By David Danzis

Las Vegas Review-Journal

(TNS)

A long-shot effort to restore the full federal tax deduction for gambling losses fell short on Capitol Hill this week.

The House Rules Committee declined to advance an amendment to a larger spending bill that would restore a gambler’s ability to deduct 100 percent of losses on annual tax filings.

U.S. Rep. Dina Titus, D-Nev., whose bipartisan-supported FAIR BET Act would restore the full tax deduction, pushed for the inclusion of a comparable proposal to be included in the Consolidated Appropriations Act, which passed the House on Thursday and has been sent to the Senate.

Recommended Articles

Under tax changes approved last year as part of the One Bill Beautiful Bill Act, bettors will be limited to deducting up to 90 percent, a shift industry advocates warn will create taxable “phantom income” for players who break even.

Titus testified Wednesday before her congressional colleagues in support of adding the deduction restoration proposal to the spending bill. Her amendment was one of nearly 70 that were considered.

The proposal’s failure effectively sidelines the effort unless lawmakers insert the reversal into a different must-pass bill later this year.

In a statement Friday, Titus said she was “disappointed that the House Rules Committee has decided not to move forward with legislation to restore the full 100 percent deduction for gambling losses.”

Gambling industry officials and tax professionals argue that the 90 percent deduction limit unfairly targets professional gamblers and high-stakes players, who will now be required to pay taxes on unrealized earnings. Poker players, high-limit slot players and sports gamblers will be the most adversely affected, according to industry experts.

Recommended Articles

“I led the charge to (restore the 100 percent deduction) with the FAIR BET Act I introduced last July after we discovered this tax on phantom winnings hidden in the OBBB,” Titus said. “I also have said from the very beginning that it doesn’t matter how this unfairness is rectified—it just needs to be fixed. It’s about righting a fundamental wrong that affects every person who gambles.”

Titus and other members of Nevada’s delegation say they plan to continue pressing the issue through future spending bills or standalone legislation.

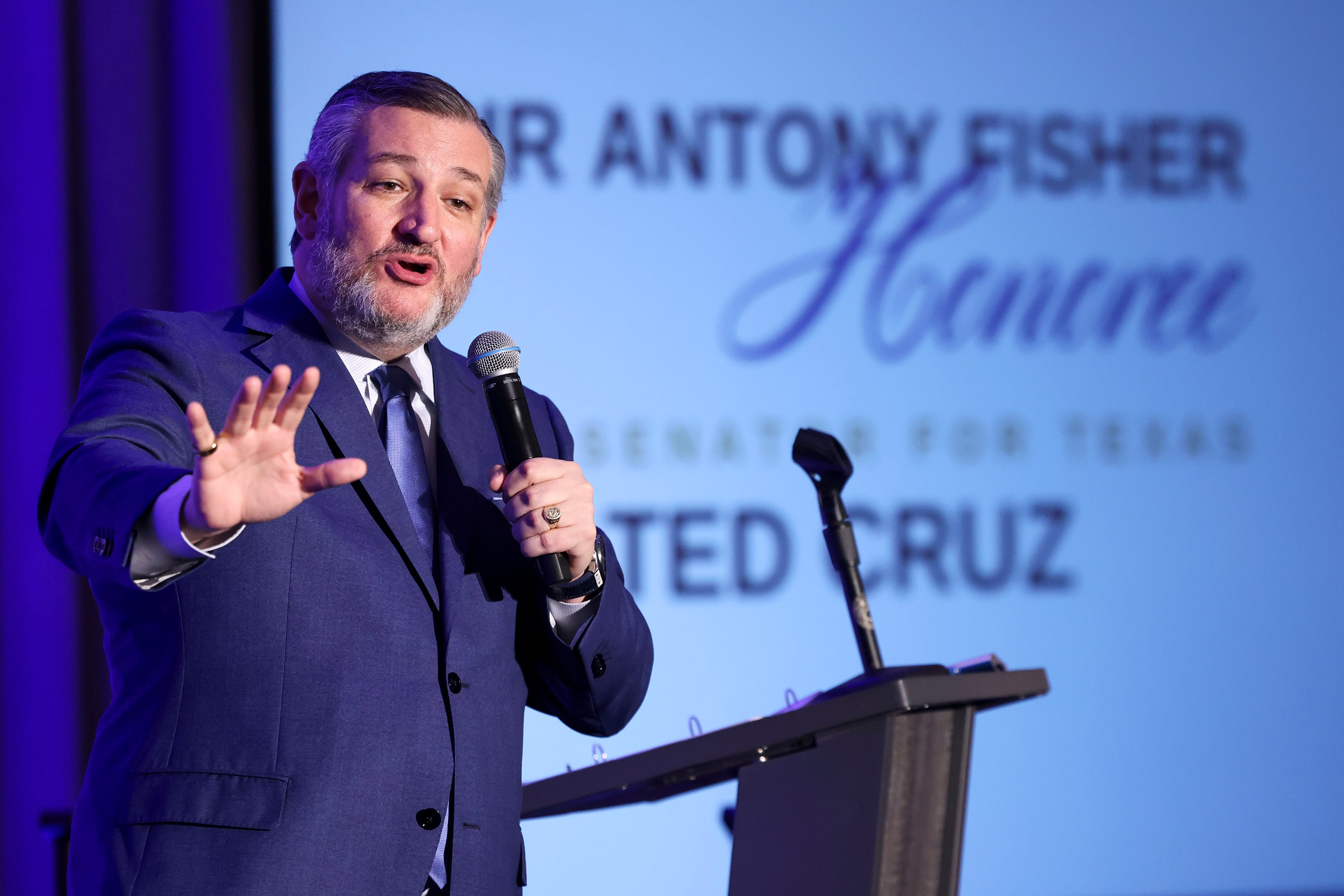

U.S. Sens. Catherine Cortez Masto and Jackie Rosen have also tried to restore the tax deduction legislatively. The pair of Nevada Democrats and U.S. Sen. Ted Cruz, R-Texas, are co-sponsors of the FULL HOUSE Act in the upper chamber.

Recommended Articles

In December, several Las Vegas casino executives representing some of the largest operators in the city and the gambling industry’s top lobbying group met with U.S. Rep. Jason Smith, R-Missouri, chair of the House Ways and Means Committee, to press for the restoration of the 100 percent deduction for gambling losses.

Recommended Articles

“There will be other opportunities this year to insert the language into another piece of legislation for consideration on the House floor,” Titus said. “I will pursue those opportunities until we get this done.”

Photo credit: uschools/iStock

_______

©2026 Las Vegas Review-Journal. Visit reviewjournal.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs