February 26, 2019

Drake Software 2010 Who’s Who

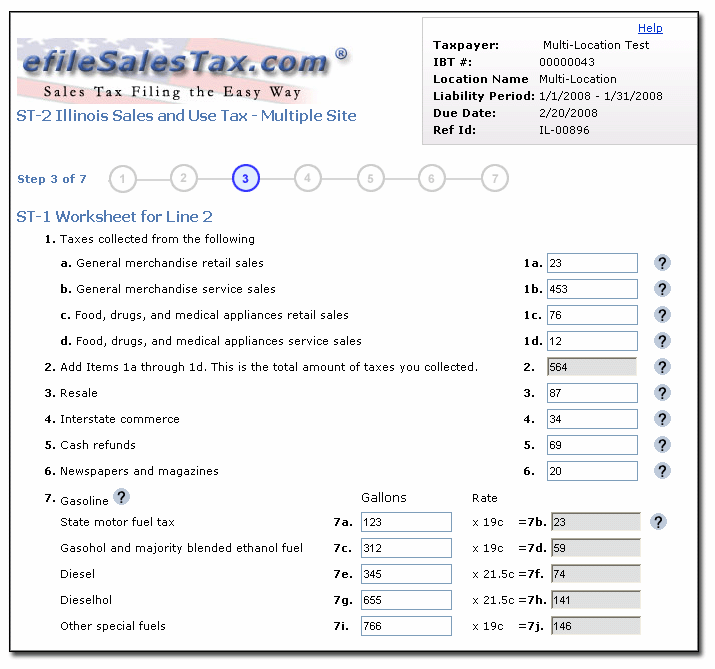

Drake Software is the Smart Choice for Tax Professionals For over 33 years, Drake’s team of programmers, tax analysts, CPAs, and EAs has provided tax professionals the tools they need to grow their businesses. Each year, Drake processes more than nine million federal- and state-accepted returns, focusing on value, consistent excellence in federal and state...…