By Christian M. Wade

Gloucester Daily Times, Mass.

(TNS)

BOSTON — Unions, advocates for low-income workers and other groups on Thursday urged state lawmakers to permanently “opt out” of several new federal laws enacted as part of President Donald Trump’s tax cut and policy bill, warning of the impact on the state’s coffers.

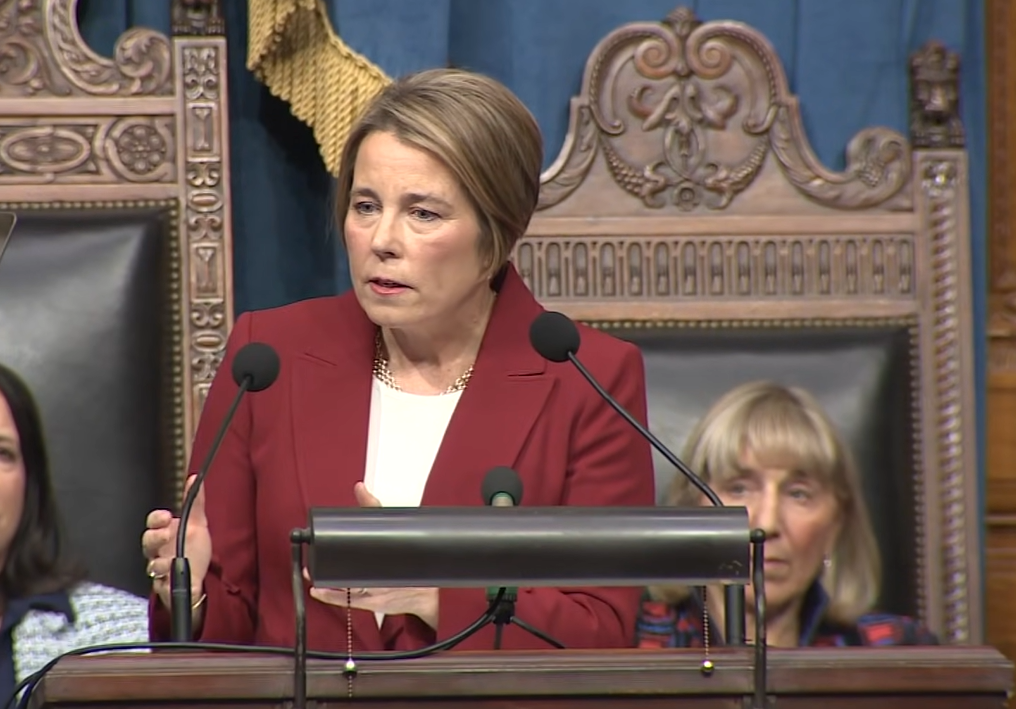

The Legislature’s Revenue Committee is considering a proposal by Gov. Maura Healey that would delay implementation until next year of what she described as the five “most costliest” changes in the federal tax code created by Trump’s One Big Beautiful Bill Act.

The legislation would allow the state in the future to “automatically” delay by up to one year implementation of any federal tax policy changes that exceed a $20 million impact on state revenue collections.

But lawmakers are being urged to go further than Healey’s proposal by permanently opting out of the new tax rules—a process known as “decoupling”—to help prevent deeper cuts to state-funded programs and services.

Recommended Articles

Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

Taxes February 5, 2026

House Advances Measure to Block D.C. Tax Code Decoupling

Taxes January 27, 2026

Massachusetts Governor Seeks to Delay Federal Tax Cuts

“We urge you to completely opt out of the tax changes rather than just delaying them,” Phineas Baxandall, policy director for the Massachusetts Budget and Policy Center, a left-leaning think-tank, told the panel Thursday during a hearing on the bill.

“Massachusetts has an opportunity to better protect our financial security and reject the inequitable and ineffective policies being thrust upon us by the federal government.”

Max Page, president of the Massachusetts Teachers Association, told the panel that the “unwise Trump tax cuts” would mean less money for schools and local governments that are already struggling amid rising costs. He suggested there are other reasons for rejecting the tax changes.

“Going along with these Trump-Republican tax cuts is going along with Trump’s program of punishing states and weakening investments in the public sector, and pitting us against one another in an atmosphere of austerity,” he said in remarks. “That’s why many states are decoupling.”

Frank Callahan, president of the Massachusetts Building Trades Council, also called on lawmakers to re-write Healey’s bill to permanently opt out of the new tax laws, which he said would mean less money for publicly funded construction projects that benefit unionized workers.

“Unless we act to decouple from the One Big Beautiful Bill Act, state agencies, municipalities, hospitals, universities, and others will be forced to cut back or eliminate spending on critical infrastructure where our members earned their living on a day-to-day basis,” he told the panel.

Trump signed his One Big Beautiful Bill, the centerpiece of his economic agenda, into law on July 4 after it passed both the Republican-controlled House of Representatives and Senate in a largely partisan vote.

Members of the state’s all-Democrat congressional delegation, including Reps. Seth Moulton and Lori Trahan, voted in unison against the $3.5 trillion spending bill.

Different path

Healey and other Democratic state leaders warn the new law will force the state to cut benefits for tens of thousands of low-income Medicaid recipients and dismantle food insecurity programs that have seen demand surge in the wake of the pandemic. The state is already taking a $3.7 billion hit, according to the Healey administration.

Finance Secretary Matthew Gorzkowicz told the Finance Committee Thursday that the governor’s proposal “strikes a balance” between the need to offset the immediate impact of the new federal tax laws while ensuring Massachusetts businesses and taxpayers benefit from the changes.

“Many states are facing similar situations and have chosen to simply decouple completely from the federal changes, including Maine, New York, Rhode Island and others,” he told the panel. “We have chosen a different path.”

Gorzkowicz said the federal tax cuts are projected to reduce state revenues by more than $442 million in the fiscal year that began in July, “leaving a large gap to fill in an already tight budget.” That’s because Massachusetts automatically adjusts its corporate tax codes to federal changes.

Among the tax relief provisions Healey wants to delay is one that would enable businesses to fully deduct domestic research and experimental costs within the year that those expenses are incurred.

Under the plan, businesses will still be able to “utilize” the change on their payments for tax year 2026, but the state will avoid losing $288 million in the next fiscal year, officials said.

The White House says the new law saves most Americans money by extending Trump’s 2017 breaks, which were set to expire at the end of 2025.

Supporters of the new law also point to provisions reducing taxes on corporations, boosting the child tax credit, increasing the deduction for state and local taxes to $40,000 and temporarily expanding Social Security tax breaks for senior citizens.

The Tax Foundation, a nonpartisan Washington-based think tank, estimates that Bay Staters will see their taxes cut by an average of $5,139 in 2026 under the new federal law—the third largest reduction in the nation following Wyoming and Washington state.

Business groups, too, have welcomed the additional federal tax relief for Massachusetts employers, whom they say are struggling with some of the highest costs for doing business in the nation.

Some argue that the state government needs to tighten its belt instead of delaying tax reforms to continue the current levels of spending on some programs and services.

“Massachusetts is at the bottom of the state rankings for economic growth, job creation, and overall tax competitiveness,” said Paul Craney, executive director of the Massachusetts Fiscal Alliance. “Even when the federal government makes changes to benefit taxpayers, Massachusetts is slow to adopt them. Ultimately, the state has a spending problem and until the governor and legislature can reduce spending, taxpayers will continue to suffer.”

Photo credit: APCortizasJr/iStock

_______

© 2026 the Gloucester Daily Times (Gloucester, Mass.). Visit www.gloucestertimes.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs