As the quarterly earnings call with investors nears, every CFO, Chief Accounting Officer and Controller gets that funny feeling in their stomachs regarding the forecast—the estimate of the company’s next quarter earnings.

Although publicly traded companies are not required to issue statements on future financial performance, most take the plunge and provide the earnings guidance. What makes finance and accounting executives queasy is the truth behind their projections. More than eight in ten (82) percent of finance departments resort to creative accounting tactics to make their company appear more profitable than it is, according to a recent global survey we commissioned.

No one can predict the future, of course. This creates an opportunity for finance teams to be extra-creative in writing up the earnings guidance; if they’re proven wrong, they can always say they made their best estimate based on a mixture of guesswork and calculation. This creates a problem for investors in a public company, however, who want to trust the forecast is as close to perfect as can be.

Creative accounting tactics, for the most part, are perfectly legal. Nevertheless, the knowledge that 82 percent of public companies may be brightening their prospects like an art conservator embellishing the brushstrokes of a dreary Rembrandt portrait is disconcerting, to say the least. Just how much are companies augmenting their financial reality—a little or quite a bit?

Creative Control

To learn more about the subject, we commissioned a survey of 760 institutional investors worldwide by independent research firm Censuswide. In addition to the eye-opening findings on the widescale use of creative accounting tactics, 84 percent of the respondents also predicted that the number of high-profile fraud cases at large corporations will increase in 2020. More than half (56 percent) the respondents said they were worried about companies in their own investment portfolios that showed a high risk of internal financial fraud.

These findings are related, suggesting that some public companies may be going too far in sprucing up their earnings, distorting the information to pull the wool over the eyes of investors and other stakeholders. While the survey wasn’t designed to ferret out which types of creative accounting were most rampant and concerning, the usual techniques include overestimating revenues, decreasing depreciation charges, masking contingent liabilities, manipulating inventory, and undervaluing pension obligations, among others.

A common scenario is for a company worried about its revenue forecast to sharply discount its prices on products or services a month or so prior to the earnings call. The idea is to ramp up sales to make the current period financial statement look better than it actually is. If things do go badly the next quarter, the company can simply state it did the best it could.

Why is this not against the law? One reason is that accounting regulations have more holes than swiss cheese. Enron’s finance team famously said they never broke the rules, they just exploited the loopholes. Another reason is the dozens to hundreds of different management systems that pump data into the finance function from across the enterprise.

To reconcile the data, accountants must match thousands of spreadsheets. Bank records, for instance, must be matched to the general ledger system. Invoices must be matched to purchase orders, credit cards and intercompany data. The sheer complexity of these tasks is part of the reason why accounting authorities permit accountants to make assumptions in the financial statement, upon which the earnings guidance is based. If the forecast falters, it’s because of all those confounding spreadsheets and complicated manual processes.

Transparency is Everything

Fortunately, there are ways to separate fact from fiction. A dose of skepticism when reading the earnings guidance makes great sense, as it puts one in the right frame of mind to question overblown comments. Knowing the prevailing types of creative accounting techniques in use also helps in detecting them. If it looks fishy, it probably is.

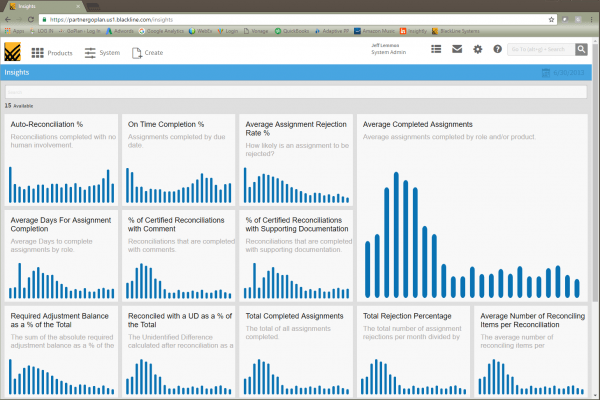

Another way to limit the risk of being fleeced is to determine if the company has automated its financial close and other accounting processes. If this is the case, accountants should have a clear view into the underlying financial data, decreasing the need to make assumptions, weakening the rationale for why an earnings forecast missed the mark.

The time has come to intensify the spotlight on creative accounting methods that obfuscate the truth and serve no real purpose. Rather, companies should liberate their accountants to be strategically creative, leveraging their experience and skill in advice to business units on how to really increase revenues and reduce costs.

=======

Therese Tucker is the founder and CEO of BlackLine, a provider of cloud-based software solutions that automate and control the financial close.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs