Sponsored Content.

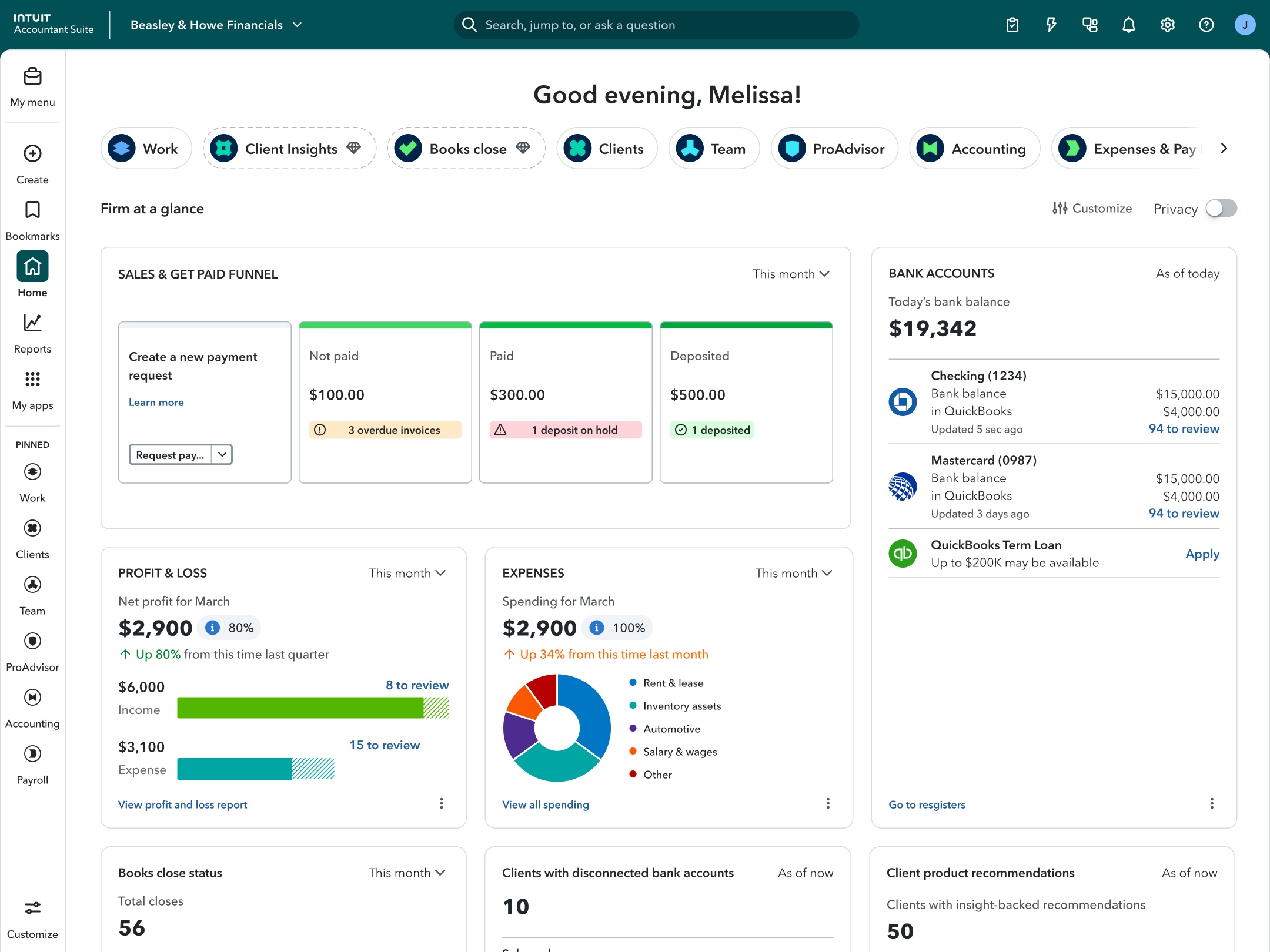

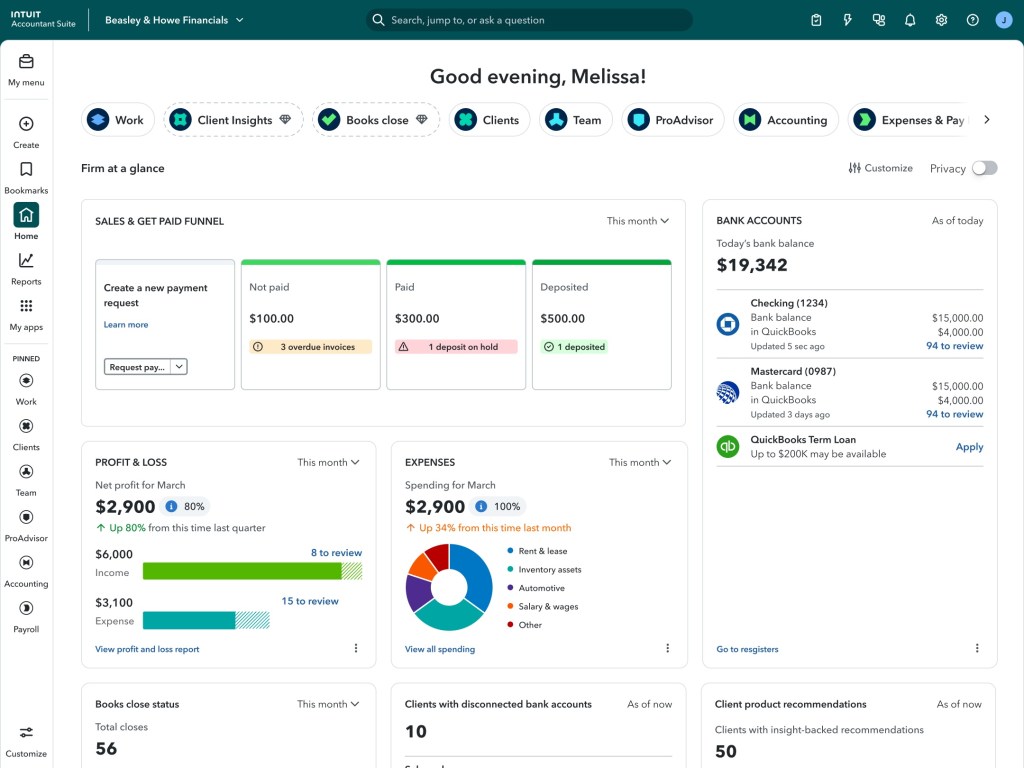

Welcome to Intuit Accountant Suite, a revolutionary platform developed specifically to manage your firm, clients, and team in a single, unified environment.

Recognizing that accountants often struggle with disconnected tools and the complexity of managing disparate client data, Intuit collaborated directly with accounting professionals to create this solution.

Intuit Accountant Suite combines the strength of the entire Intuit platform, the ability to centralize all client data in one location, and the latest breakthroughs in AI. Intuit Accountant Suite will replace QuickBooks Online Accountant, which is scheduled to sunset December 2026.

Key features of Intuit Accountant Suite

A streamlined, unified workflow is front and center in Intuit Accountant Suite, with key features covering many areas:

- Consolidated client management offers a single sign-on experience, providing better insight across all services rendered, and eliminating the need for exporting data or juggling multiple client logins. Intuit Accountant Suite significantly reduces manual effort by assigning unique, firm-specific client identification numbers that are invaluable for streamlining searching, tracking, and billing processes.

- The underlying infrastructure has been modernized for optimized performance and customization, ensuring fast and responsive operation regardless of the firm’s client volume. Team members benefit from custom dashboards, allowing them to personalize their home base to clearly surface critical tasks, reminders, and AI-powered insights relevant to their role.

- Critical to efficiency are the enhanced service delivery modules and controls. Intuit Accountant Suite includes specialized modules such as Books Close (currently in beta), which allows firms to track the close status across all clients, assign work, and use batch actions for greater efficiency. Role-based access controls enable compliance and efficient management by allowing firms to delegate tasks with customizable roles and permissions across accounting, bookkeeping, and payroll services.

- A new ProAdvisor dashboard integration gives firm leaders a clear, firm-wide overview of team members’ contributions to achieving firm-level points, along with training participation and progress, fostering a culture of continuous development.

Unlocking strategic growth: Benefits for the accountant and client

Intuit Accountant Suite also shifts your role to trusted strategic advisor, benefiting the firm and its clients.

For example, Intuit Accountant Suite delivers firm efficiency through the integration of Intuit Intelligence. This revolutionary system acts as a central hub, providing immediate and accurate answers to any firm-specific business question—from identifying the most profitable client segments to analyzing staff utilization for capacity planning. This strategic insight fuels faster, more confident decision-making regarding firm operations.

Intuit Accountant Suite can also directly address capacity constraints by allowing firms to leverage Intuit’s trusted experts as a seamless extension of their virtual team when added bandwidth is needed. Intuit promotes a model of seamless collaboration where AI handles the routine, repetitive work, freeing up the accountant to step in when the stakes are higher or when complex data interpretation and human judgment are required. This dynamic collaboration provides assurance and saves significant time.

For clients, the benefit is clear: Better money outcomes, achieved through the speed of AI when combined with the trust of human professional oversight. Clients gain the ability to save time, simplify their day-to-day operations, and make more confident business decisions. The system proactively detects anomalies and financial trends across their data, mitigating risks before they become costly problems. For complex, compliance-heavy tasks such as sales tax, the reliance on technology actively helps reduce errors. With features like the enhanced Payments Agent, clients can also expect to get paid faster and maintain more predictable cash flow, directly supporting their business health and growth.

The dawn of agentic AI: Your new virtual firm team

The engine driving this transformation is the virtual team of AI agents operating within the Intuit Intelligence system. These are not simple chatbots; they are sophisticated, purpose-built tools capable of completing complex tasks on behalf of the user, ingesting and analyzing data input from multiple sources, and delivering actionable insights and recommendations. This is the essence of agentic AI: autonomous, goal-oriented technology that works collaboratively with human professionals.

Intuit has expanded this virtual team with new and enhanced agents focused on conquering time-consuming compliance and administrative tasks:

- New Customer Agent: Clients can save time and win more deals by focusing on high-value opportunities and automating lead generation, qualification, and nurturing. The new Customer Agent sources leads from their Gmail inbox, drafts personalized email responses they can edit and send, and tracks customer opportunities in their sales cycle.

- New Payroll Agent: Complete payroll with less of the prep, but all the control and accuracy with a Payroll Agent that works with employees and admins to provide updates, insights, and payroll drafts—even on mobile. Your client’s employees receive messages from the agent that allow them to submit hours to be saved in a payroll draft. Those completing payroll will get notified of any anomalies and can revise and approve the draft for processing.

- Accounting Agent enhancements: The Accounting Agent can now automatically extract transactions from a client’s PDF statements and compare them to information in Intuit Enterprise Suite, identifying errors and suggesting how to resolve them. It will help pinpoint transactions that need more context and gather more information from other users. The agent will now request pictures of your client’s Mastercard credit card receipts in real time, helping save time at month end for your team and your client.

- Finance Agent enhancements: Manage finances more efficiently with optimized month-end close and a faster path to insights, summary, and analysis with new time period customization, editable AI-generated text in summary highlights and insights, and PDF capability for saved reports. Plus, an enhanced Business Feed now displays KPIs with the highest variance first, and you can drill down on KPIs by dimension.

- Payments Agent enhancements: Find more efficiency and better money outcomes with the Payments Agent that autofills estimates based on leads generated from a client’s content in Gmail and proactively drafts recurring invoices for clients to send to their customers. Use it to monitor a client’s cash flow, and optimize invoicing and payment collection.

- Project Management Agent enhancements: Clients can boost their overall productivity and profitability with improved coverage, insights, and accuracy across the agent’s key skills. The Project Management Agent can now convert signed contracts from the Customer Hub into projects, create budgets from spreadsheets, convert estimates into budgets, and provide summaries with a view of total cost, total income, and key factors causing deviations.

Intuit Accountant Suite, with its foundation in agentic AI, signals a new partnership between technology and the accounting profession. By automating the foundational work, it empowers accountants to achieve greater scale and deliver the strategic counsel that is more vital now than ever, redefining the firm of the future.

Find out more about Intuit Accountant Suite and learn how it improves workflow and streamlines your firm.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs