November 18, 2015

The Ultimate Year -End Guide to Payroll Compliance and Benefits

With this guide, we hope to help you navigate the ins and outs of getting your compliance and benefits ready for end of year.

November 18, 2015

With this guide, we hope to help you navigate the ins and outs of getting your compliance and benefits ready for end of year.

October 19, 2015

May 10, 2012

August 11, 2011

November 18, 2015

With this guide, we hope to help you navigate the ins and outs of getting your compliance and benefits ready for end of year.

October 19, 2015

For accounting firms considering adding payroll to their suite of products that are offered to clients, the payroll reviews this month will certainly come in handy. And for those already offering these services, it never hurts to see what’s available.

May 10, 2012

Release includes enhancements to its signature, award-winning electronic pay offering .

November 14, 2011

Easy, yet powerful professional program automates payroll runs, compliance reporting and payments.

August 11, 2011

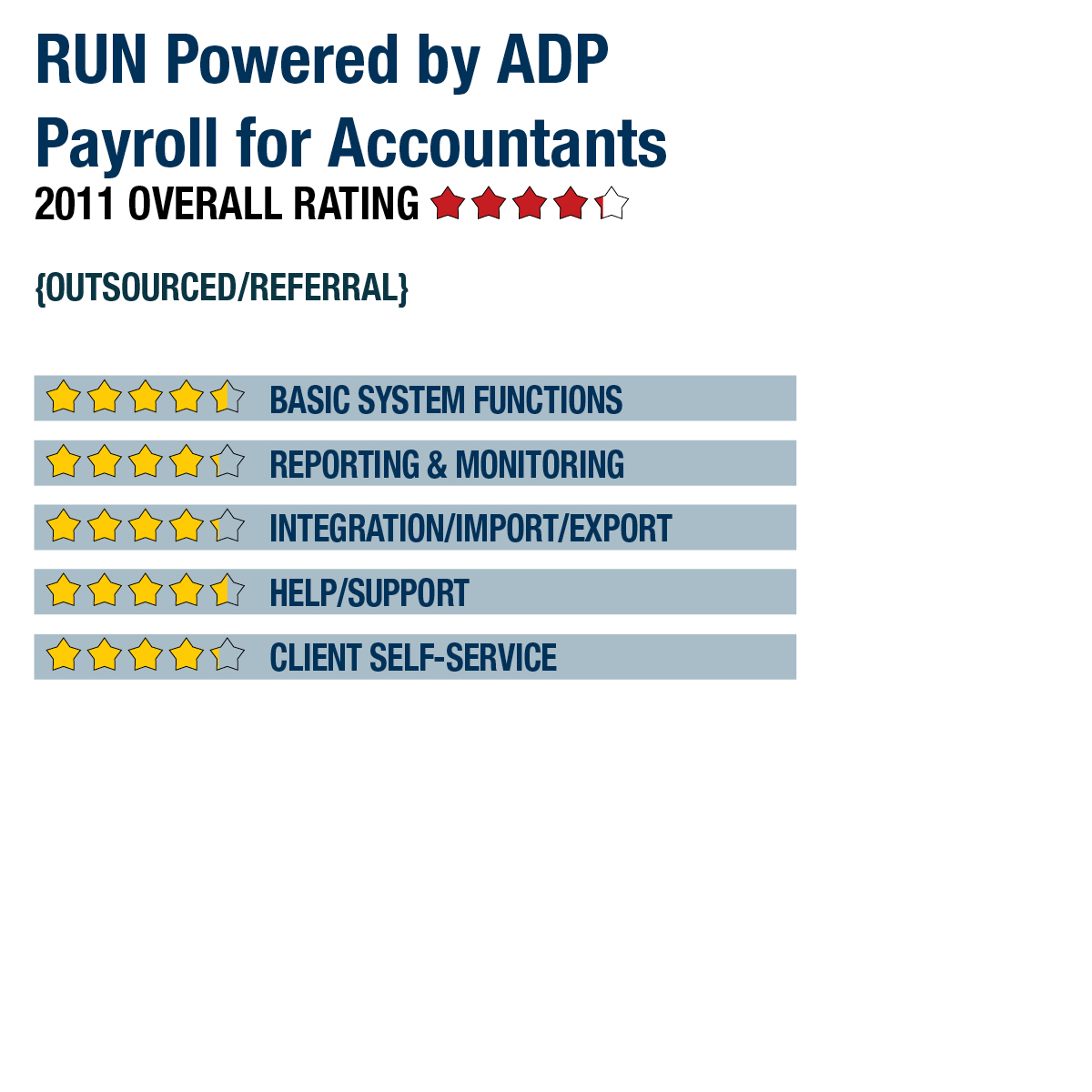

800-Call ADP (225-5237) www.accountant.adp.com 2011 Overall Rating 4.25 Best Fit Firms who manage payroll and compliance needs for multiple client businesses, but who prefer most compliance work to be outsourced. It’s also a good fit for professionals who want to provide human resource tools and workers’ compensation premium payment solutions. Strengths Available in full-service...…

May 3, 2011

WHITE PLAINS, New York — May 3, 2011 — FUND E-Z Development Corporation (www.fundez.com), a leading provider of nonprofit accounting, fundraising and HIPAA billing software, today announced that Positive Pay, an automated fraud detection tool, has been integrated with FUND E-Z Nonprofit Accounting Software. Positive Pay is a feature that provides nonprofit and governmental organizations...…

March 1, 2011

CINCINNATI, Ohio – March 1, 2011 – Cincinnati-based Paycor Payroll Services has won the People’s Choice Stevie Award for Favorite Customer Service in the Financial Services category in the fifth annual Stevie Awards for Sales & Customer Service. This award was determined by Paycor clients, CPAs and the general public through popular vote. “Receiving a...…

October 26, 2010

Newport News, Virginia – PenSoft, a leading developer of payroll software, announces the release of PenSoft TimeOnline as a part of their commitment to offer value add-ons to their customers. PenSoft TimeOnline is a web-based application delivering a fast, easy, and customizable method of time & attendance. It is versatile to meet the needs of...…

October 6, 2010

September 24, 2010

Viewpoint V6 Software addresses the issues and challenges contractors face by providing a configurable and integrated suite of applications for Accounting, Human Resources, Operations, Project Management and reporting and analysis tools. Built on a contemporary Microsoft SQL Server / .NET platform, Viewpoint V6 Software provides the tools, technology and information companies need to empower employees,...…

September 9, 2010

Vigilant Solutions’ Product Line features an extensive array of business software products tailored for retail, wholesale, manufacturing and service industries of any size. Point of Sale (P.O.S.), Invoicing (including Purchase Order), Inventory Control, Accounting, Payroll and Customer Relationship Management (C.R.M.) are at the forefront of Vigilant’s offerings.

August 25, 2010

Carillon ERP is designed to support businesses’ financials, supply chain management, manufacturing, construction, inventory management, sales order processing, purchasing, production orders, job costing and profitability, time & billing, payroll, contact relationship management and mobile workforce. Carillon has complete multi-company, multilingual, and multicurrency functionality.