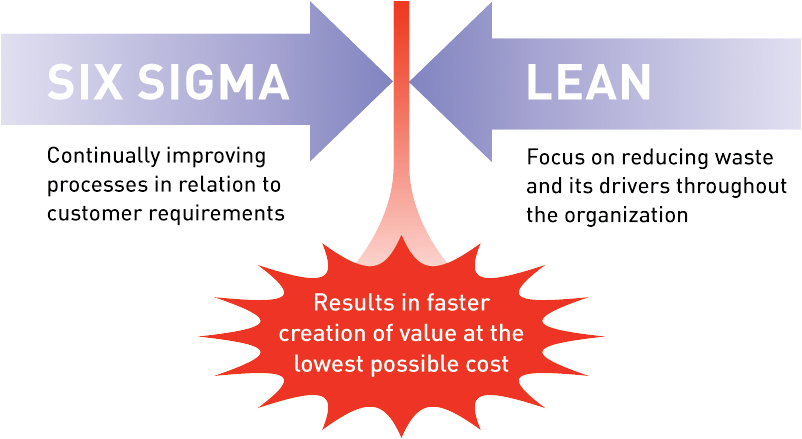

Audit re-engineering has been around for decades and delivered significant increases in firm productivity and is now making another quantum leap in improvement by integrating the key tenants of Lean Six Sigma (LSS) into today’s digital audit workflows.

Production efficiencies learned in the manufacturing environment are being applied to audit and accounting practices and building quality control into the three major phases of a compliance engagement: planning, fieldwork, and wrap up/delivery, in addition to adding value from the client’s perspective, which is becoming a key differentiator in delivery of A&A services.

PLANNING

One of the key premises of every audit re-engineering firm is that engagement planning needs to become a priority within the firm and be done in conjunction with clients. LSS helps firms define Key Performance Indicators (KPIs) to determine whether an engagement is successful such as completing field work on time, delivering the report by a specific due date, and whether the engagement was over/under budget and implementing a mechanism to ensure they are utilized.

Integrating KPIs into the planning process begins with having the client agree to provide their trial balance and all other required schedules to the firm on an agreed upon date or “they” will be responsible for delaying delivery of the report. Too often, firms take on the burden of dealing with incomplete or delayed source document, which unfortunately many firms have trained their clients that this is acceptable behavior.

Planning should be done with the entire engagement team first and then include the client so everyone’s expectations are set. It should take into account the size of the client and the overall risk of the engagement and be done in conjunction with any other similar niche clients to improve the overall efficiency of the team.

Working as a segment/niche team allows for partners, managers and staff auditors to discuss and understand the plan for each individual client, including determining the appropriate level of staffing for each day on the job as well as to tailor the engagement program to what is necessary for that client. Doing this with all team members also allows for discussion on the impact of any new accounting standards and for the drafting of preliminary footnotes, so staff are in tune with the requirements before beginning fieldwork.

One of the key components of planning is to include the time needed to substantially complete each engagement before starting the next one. Too often firms neglect planning and “wrap up” days with reviewers and partners, which are necessary to meet the scheduled delivery date. Another important LSS component of planning is determining the optimum onsite staffing requirements needed for the job.

While there are times where overstaffing is important for training and possibly for inventory observation, if it is not necessary for staff to be onsite on a particular day, it is better to have them work remotely through the collaboration tools mentioned below in the Fieldwork section. LSS principles also support using a workflow tool which tracks target dates and sends out warnings to notify managers as to the adherence to the schedule and promote communications with the client when the schedule is at risk.

Another important part of the planning with the client is educating them on all documents needed and how they should be delivered. Using client portals helps in planning, as the in-charge can be notified when documents are uploaded and those documents are also accessible to any member of the audit team, which is not the case with email that is usually only available to the recipient.

If the client does not deliver the required documents on time, the firm must be prepared to invoke the previously agreed upon consequences with the client, which is why it is critical that the partner, manager, and staff are all in tune with this, which was part of the initial planning.

FIELDWORK

Firms must adhere to their plan to ensure they complete all necessary detail work while they are in the field, which also includes preparing a draft of the financial reports (including footnotes and previewed disclosures), and having the necessary personnel scheduled to review the work before leaving the client site, which can be again be managed with a digital workflow tool.

One of the key tenants of LSS is to do quality control at each step of the process meaning supervisors and managers need to manage the engagement status daily, review completed work, and verify that work is done right the first time. All firm know that picking it up later over and over again vastly expands the hours on the engagement as the auditors have to “re-learn” the engagement each time as they have already moved on to another engagement.

When beginning fieldwork, auditors should plan to start with the most difficult components of the audit so they can be completed before wrap up to allow for any unforeseen issues, and then schedule to do the lower risk, more standardized items at the end of fieldwork, while the supervisor is doing the onsite review.

Using live collaboration tools such as Microsoft Lync or Skype will allow the auditor to ask the in-charge or another partner to review any complex issues, again while they are still in field. Working with all files centrally on the firms servers either via Citrix/Windows Terminal Server (WTS) or through another cloud-based engagement application will allow client workpapers to be reviewed when they are completed and will ensure they are done with a minimum amount of rework as the information will still be fresh in the auditor’s mind.

Using Citrix/WTS also reduces technical issues experienced by firms that check out binders to local workstations and setup field networks, which often cause IT problems for audit staff at the start of each day. Another LSS planning component includes transferring the trial balance to the tax return and having tax personnel review the information to answer any questions while the engagement information is still available.

Finally, one of the most important differentiators that LSS provides is to highlight those items that add value from a client perspective. Part of any engagement outcome should be to have all personnel proactively look for and document value-added improvements as field work is being done so that these items can be considered for client discussion at delivery, opening the door to future value added services.

WRAP UP and DELIVERY

Another one of key tenants of Lean Six Sigma is promoting and adhering to a firm standard for all financial statement delivery, which can be documented and personnel trained on. When staff have to adjust their work to the preferences of individual partners, efficiency is lost causing rework.

Engagement wrap up and delivery should be focused on the second partner/Quality Control Review and require minimal additional staff time if the planning for the field work was adhered to. One common mistake firms make is they overschedule work when clients don’t meet their agreed upon deadlines, leaving the audit staff to scramble to complete multiple engagements simultaneously.

Firms need to also schedule days to wrap-up engagements (and have the partners respect those days), to do the preliminary tax return, and to have agreement on footnotes, so all that is left is the physical cosmetics of the report for delivery.

A final contribution of LSS to the engagement is scheduling time during the wrap up for the audit team to discuss specific opportunities they have identified for client improvement. After delivery of the financial statements and discussion of any internal control requirements, the audit team should provide high level ideas for improvements and schedule a time to follow up with the client during the off season, thus adding value to the engagement and differentiating the delivery of the client’s financial report from other commodity providers.

CONCLUSION

The summer provides a great opportunity for firms to step back and take an objective look to see how “lean” principles can improve their audit processes as well as add value to client engagements, which is one of the key goals of Lean Six Sigma (LSS).

———————-

Roman H. Kepczyk, CPA.CITP and Lean Six Sigma Black Belt is Director of Consulting for Xcentric, LLC and works exclusively with accounting firms to optimize their internal production workflows within their tax, audit, client services and administrative areas. His Quantum of Paperless Guide (available on Amazon.com) has been updated for 2014 with the latest AAA paperless benchmark statistics and outlines 32 digital best practices all accounting firm partners need to understand today.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management, Technology