For many growing businesses, there comes a distinct tipping point. The accounting software that effortlessly managed the books during the startup phase begins to creak under the weight of expansion. Managing multiple entities becomes a logistical nightmare of logging in and out of different files. Excel spreadsheets are in abundance, becoming the glue holding complex financial reporting together.

This is the “mid-market gap,” a challenging space for accounting professionals to manage with key, regular insights they can use to advise and guide their clients to success.

By now, you are probably familiar with the Intuit Enterprise Suite, first launched in fall 2024 with continuous improvements over the last year, including the original features, as well as new features released in March, July, and November 2025. With the release in November, Intuit’s commitment to AI and automation to work smarter and make workflow faster is ever-present in Intuit Enterprise Suite.

What is Intuit Enterprise Suite?

Intuit Enterprise Suite is a configurable, AI-native financial intelligence platform designed specifically for mid-market businesses. It serves as an integrated ecosystem that goes beyond standard accounting to include financial management, payroll, HR, marketing, and cash flow optimization.

Unlike traditional small business accounting tools, Intuit Enterprise Suite is designed for organizations that operate across different locations, subsidiaries, and franchises. Before Intuit Enterprise Suite, these businesses often had to rely on disjointed manual processes to consolidate their financial picture. Intuit Enterprise Suite solves this by providing a unified view where finance teams can manage intercompany transactions, consolidate reporting, and oversee operations from a single login.

This cloud-native ERP solution emphasizes usability and automation through AI Agents: intelligent digital assistants that actively help manage project profitability, detect accounting anomalies, and even draft communications to customers.

Got Construction Clients: 7 Key Tech Investment Insights

Intuit Enterprise Suite was created for businesses in the construction, professional services, and nonprofit sectors, and any organization that requires dimensional reporting—tagging transactions by location, department, or project—rather than a simple chart of accounts. It fills the void for CFOs and controllers who need enterprise-grade power, including granular user permissions, advanced KPIs, and sophisticated budgeting.

A new, free Intuit report written by content expert Deborah Huso focuses on the construction industry, revealing tech investments that are driving profits and solving for cost and labor. Her research and insights provide these key insights that are included in the report:

- Underutilized and poorly integrated technology, as well as data silos, remain key challenges for construction firms.

- Most decision-makers see AI adoption and skills as critical to future growth and maintenance of a competitive edge.

- Rising costs remain an industry-critical issue.

- Proactive investment in technology solutions is a non-negotiable imperative.

- Construction leaders see opportunities in technology, and specifically AI, to help fill critical labor gaps.

- Integrated, intuitive platforms with AI-enabled intelligence and tools are vital for efficient performance.

- Optimize data and insights with AI-powered intelligence for faster decision-making.

Get a copy of the report to get in-depth analysis for each of these highlights.

November Feature Updates

The November 2025 updates touch on nearly every aspect of Intuit Enterprise Suite, from how intercompany expenses are allocated to how payroll is processed for hundreds of employees. Here’s a list of the new features.

Multi-entity Financial Management Updates

For the mid-market CFO, managing multiple legal entities is often the biggest time sink. The November 2025 update introduces features that turn disjointed entity data into a cohesive command center. The goal is to strengthen controls while offering the flexibility needed for rapid decision-making.

- Consolidated view for enhanced control: The platform now offers a single, consolidated dashboard for multi-entity data. This allows administrators to safely extend access beyond the primary admin, facilitating better collaboration while maintaining strict security controls. You can now assign specific permissions to team members for critical multi-entity capabilities, such as accessing the shared chart of accounts and intercompany account mapping.

- Multi-entity reporting enhancements: Reporting has been deepened to provide richer details and expanded drill-down capabilities within consolidated reports. This gives finance teams greater visibility into intercompany activity, allowing for faster closing of books and more accurate advisory insights.

- Expanded intercompany expense allocations: Previously, allocations were limited to bills, checks, and expenses. Now, intercompany allocations cover a broader range of account types and include refunds. This flexibility allows teams to filter transactions by allocation status and add reference information, significantly reducing the manual tracking previously required.

- Dynamic allocations: This is a major productivity booster. Instead of spending hours processing repetitive journal entries, users can now sum their balances and allocate them in a single step. This dynamic allocation capability speeds up month-end processes, provided that intercompany account mapping is set up beforehand.

- One-time transition process: To access these new features, current QuickBooks Online clients can schedule a one-time transition process (taking about 3 hours) through January 31, 2026. This ensures legacy data is correctly migrated to the new consolidated architecture.

New and Improved Intuit AI Agents

The November update also introduces new agents and significantly upgrades existing ones to handle specialized tasks:

- New Customer Agent: This agent focuses on revenue generation. It can source leads directly from a Gmail inbox, draft personalized email responses for review, and track customer opportunities through the sales cycle. This effectively adds an automated sales development representative to the team.

- New Payroll Agent: Designed to take the stress out of pay runs, this agent works with both admins and employees. It can provide updates and insights, and even draft payroll runs. Uniquely, it interacts with employees via mobile to gather hours, notifies admins of anomalies, and facilitates the revision and approval of drafts.

- Accounting Agent enhancements: This agent can now extract transactions from PDF statements and compare them against IES data to identify errors. It proactively suggests resolutions and can even request missing documentation—such as photos of Mastercard receipts—in real-time, preventing the end-of-month “chase” for receipts.

- Finance Agent enhancements: Aimed at the CFO, this agent helps optimize the month-end close. It now supports time period customization and provides editable, AI-generated text for summary highlights. It also enhances the Business Feed by displaying KPIs with the highest variance first, allowing leaders to focus immediately on outliers.

- Payments Agent enhancements: To improve cash flow, this agent now autofills estimates based on lead content found in Gmail. It can also proactively draft recurring invoices and monitor cash flow trends to suggest optimizations in payment collection.

- Project Management Agent enhancements: For project-based businesses, this agent is vital. It can now convert signed contracts from the Customer Hub directly into active projects, create budgets from uploaded spreadsheets, and convert estimates into budgets. It provides summaries that highlight cost deviations, giving project managers a clear view of total cost versus total income.

Business Intelligence and Reporting

The November 2025 update overhauls the Business Intelligence (BI) capabilities of Intuit Enterprise Suite:

- KPI scorecard: This new feature provides a centralized, real-time view of business health. Users can access a library of nearly 100 pre-defined Key Performance Indicators (KPIs) or build custom ones. Crucially, these can be tracked at a consolidated level across multiple entities.

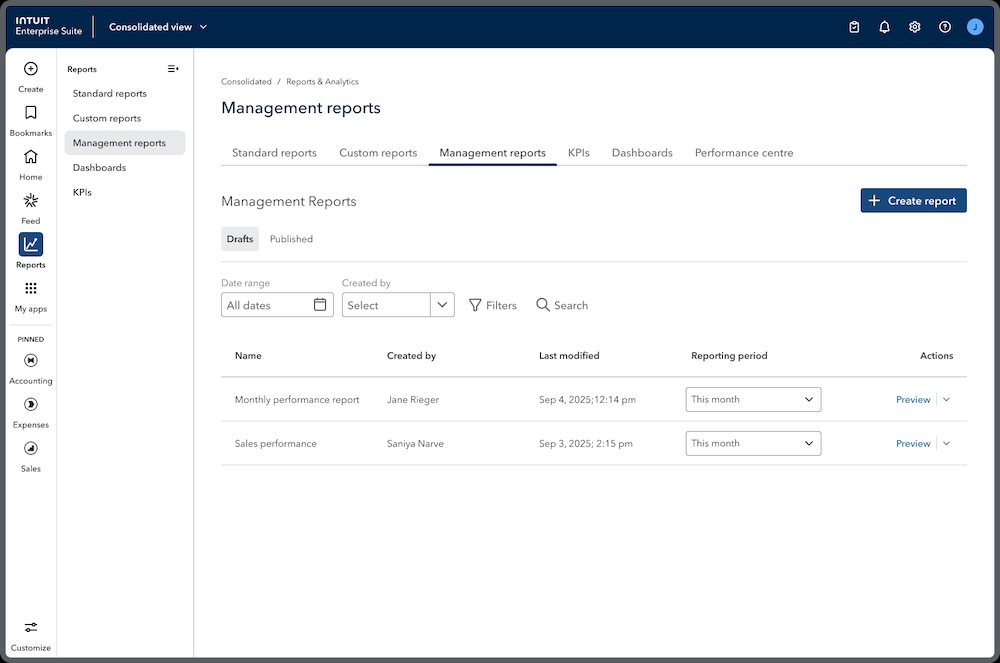

- Enhanced reporting packages: The update streamlines the creation of board-ready report packages. Users can build polished, branded packages that combine financial reports, charts, and written insights, saving hours of formatting time before executive meetings.

- Customizable dashboards: Users can now start with prebuilt dashboards for critical metrics like Profitability or Cash Flow, or build their own using drag-and-drop widgets. These dashboards support AI summaries that explain trends in plain English.

- Management reports: This feature allows for the creation of professional presentation packages that include cover pages, executive summaries, and branded elements, turning standard financial data into a narrative for stakeholders.

Dimension and Experience Enhancements

The “enterprise” in Intuit Enterprise Suite often refers to the ability to slice and dice data via “dimensions” (tags), rather than creating thousands of sub-accounts. The November update refines how these dimensions work and improves the overall user experience.

- Dimensions on Spreadsheet Sync: Spreadsheet Sync is a favorite tool for finance teams who love Excel. Now, users can create and update dimension values for multiple transactions directly within the spreadsheet tool and sync them back to IES. This bridges the gap between flexible Excel modeling and rigid ERP data entry.

- AI-powered dimension recommendations: To ensure data hygiene, AI now suggests dimension values for products, services, and fixed assets that lack default assignments. This minimizes manual tagging errors and improves the accuracy of dimensional reporting.

- Bill payment release approvals: To strengthen internal controls, the suite now supports automated workflows for bill payment approvals. Administrators can set specific criteria and designate final approvers (currently for single-entity approvals only).

- Instant bill payments: For urgent cash flow needs, clients can now choose an “instant payment” option to deliver funds to eligible vendors within minutes, subject to a 1% fee.

- W-2 and payroll scalability: The system is now better equipped for larger workforces. Organizations with 100+ employees can access and print W-2s instantly without lag. Payroll processing load times have been improved for companies with up to 200 employees.

- New navigation and visual updates: The platform features a modernized “all-in-one” navigation experience. Users can bookmark pages, pin frequently used apps, and customize their workspace with widgets from an expanded library.

- Customer and vendor data enhancements: To support businesses upgrading from QuickBooks Desktop, IES has improved data compatibility for shipping addresses, vendor transactions, and notes, ensuring a smoother migration experience.

Try Intuit Enterprise Suite Today

With these new features of Intuit Enterprise Suite, you and your clients can spend less time reconciling intercompany accounts and more time using business intelligence to steer their organizations toward growth. As the mid-market gap continues to be a pain point for growing companies, Intuit Enterprise Suite is positioning itself for the future.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs