Anyone who has ever tried to call the Internal Revenue Service knows what to expect first … a wait. Sometimes a really long one. For tax professionals who need to reach the IRS more frequently on behalf of clients, this can be a waste of precious time and productivity.

For the past several months, staff at Beyond415 has been researching it by calling the IRS Practitioner Priority Service (PPS) individual and business lines to measure and record wait times to see what day and time were the best for professionals to call. Here are some conclusions from their analysis of call wait times:

Individual taxpayer PPS line

- (866) 860-4259, option 3

- PPS operating hours: 7 a.m. to 7 p.m. (your local time), Monday through Friday

Regardless of day, the best time to call for your individual taxpayer clients is first thing in the morning, between 7 a.m. (ET) and 8:15 a.m. (ET). Even when we called at 9:30 a.m. – the next best option – the average hold time increased by five times.

Business taxpayer PPS line

- (866) 860-4259, option 4

- PPS operating hours: 7 a.m. to 7 p.m. (your local time), Monday through Friday

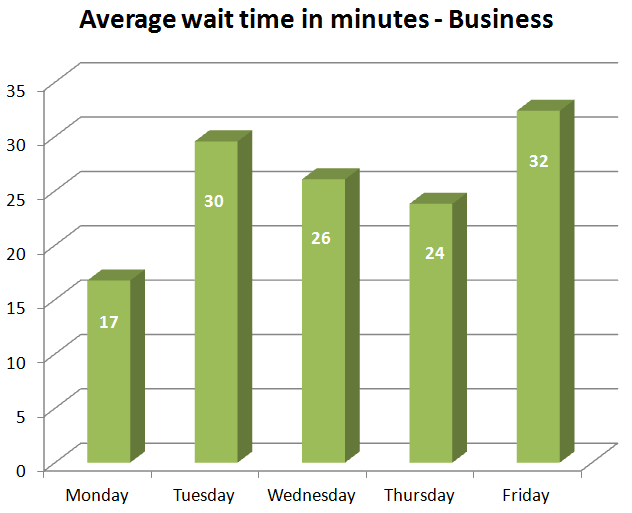

For the business PPS line, the biggest determining factor for hold time is day of the week. The best day to call is Monday. We found no discernible difference in hold times between morning and afternoon. Can’t call Monday? Early morning (7 a.m. sharp) is your best bet on other days.

Calling the IRS isn’t always predictable – sometimes you just get lucky. There’s always an exception to the rule. However, we found that the worst time to call is 11 a.m. or later on Friday. We made 32 calls in that timeframe, and only twice were we on hold for less than 15 minutes.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs