By Sabrina Eaton

cleveland.com

(TNS)

CLEVELAND – U.S. Rep. Max Miller has introduced bipartisan legislation that would reverse a recent change in federal tax law that forces gamblers to pay taxes on money they never actually earned.

Miller, an Ohio Republican, and Rep. Steven Horsford, a Nevada Democrat, introduced the Facilitating Useful Loss Limitations to Help Our Unique Service Economy (FULL HOUSE) Act on Jan. 8. The bill would restore the long-standing rule allowing gamblers to deduct 100% of their gambling losses against their winnings.

The change they’re seeking to reverse was included in the One Big Beautiful Bill law enacted last year. That legislation reduced the gambling loss deduction from 100% to 90%, effective Jan. 1, 2026.

Under the new rule, a gambler who wins $100,000 but loses $100,000 within the same year can deduct only $90,000 in losses. That means they owe taxes on $10,000 even though they broke even for the year—what tax experts call “phantom income.”

The provision was adopted to help pay for the tax cuts and other measures the bill contained. Miller would like to see that reversed.

Recommended Articles

“The FULL HOUSE Act is about basic fairness in the tax code,” said a statement from Miller. “Americans should not be taxed on money they didn’t actually take home. By restoring the full deduction for gambling losses, this bill ensures the IRS treats taxpayers honestly and consistently.”

A statement from Horsford predicted the policy would drive major tournaments abroad, push gaming underground and hurt tourism in Nevada.

“Taxing people on money they never actually earned is fundamentally unfair and harmful to Nevada’s economy,” Horsford said. “There is strong bipartisan agreement that this provision was a mistake, and Congress must act to correct it.”

For decades, federal tax law allowed taxpayers to deduct gambling losses up to the full amount of their gambling winnings. Gamblers who itemize deductions on their tax returns could claim these losses on Schedule A of Form 1040, effectively paying taxes only on their net gambling profits

According to the Tax Foundation, a nonpartisan, nonprofit think tank that analyzes tax policy, Nevada isn’t the only state that would be affected. It says Michigan, Pennsylvania, West Virginia, New Jersey, Delaware, Connecticut and Rhode Island have legalized online gambling, while popular land-based commercial or tribal casinos can be found in nearly every state. State tax revenues from online gaming, nearly $3 billion in 2024, will also be affected if gamblers change behavior, the organization says.

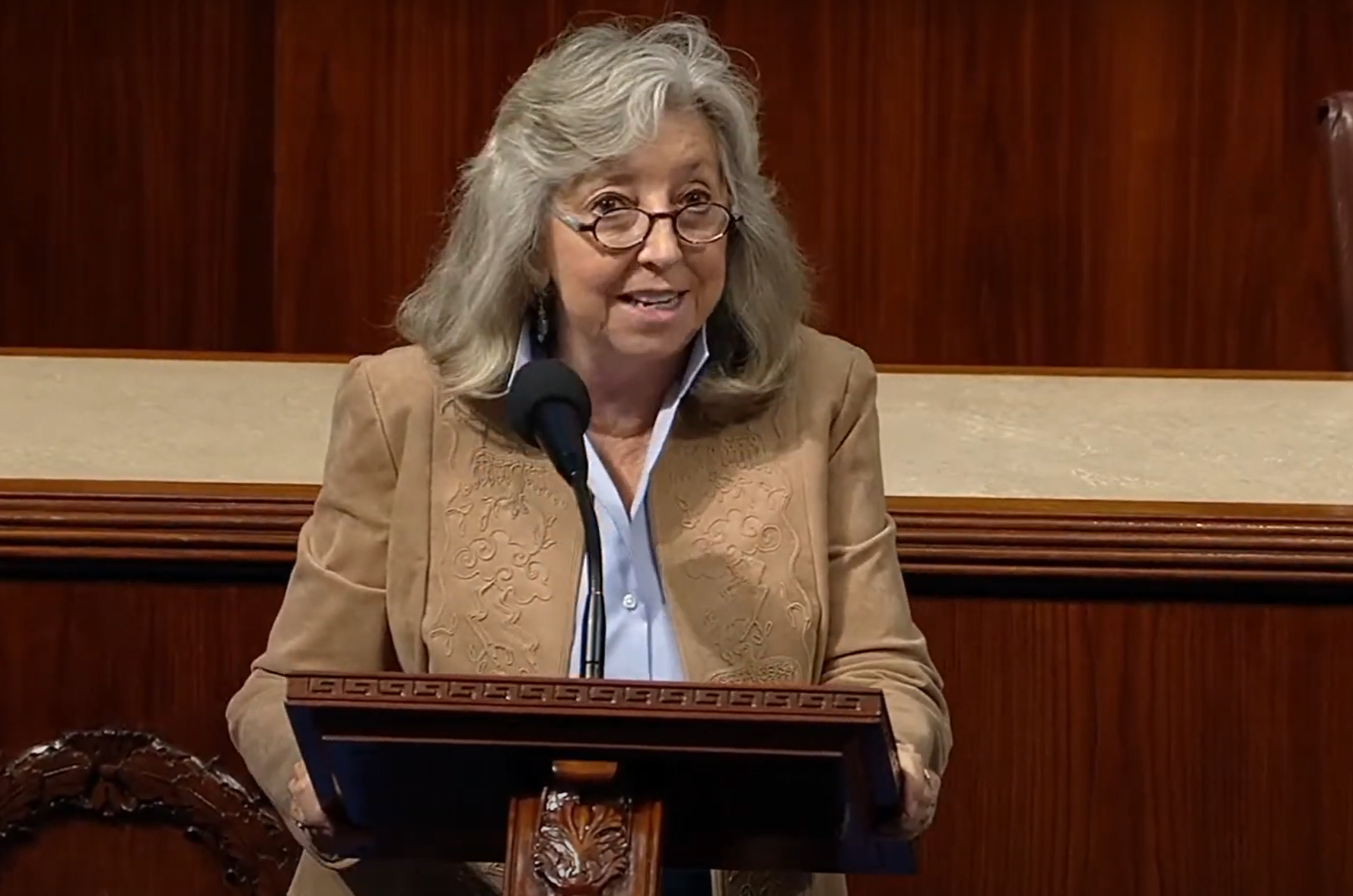

The bill has been referred to the House Committee on Ways and Means, where both Miller and Horsford serve. In addition to Horsford, the bill is cosponsored by Democrats Susie Lee of Nevada and Thomas Suozzi of New York.

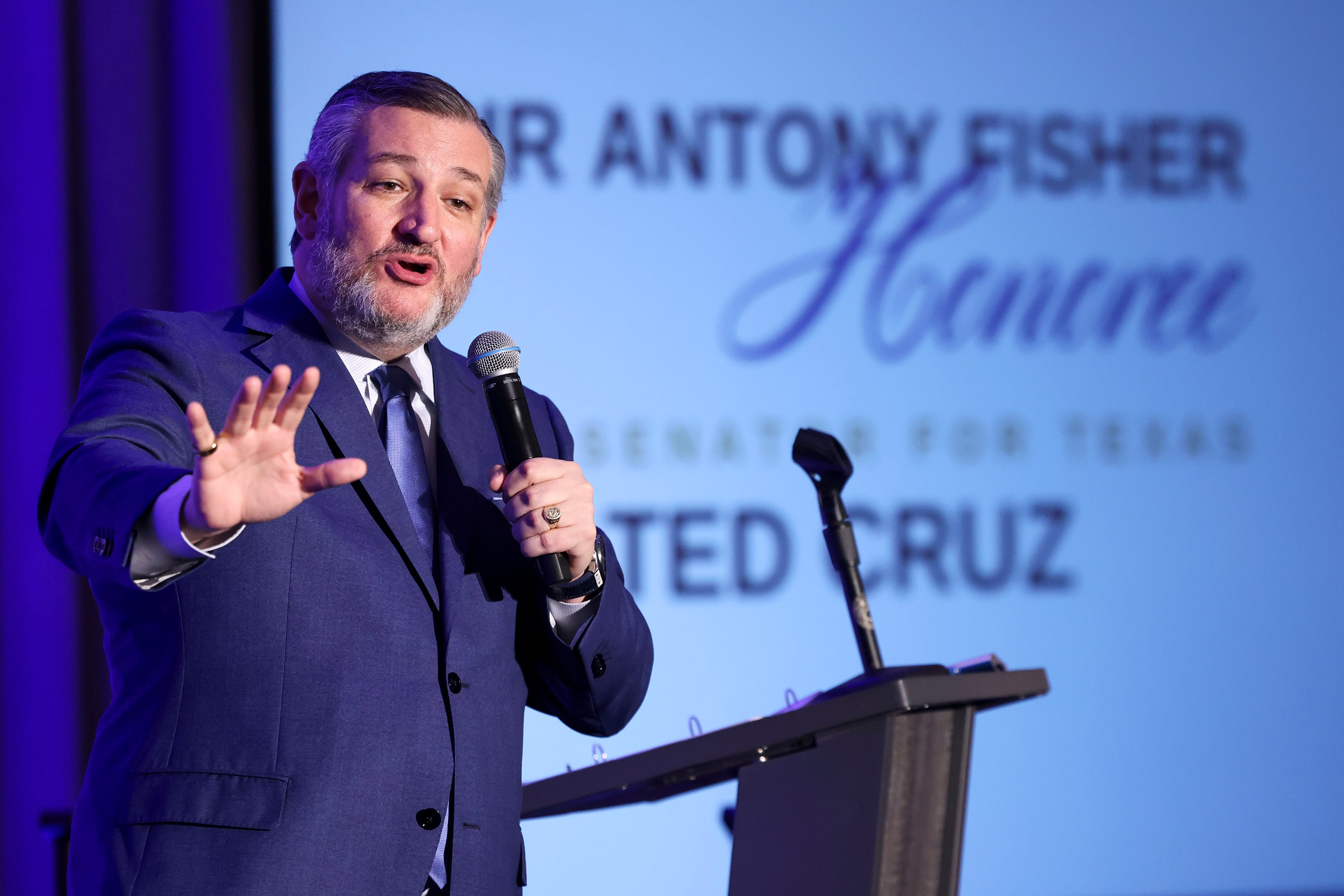

A companion bill in the Senate has been introduced by Sens. Catherine Cortez Masto and Jacky Rosen, both Nevada Democrats, along with Republican Sens. Ted Cruz of Texas and Bill Hagerty of Tennessee.

Recommended Articles

Photo credit: Sezeryadigar/iStock

______

©2026 Advance Local Media LLC. Visit cleveland.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs