being appreciated,’ ‘a sense of belonging,’ ‘acknowledged for my contributions,’ ‘the great corporate culture, a sense of security.’” While I don’t know the original origin of the acronym, I’m reminded of an old Zig Ziglar saying that people listen to WIIFM – What’s In It For Me?

Most CPAs I know serve their clients well. Do you want to have the client’s best interest in mind? If so, you need to apply advisory thinking to your practice, and pick technology tools to support those efforts. Use the whole-of-client advisory approach to build a practice and relationships that can last for decades and generations. And always look for ways to create the very best client experience!

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: CAS, Digital Currency, Firm Management, Tax Planning