February 24, 2012

Form 1097-BTC

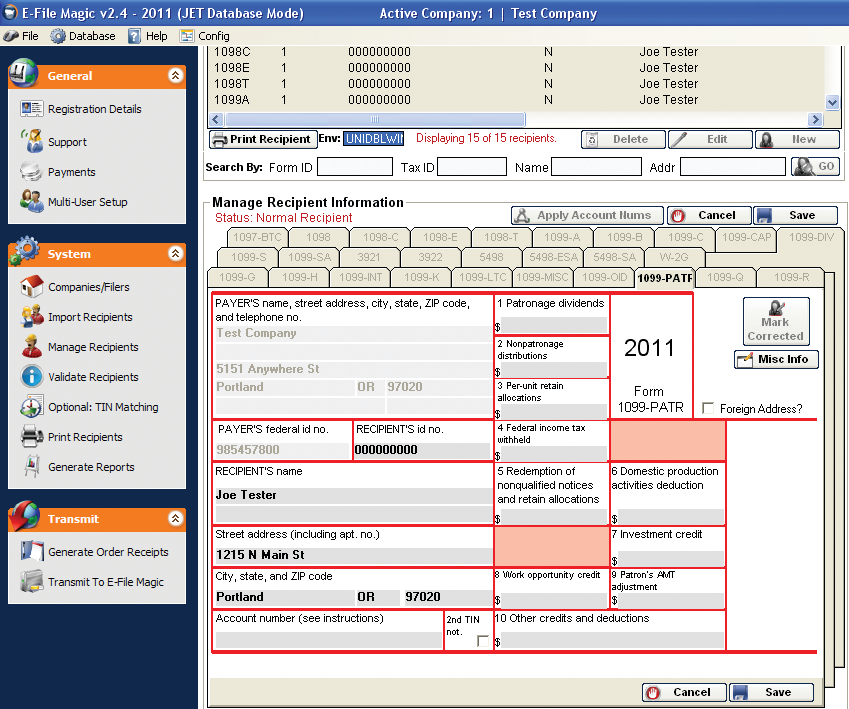

Using the E-File Magic 1097-BTC software you can print, mail, and e-File your 1097-BTC forms with ease. Unlike our competitors we do not charge expensive licensing fees for our software. You pay only for e-File Services (required), and optionally print and mail services. This makes your year end reporting requirements even simpler than ever. Just...…