By Katherine Rodriguez

nj.com

(TNS)

The Internal Revenue Service and the Treasury Department confirmed that military members do not owe taxes on the one-time supplemental basic allowance for housing payments distributed in December 2025.

The payments, which totaled $1,776, were distributed to approximately 1.45 million active-duty service members, according to the IRS.

Here’s what you need to know about the military members eligible for the payments, how they came about and why these stipends are tax-free.

Which members of the military are eligible for the tax-free housing stipend and where did the stipend come from?

Those service members in the Army, Air Force, Navy, Marine Corps and Space Force with pay grades O-6 and below, as well as eligible Reserve Component members as of Nov. 30, 2025, were eligible for the payments.

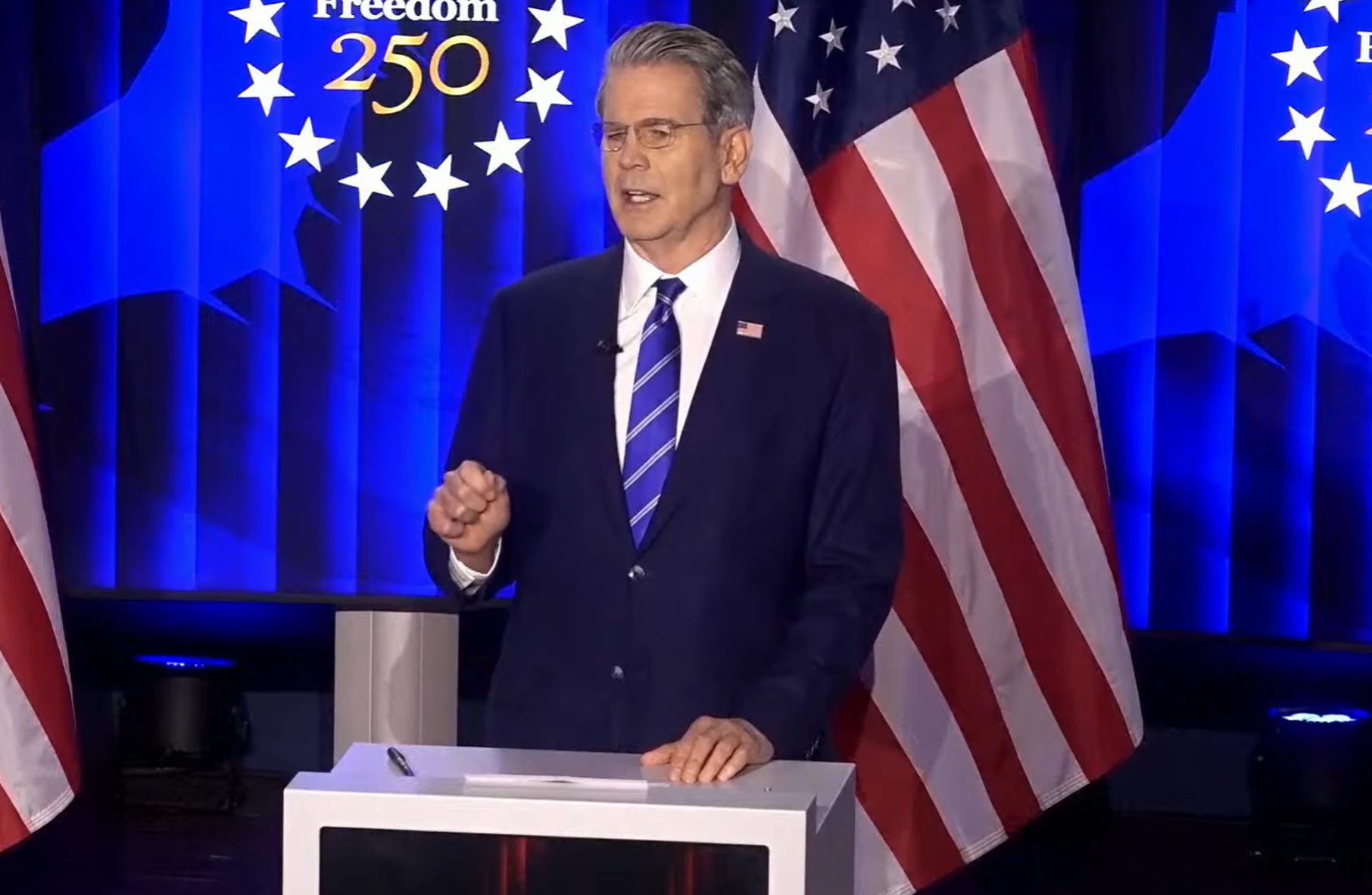

The payments were part of President Donald Trump’s “Warrior Dividend” announced before Christmas.

The “Warrior Dividend” was funded by a $2.9 billion congressional appropriation included in the One Big Beautiful Bill Act signed into law in July 2025.

Recommended Articles

Why are these housing stipends tax-free?

Federal tax law specifically excludes “qualified military benefits” from gross income, according to the IRS.

This means that basic allowance for housing payments qualifies under this exemption.

Photo credit: Pgiam/iStock

______

©2026 Advance Local Media LLC. Visit nj.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs