By Jordan Nathaniel Fenster

Journal Inquirer, Manchester, Conn.

(TNS)

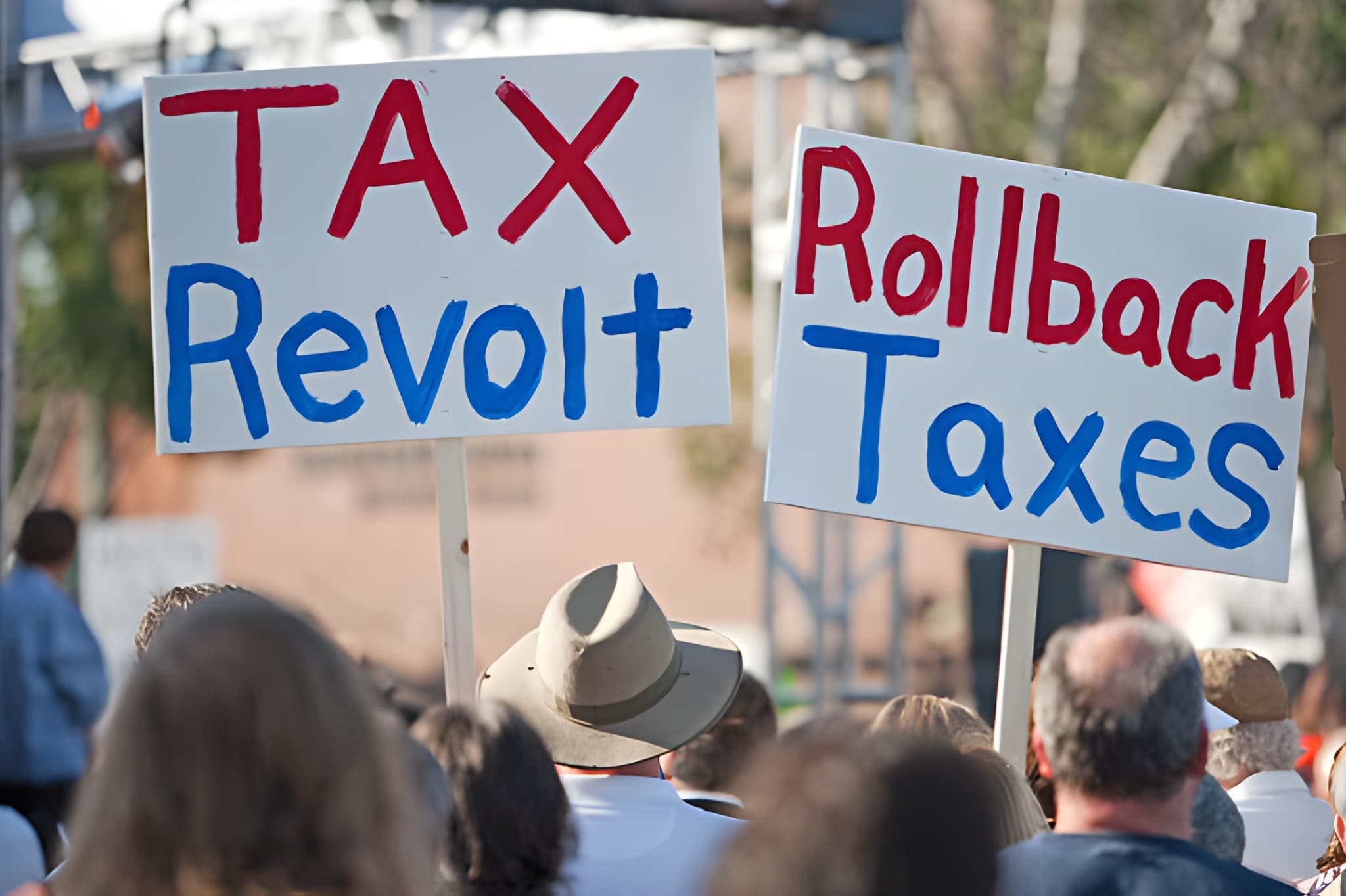

A small but loud group of social media influencers have lately been suggesting that taxpayers use the power of the purse to protest their unhappiness with the government.

“So, we’re not paying taxes this year, right?” one poster on Instagram asked. “Tax protest 2026. Spread the word.”

“Are you tired of the government using our tax dollars to fund genocide and bail out billionaires?” asked another, before suggesting what she called a “safe and effective way” to not pay taxes.

Another poster admits that although it “might be a terrible idea,” he said he intends to withhold his federal taxes until April 2027, because he “can’t continue to fund this government’s treatment of immigrants.”

There is actually historical precedent for tax protests, which have a long and storied past. But there are real-world consequences to not paying taxes that one Connecticut tax preparer said makes such a protest inadvisable.

“You will get arrested if you don’t file your tax return as part of protest,” said Daniel Friedman, CEO and a partner at WMGNA, a tax preparer and financial solutions firm headquartered in Farmington, CT. “If it’s a certain amount, over $66,000 they can take your passport.”

Protesters say they don’t want their money used to fund policies they oppose, such as corporate bailouts, immigration enforcement and military aid. By withholding taxes, they argue, it is a way to withdraw consent.

Singer and songwriter Joan Baez was not arrested in 1963 when she publicly refused to pay the 60% of her taxes she believed funded U.S. military operations.

“Our modern weapons can reduce a man to a piece of dust in a split second, can make a woman’s hair fall out or cause her baby to be born a monster,” she wrote in a press release that is preserved in a Northwestern University database. “I’m not going to volunteer the 60% of my year’s income tax that goes to armaments.”

Baez refused for years to pay the percentage of her income tax she said was funding military operations, though she later acknowledged that the government was taking the money directly from her bank account, and that, due to imposed penalties, she would pay more than she otherwise would have.

“That kind of tax protest has been around a very long time,” said Scott McLean, professor of political science at Quinnipiac University. “Henry David Thoreau, in the famous essay, ‘Civil Disobedience.’ What was the civil disobedience? He didn’t pay the poll tax. He said the tax was unjust, and he was thrown into jail for it.”

There are other instances as well, going back to the Magna Carta of 1215, one of the bases for the U.S. Constitution, which was designed as a means of protesting what was seen as unjust taxation.

More recently, McLean noted the Peacemakers tax protest in the late 1940s, which also encouraged withholding taxes as a protest against war.

The difference, he said, is that it was “a very organized protest. It wasn’t just, ‘I’m not going to pay taxes. I’m going to lobby and work and change the laws,’ a major grassroots, populist movement.”

“I don’t know if the people you’re seeing on your Instagram are the Henry David Thoreau type of people,” McLean said. “I don’t know if they have a big pacifist, anarchistic philosophy, or they’re just people that just don’t want to pay tax.”

Although there “is some randomness” in whom the IRS decides to audit, they will often “go where the money is,” Friedman said.

“IRS is more likely to come after the $5, $600,000 wage earner with a W2, and they can’t match it up to a tax return, a lot quicker and with alacrity and severity than you would see at $50, $60,000,” he said.

Although some people can go years without paying taxes before the IRS gets wind, Friedman said software is making it easier to identify people who should have paid taxes but didn’t.

“If you have a W2 and you don’t file your 2025 tax return, you will get a notice,” he said. “If a 1099 is missed, they’ll send a notice out: ‘Hey, we got this 1099. We ran it through the computer. There’s no tax return matching.’”

At that point, filing your taxes is the easy way to make the IRS go away, Friedman said: “What happened? Honest mistake? OK, we get it. No fraud, no prison, no Guantanamo Bay.”

Photo credit: wh1600/iStock

_______

© 2026 Journal Inquirer, Manchester, Conn. Visit www.journalinquirer.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs