By Christian M. Wade

The Salem News, Beverly, Mass.

(TNS)

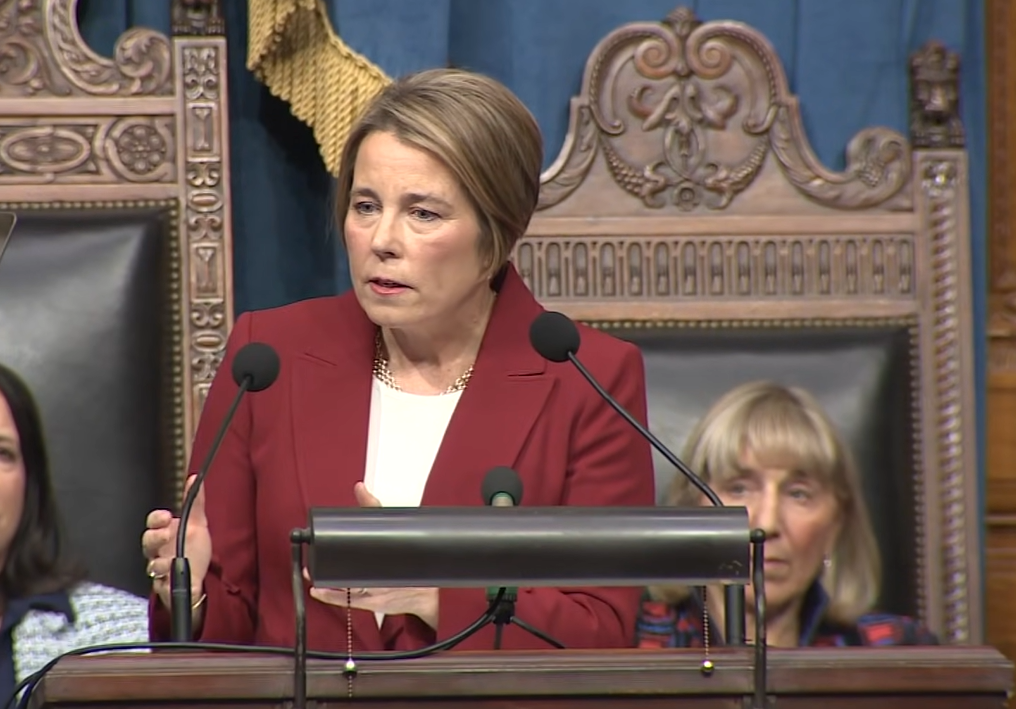

BOSTON — Democratic Gov. Maura Healey is seeking to blunt the impact to state coffers from changes to the federal tax code under President Donald Trump’s new tax cuts and policy law, but business groups say the move would hurt Massachusetts’ competitiveness.

Healey has filed legislation that would delay implementation of what she described as the five “most costliest” changes in federal tax code created by Trump’s One Big Beautiful Bill Act until next year.

Another provision of the proposal, which requires legislative approval, would allow the state in the future to “automatically” delay by up to one year implementation of any federal tax policy changes that exceed a $20 million impact on state revenue collections.

In a letter to legislative leaders, Healey said the proposal is a “thoughtful, phased-in approach” to implementing federal tax reforms at the state level “that will ensure our current fiscal rear 2026 budget—and the critical services it provides—remains intact” while also providing tax relief.

“This approach will allow Massachusetts to spread the tax revenue impact of the OBBBA provisions over multiple fiscal years while beneficiaries will immediately see the tax benefit of OBBBA at the federal level and realize the full benefits at the state level in one to two years,” Healey wrote.

Among the tax relief provisions Healey wants to delay is one that would enable businesses to fully deduct domestic research and experimental costs within the year that those expenses are incurred.

Healey said under her plan, businesses will still be able to “utilize” the change on their payments for tax year 2026, but the state will avoid losing $288 million in the next fiscal year.

Healey, who is expected to file her preliminary budget next week, said she recognizes many businesses “stand to benefit from the new tax rules, and Massachusetts, in general, will be in a better competitive position compared to our competitor states if these provisions are allowed to take effect.”

But she said her plan “balances that goal against the reality that our ability to deliver the programs and services paid for through the budget that our communities, schools, workers and most vulnerable residents rely on would be at risk if the revenue impacts are not mitigated.”

Trump signed his One Big Beautiful Bill, the centerpiece of his economic agenda, into law in July after it passed both the Republican-controlled House of Representatives and Senate in a largely partisan vote.

Members of the state’s all-Democrat congressional delegation, including U.S. Reps. Seth Moulton and Lori Trahan, voted in unison against the $3.5 trillion spending bill.

But Healey said the timing of the tax cuts going into effect this year under the bill gives Beacon Hill’s budget writers little time to plan for the estimated $442 million fiscal impact of the federal tax policy changes on the state’s operating revenues.

“And we are not alone,” she wrote. “States around the country are facing and have made similar choices about if and when to implement OBBBA tax changes.”

The White House says the new law saves most Americans money by extending Trump’s 2017 breaks, which were set to expire at the end of 2025.

Trump and other Republicans point to provisions reducing taxes on corporations, boosting the child tax credit, increasing the deduction for state and local taxes to $40,000 and temporarily expanding Social Security tax breaks for senior citizens.

The Tax Foundation, a nonpartisan Washington-based think tank, estimates that Bay Staters will see their taxes cut by an average of $5,139 in 2026 under the new federal law—the third largest reduction in the nation following Wyoming and Washington.

Business groups, who have welcomed the additional federal tax relief for Massachusetts employers, say employers are struggling with some of the highest costs for doing business in the nation. They are criticizing Healey’s plans to delay the relief for employers.

“This tax conformity package is just another example of Beacon Hill speaking out of both sides of their mouths,” said Chris Carlozzi, state director of the Massachusetts chapter of the National Federation of Independent Businesses. “While lawmakers claim they want to make the Commonwealth more competitive, delaying the economic benefits of tax cuts would no doubt prove otherwise.”

“Just as state policymakers face budgetary challenges, so do Massachusetts small businesses that are saddled with rising healthcare, energy, and labor costs and who would see the fiscal benefits of federal tax changes like being allowed to fully expense their equipment purchases,” he added.

Healey has been under pressure from progressive groups to “opt out” of several federal laws in Trump’s tax cut and policy bill to help offset the looming fiscal hit to the state’s coffers.

The left-leaning Massachusetts Budget and Policy Center has warned corporate tax changes in the new tax law pose a “significant threat” to the state budget and had called on Healey to “decouple” the state from the federal law to help prevent deep cuts to state-funded programs.

“Massachusetts has a history of opting out of federal policies that do not serve our interests or harm our most vulnerable populations,” the group said in a recent statement. “Lawmakers must act quickly and do it again.”

Healey urged lawmakers to give her proposal “swift consideration” to “provide clarity and certainty around our tax code as soon as possible this filing season” and “deliver this tax relief to our businesses and residents and in a thoughtful and responsible manner that protects all our constituents.”

_______

© 2026 The Salem News (Beverly, Mass.). Visit www.salemnews.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Joseph Clark January 27 2026 at 8:53 pm

Healey has got to go 😡. The Feds give us a tax break, and she has to delay it by one year to pay for all the free benefits she gave to illegals with taxes from Massachusetts citizens.