By Linda F. Hersey

Stars and Stripes

(TNS)

(Dec. 2) WASHINGTON — Health insurance coverage for 267,000 veterans and their families will be at risk if tax credits that lower their premium costs under the Affordable Care Act are allowed to expire, Democratic lawmakers warned Tuesday.

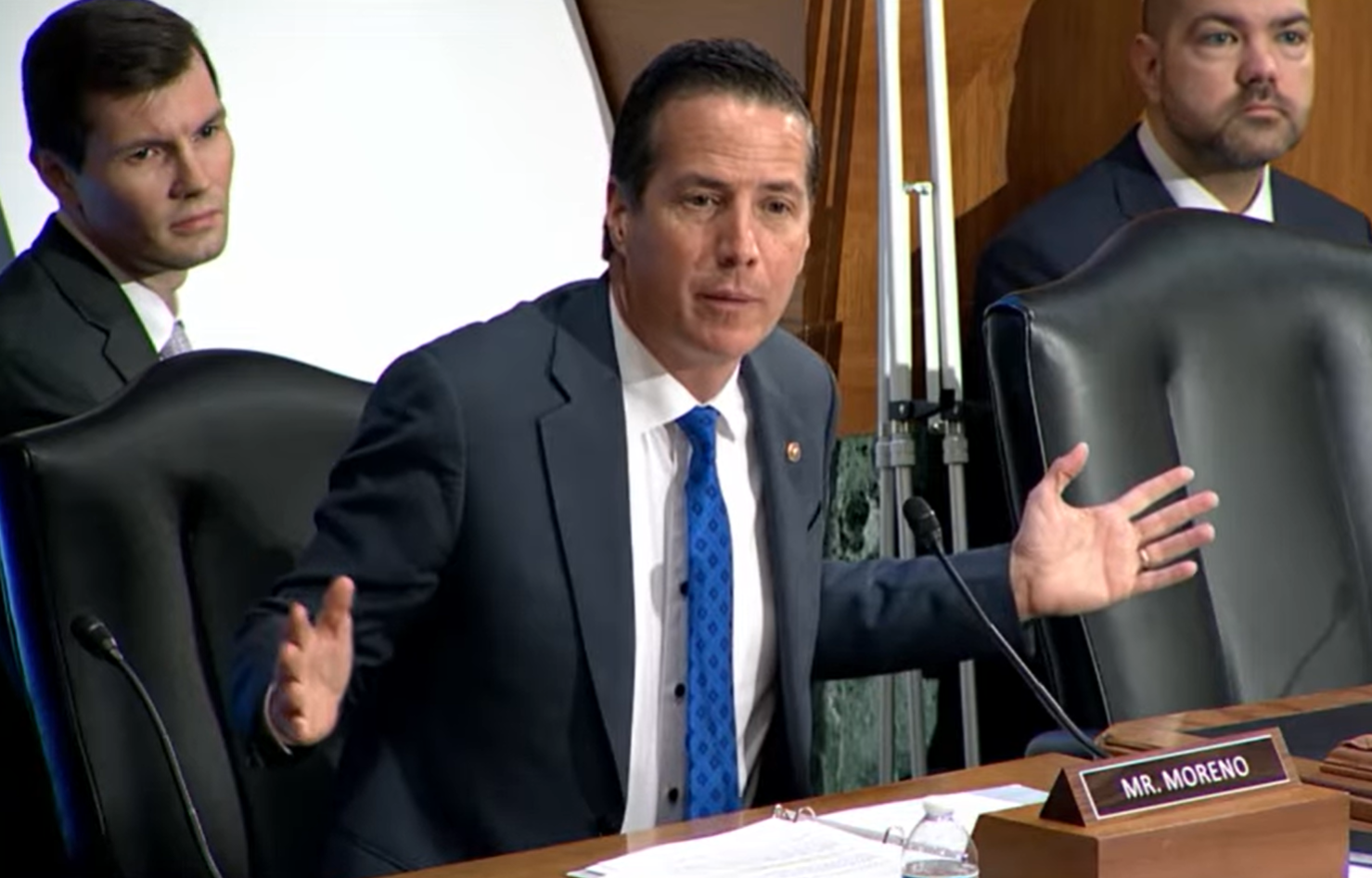

Sen. Richard Blumenthal, D-Conn., said that there are only 12 working days left in December for Congress to renew premium tax credits under the ACA, also known as Obamacare, which runs out at the end of the month.

Individuals enrolled in the ACA program access health insurance with lower costs based on their annual income and household size, among other factors.

But Blumenthal, the top Democrat on the Senate Veterans’ Affairs Committee, accused Republicans of refusing to work with Democratic lawmakers to extend the tax credits, which have made premiums free or have significantly lowered out-of-pocket costs for millions of Americans, including veterans.

“Veterans who rely on the tax credits will be harmed if Republicans allow these critical tax credits to expire,” Blumenthal said at a news conference. “Americans, including veterans, are seeing the sticker shock now.”

Health insurance enrollment through the ACA topped 24 million in 2025, more than double the number of enrollees five years ago.

A family of four with a household income of $45,000 currently has no annual premium but will be charged $1,607 a year, according to the Bipartisan Policy Center, a nonprofit organization that advocates to end partisan differences in policymaking.

A 60-year-old couple with an annual income of $85,000 could face a yearly premium that is a quarter of their annual income, instead of 8.5% with the tax credits, according to the center.

President Donald Trump said last week that extending the subsidies temporarily may be needed to work out the details of creating an alternative to the tax subsidies under the ACA program, which was developed under former President Barack Obama.

“Some kind of an extension may be necessary to get something else done, because the unaffordable care act has been a disaster,” Trump told reporters on Air Force One, referring to the Affordable Care Act.

The president said he would support a plan to shift dollars from the tax credits to individual health savings accounts for enrollees. “You give the money to the people. I like it the best,” Trump said.

Recommended Articles

But Rep. Mark Takano, of California, who is the top Democrat on the House Veterans’ Affairs Committee, criticized Trump’s proposal for health care savings accounts as not addressing the rising costs of health insurance.

“Substituting health savings for the tax subsidies is a sleight-of-hand scam. Receiving $2,000 or $3,000 to buy a visit to the doctor does nothing to take care of the retail rates for insurance that consumers face,” Takano said.

He predicted that higher premiums will cause thousands of enrollees to either drop their coverage or face hardship meeting other basic expenses that “have been skyrocketing,” including for housing, groceries and child care.

Lindsay Church, executive director of Minority Veterans of America, warned that the free and low-cost health care many veterans receive from the Department of Veterans Affairs does not extend to their spouses, children or caregivers.

“A critical safety net for veterans and their families is unraveling,” Church said. “These tax credits cap premiums and provide protection from crippling health care costs. They ensure working people will not face a financial cliff.”

Church offered the recent example of a veteran with a family whose health insurance costs under the ACA program will go from zero to $500 per month in 2026 if the tax credits are not renewed by Congress.

Veterans who use the discounted insurance plan for themselves or family members often do not qualify for Medicaid, Medicare or Tricare—the uniformed services health care program—veterans advocates said.

The recent federal government shutdown resulted after Republican leaders excluded the tax credit from a short-term spending bill for government services. Democrats initially had refused to adopt the spending bill unless the tax credit was part of it.

But the longest government shutdown in U.S. history—43 days—ended after several Democrats voted with Republicans to fund the government through Jan. 30, 2026, without the extension.

“There is zero excuse for failure to extend the health care tax credits,” Blumenthal said. “Veterans and their families will bear the brunt of that failure by Congress.”

Republicans argue that the subsidies were “enhanced” during the COVID-19 pandemic and intended only as a temporary measure.

Enacted in 2021 under the American Rescue Plan Act, the tax credits lowered the percentage of their income that individuals and families must spend for health insurance premiums.

An increasing number of people under the age of 55 are enrolling in the ACA program to buy health insurance for themselves and family members, according to the Bipartisan Policy Center. These individuals will be disproportionately affected by higher premiums without the renewal, according to the center.

Former service members who use the ACA program for individual coverage may be unable to get some or all of their health care through the VA, according to veterans advocates.

Some former members of the National Guard or reserves may not qualify for free or low-cost VA health care benefits, if they served only for training purposes. They must have been called to active duty by federal order and completed their full service.

A dishonorable discharge is another factor that disqualifies a former service member for VA health care benefits.

Veterans also must meet the minimum requirement of 24 continuous months of military service, unless they were discharged for disability or hardship, or they served prior to Sept. 7, 1980, according to the VA.

Photo credit: Douglas Rissing/iStock

_______

© 2025 the Stars and Stripes. Visit www.stripes.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs